Many oil trading Executives think that the oil price may have come to the bottom and it will rise. With that in the case, it will help the European Central Bank raise the inflation rate to a more normal level and faster the economic recovery with the negative interest rate and other massive stimulus policies. Reuters Estimates show that most respondents think what is hampering the Eurozone economy is the demand delay instead of the accessibility of credit loans. They don’t think that the ECB will further turn down the already negative deposit interest rate.

BOJ president Haruhiko Kuroda said in Washington that the over-appreciation of JPY/USD had got some correction in the past few days. Though the Japanese exchange rate is determined by the Ministry of Finance rather than the central bank, Haruhiko Kuroda’s remarks should still be paid attention to because this was the first time he had described the JYP rise as “excessively”.

In the Reuters survey of 16 analysts, half of the respondents said that the BOJ would further ease the monetary policies during its April 27-28 meeting.

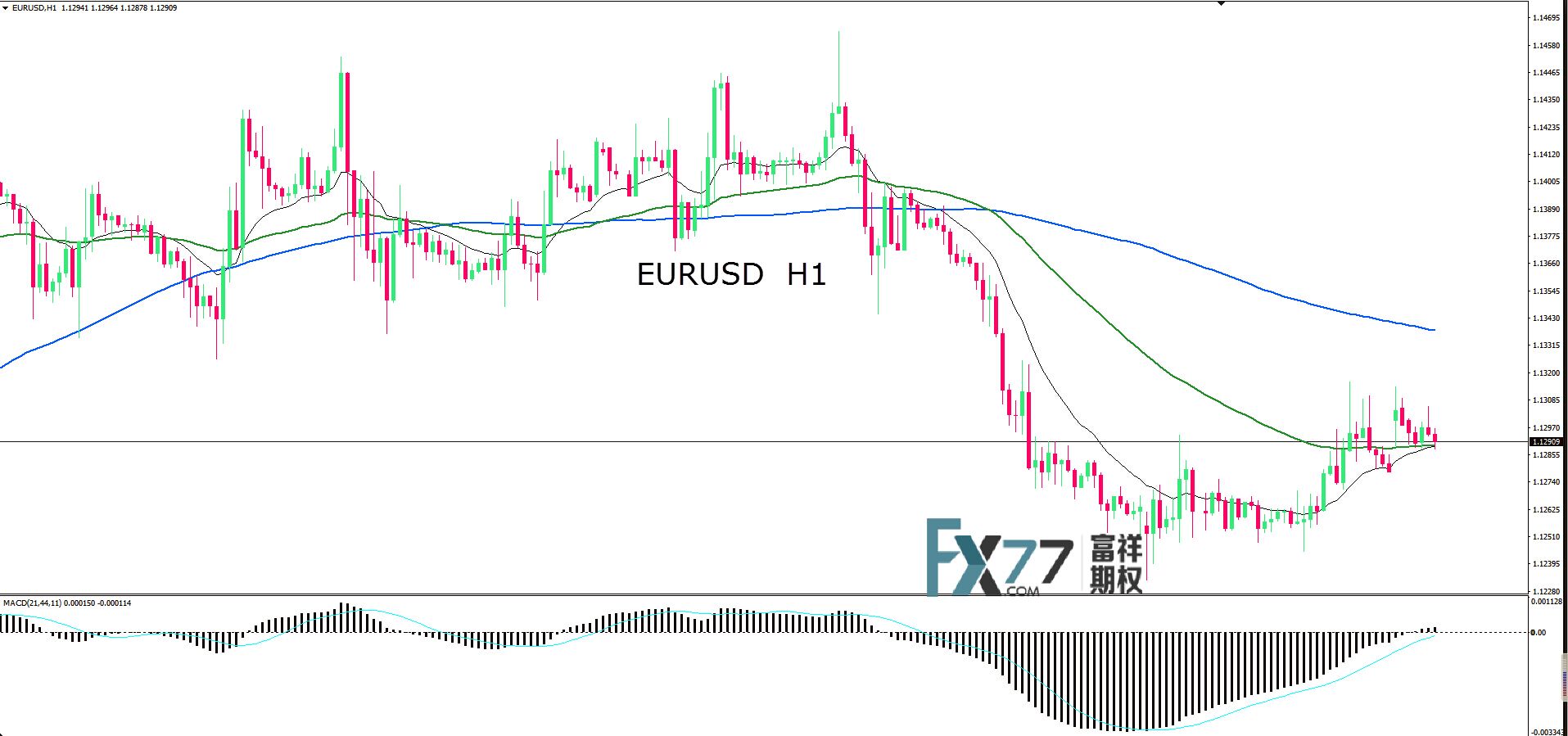

Seen from the Chart H1, EUR/USD remains the bullish trend in the morning session but seen from the MACD, the momentum is not strong and the it is possible to fall again anytime. Therefore, we are mainly put options buyers during the daytime session.(HKT)

