Mondelez International, Inc. (NASDAQ:MDLZ) reported third-quarter 2017 results, with both earnings and revenues surpassing the Zacks Consensus Estimate.

Adjusted earnings of 57 cents per share beat the Zacks Consensus Estimate of 54 cents by 5.6%. Adjusted earnings grew 12%, primarily driven by operating gains.

Sales Details

Net revenues increased 2.1% year over year to $6.53 billion on organic revenue growth and currency tailwinds. Emerging markets’ net revenues increased 4.5%, while developed markets revenues were up 0.7%. Power Brands also witnessed a 5.6% increase in revenues.

Regionally, Asia, Middle East & Africa, Europe and North America registered a respective 2.6%, 1.3% and 3% decline in revenues. However, Latin America’s revenues increased 5.5%.

Reported total revenues exceeded the Zacks Consensus Estimate of $6.46 billion.

Organic revenues increased 2.8%, better than the 2.7% decline seen last quarter. The improvement was primarily driven by Power Brands as well as strong performance in Europe and emerging markets.

Pricing increased 1.5%, more than 1.1% in the previous quarter. Volume mix increased 1.3%, as against the 3.8% decline in the last quarter.

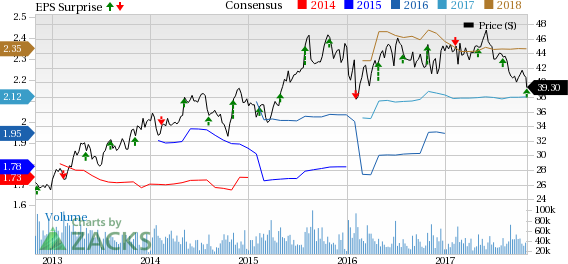

Mondelez International, Inc. Price, Consensus and EPS Surprise

Margins

Adjusted gross margin decreased 60 basis points (bps) year over year to 39.5%, as higher input costs and select trade investments in some key markets were partially offset by continued net productivity gains.

However, adjusted operating margin expanded 130 bps year over year to 16.9% on the back of lower overhead costs owing to continued cost reduction.

Financials

Mondelez reported cash and cash equivalents of $844 million as on Sep 30, 2017, down from $1.74 billion at the end of 2016.

The company repurchased more than $700 million of its common stock and paid approximately $300 million in cash dividends.

2017 Guidance

Organic net revenues are expected to increase approximately 1% only owing to the malware incident.

Adjusted operating margin is still expected in the mid-16% range.

Management continues to expect adjusted earnings increase at a double-digit rate on a constant-currency basis.

Zacks Rank & Peer Releases

Mondelez currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dr Pepper Snapple Group Inc. (NYSE:DPS) reported third-quarter 2017 adjusted earnings per share of $1.10, missing the Zacks Consensus Estimate by 4.3%. Earnings were down 6% on a year-over-year basis owing to the recent hurricanes in United States, earthquakes in Mexico and a previously disclosed write-off of prepaid resin inventory.

The Hershey Company’s (NYSE:HSY) earnings and revenues beat the Zacks Consensus Estimate in third-quarter 2017. Growth in its core brands, successful innovation and progress in multi-year productivity, and cost-saving initiatives helped the company post better numbers.

The Procter & Gamble Company (NYSE:PG) , popularly known as P&G, reported first-quarter fiscal 2018 financial results, wherein earnings and revenues surpassed expectations. However, the company has been struggling to boost organic sales in a decelerating global market.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Dr Pepper Snapple Group, Inc (DPS): Free Stock Analysis Report

Hershey Company (The) (HSY): Free Stock Analysis Report

Mondelez International, Inc. (MDLZ): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Original post

Zacks Investment Research