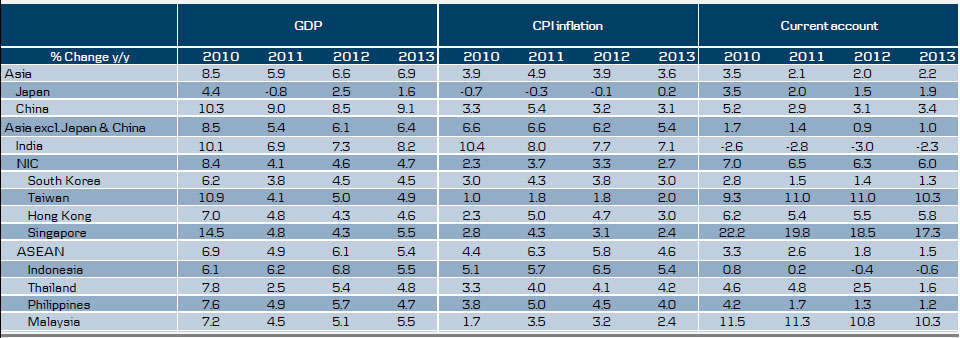

• Slower growth and lower inflationary pressure have created room for monetary and fiscal easing across Asia. This is expected to support a gradual recovery in 2012.

• China is expected to avoid a hard landing and recover in 2011 supported by fiscal and monetary easing. However, China’s policy easing will be cautious and the recovery in Q1 will only be modest.

• In our view there is not a bubble on the property market for China as a whole and a full scale collapse is unlikely.

• In Japan the recovery after the earthquake has temporarily lost steam but should regain speed in H1 12 supported by reconstruction and stronger exports.

• Japan’s rating might soon be cut and with the domestic saving surplus declining fast Japan could be subject to a confidence crisis.

• In India growth has slowed substantially on the back of aggressive monetary tightening. India looks increasingly vulnerable because it lacks the policy flexibility of the rest of Asia.

China: Short-term headwinds, but recovery in 2012

The Chinese economy currently faces two headwinds. The first headwind is the subdued exports in the wake of the recent slowdown in the global economy. So far the slowdown in China’s exports has been much less severe than the one in the wake of the global financial meltdown in late 2008.

China’s exports were broadly flat in H2 11 as weaker exports to Europe were largely offset by stronger exports to other regions including the US. To put it into perspective, China’s exports plunged more than 25% in late 2008. Looking ahead there should be less headwind from exports, as the impact from Europe should prove less negative in the coming quarters. That said, the European debt crisis and the external development remain a major risk for China in 2012.

The second headwind is the lagged impact from monetary tightening over the past two years. Particularly the property market has suffered and weaker construction activity has started to weigh on growth. So far the slowdown in the property market does not appear to be as severe as in 2008, when the housing market also suffered after monetary tightening and regulatory tightening. In the short run the imbalance in the property market will continue to weigh on growth and the slowdown in the property market could turn out to be more severe than in 2008. However, we do not expect a collapse in the property market as many appear to be fearing.

Property market weak, but not expected to collapse

We regard the current weakness in the house market as largely cyclical, driven mainly by a 20% increase supply of new homes in urban areas in 2011 while sales only increased 6%. However, we do not believe there has been excess housing construction for China as a whole in recent years. The supply of new homes in China appears to be following a path very similar to Japan and South Korea when they were at a similar stage of development. Housing starts have been declining in recent months, suggesting that the supply of new homes will start to decline in H1 12 which will create a better balance in the housing market. So far sales of new homes have been relatively resilient, but should new homes sales start to decline substantially it will prolong the supply adjustment.

In addition it should be remembered that China still has considerable policy flexibility to support the housing market and construction: 1) PBoC could ease monetary policy more aggressively, 2) the ambitious plans for construction of social housing could be speeded up and 3) the regulatory tightening targeting the property market introduced in 2007 could be rolled back. This includes substantially higher down payment requirements in connection with home purchases.

China’s key advantage relative to the rest of the world remains its policy flexibility. We expect inflation to decline below 3.5% y/y by mid 2012 and hence China should again be in a position where it can ease both monetary and fiscal policy if needed. With gross central government debt only 17% of GDP, China also appears to be in a favourable position to manage any issues regarding excessive debt in local government funding vehicles (estimated to be 26% of GDP) and possible bad loans in the banking sector.

However, we expect the policy response in the coming months to be cautious as the severity of the slowdown is still uncertain: 1) The regulatory tightening measures against the property market will most likely stay in place. The government is actually targeting a minor decline in house prices to improve new home affordability that has become an important social issue, 2) We do expect the reserve requirement to be cut by at least another 150bp in H1 2012, but we do not expect the leading interest rates to be cut at this stage and 3) Fiscal policy will be eased slightly possibly by speeding up construction of social housing and restarting the ambitious railway construction programme that was temporarily put on hold after some accidents. The successful programme with consumer subsidies for purchase of durable consumer goods from 2009 could also be reintroduced as part of fiscal easing.

Policy easing to support recovery in 2012

In our view China will avoid a hard landing in 2012 and the slowdown should prove less severe than the one China experienced in 2008 in the wake of the global financial crisis. This primarily reflects that the slowdown in exports should prove far less severe than in 2008 and that the slowdown in the housing market at this stage does not appear to be more severe than in 2008.

In the last three quarters of 2011 growth is estimated to have been around 7%

q/q AR, which is below potential GDP growth (estimated at 9%). Our GDP forecast for 2012 has been revised down to 8.5% from 8.9% reflecting that growth in Q4 11 and Q1 12 have been revised lower due to a larger negative impact from the property market. We expect GDP growth to improve in the coming quarters on the back of a less negative impact from exports and a gradual impact from policy easing in China. GDP growth is expected to improve to 8% q/q AR in Q1 12 to more than 9% q/q AR in the last three quarters of the year.

We estimate that China’s current account surplus declined to just 2.9% of GDP in 2011 from 5.1% of GDP in 2010. As China has also stopped accumulating FX reserves in Q4 11, it has stronger arguments for arguing that its currency is no longer substantially undervalued. Hence, we think the pace of appreciation of CNY will slow to about 3% in 2012 from close to 6% last year.

In Q3 11 the economy largely recovered from the devastating earthquake and

tsunami that hit Japan in March 2011. However, the recovery has lost steam and we now estimate that GDP expanded just 0.7% q/q AR in Q4 11 after surging close to 6% q/q AR in Q3 11. Part of the explanation is slower export

growth in the wake of the global slowdown. In addition, the supply chain of many Japanese manufacturers has again been disrupted, this time by the flooding in Thailand in October and November. Reconstruction after the earthquake has also temporarily lost pace. Finally, private consumption appears to have contracted in Q4 11 after extraordinary strong private consumption in Q3 11, when private consumption was boosted by pent-up demand and restocking of durable consumer goods.

We do not expect Japan to slip back into recession. Firstly, while the global development remains the single biggest risk for Japan in 2012, the impact on exports is expected to be less negative in the coming quarters. Secondly, a resilient labour market suggests that private consumption will resume expanding moderately. Finally, the approval of the JPY12trn third supplementary budget by the Diet in November has also cleared the way for accelerated spending on reconstruction in the coming quarters.

The impact from fiscal policy on growth will be also expansionary in 2012 because of reconstruction and despite the recovery the public deficit in 2012 will remain largely unchanged, close to 10% of GDP. Gross public debt is expected to exceed 235% of GDP. Political negotiations about a long-term plan for consolidation of public finances have started. The government’s proposal includes raising the consumption tax from 5% to 10% in two steps starting from 2014. An agreement on fiscal consolidation will most likely not include any major new fiscal tightening before the next election for the Diet, which is due before September 2013. That said, the impact on growth from fiscal policy is poised to be substantially negative in 2013 as reconstruction activity gradually declines.

We expect Japan’s sovereign debt rating to be downgraded in 2012 (current ratings are AA- by Standard & Poor’s and Aa3 by Moody’s). So far there has been no spill over from the European debt crisis because Japan’s debt is financed primarily by Japan’s large domestic saving surplus, but it should be

remembered that Japan - just like Italy - is vulnerable to a possible confidence crisis and higher interest rates due to its huge gross debt – not least because its saving surplus is now declining fast.

Japan in 2012 will face headwinds from the stronger JPY. In real terms the effective JPY exchange rate has appreciated by about 25% since 2007 and we

estimate that the appreciation of JPY could subtract as much as 0.5%-points from GDP growth in 2012. Japan’s current account surplus is expected to decline substantially from 3.5% of GDP to just 1.5% of GDP in 2012. A surge in natural gas imports due to the permanent closure of nuclear plants has contributed to the large decline in the current account surplus. With the recovery losing considerable steam in late 2011, continued appreciation pressure of JPY and consumer prices still declining, we expect Bank of Japan to expend its asset purchases further in 2012. Should JPY continue to appreciate against USD, we also expect Japan to continue to intervene in the FX market if needed.

Fiscal easing to support recovery across Asia

In the rest of Asia growth has slowed substantially on the back of slower export growth and monetary tightening. With the exception of Indonesia growth has been below potential in H2 2011. However, inflationary pressure have also eased substantially driven not least by lower food price inflation. Hence leading interest rates have peaked across Asia and both monetary and fiscal policy are now moving in a more growth-supportive direction. Real interest rates remain very low and for that reason monetary policy is only being eased cautiously. So far only Indonesia, Thailand and the Philippines have cut their leading interest rates. In Thailand the cut in the leading interest rate was mainly the result of the sharp contraction in the economy in the wake of the flooding in October and November.

However, contrary to the developed countries, fiscal policy is again turning expansionary across Asia. Indonesia, South Korea, Thailand, the Philippines and Malaysia will all ease fiscal policy. Together with lower inflation and a gradual improvement in exports this is expected to support recovery in H1 2012.

India looks increasingly vulnerable, because unlike the rest of Asia it does not have the policy flexibility ease fiscal and monetary policy due to resilient elevate inflation, high budget deficit and public debt and a 3% current account deficit. While there are signs that the Indian economy started to recover in late 2011 there is an increasing risk of a relatively hard landing.

General Disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Monetary and Fiscal Easing Could Support Gradual Asian Recovery

Published 01/18/2012, 01:50 PM

Updated 05/14/2017, 06:45 AM

Monetary and Fiscal Easing Could Support Gradual Asian Recovery

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.