Support: 1.1250/1.1220 Resistance: 1.1320/1.1340

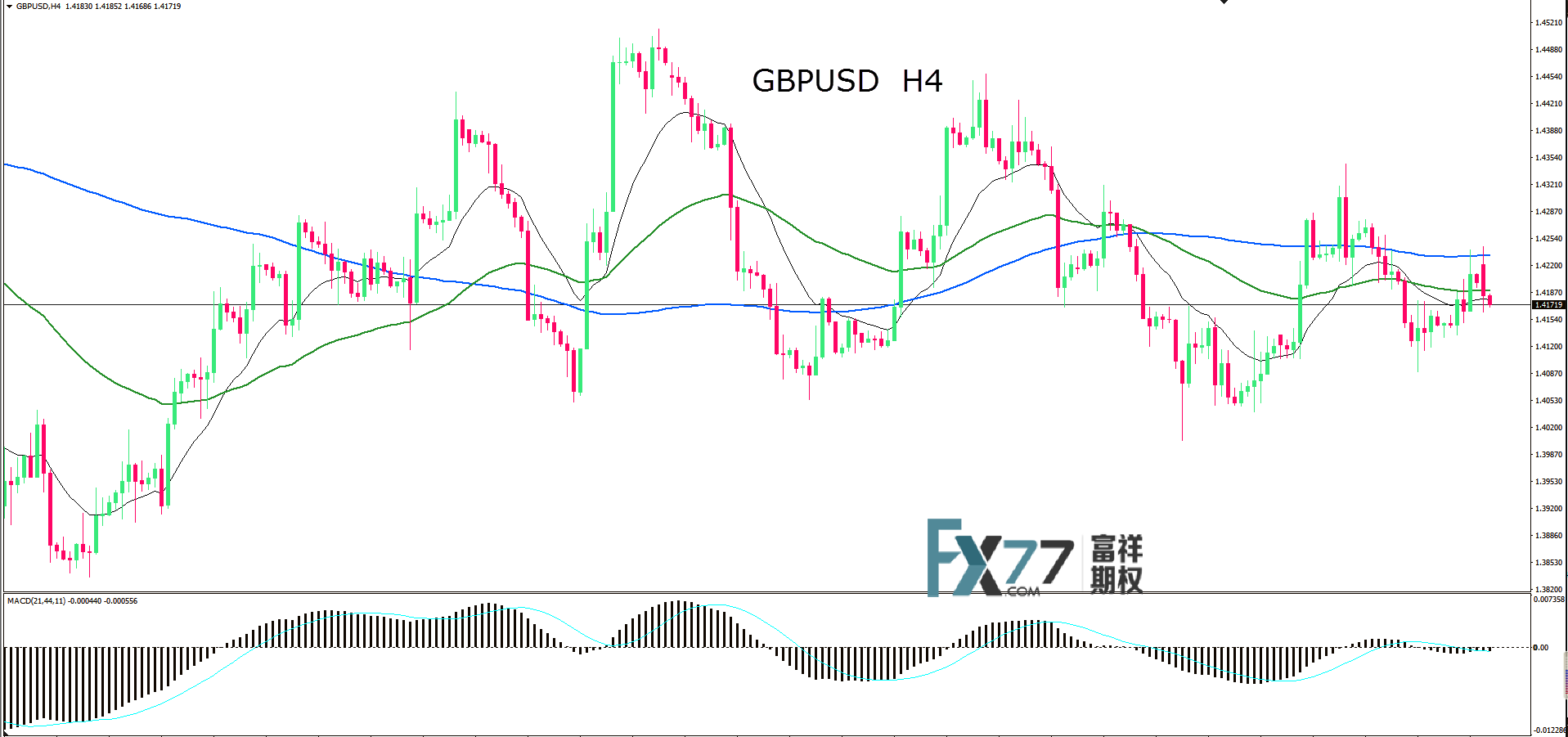

Seen from the H4 MACD, GBP/USD is vibrating between a small range in the morning but the trend tends to fall. We are mainly put options buyers overall during the daytime session. (HKT)

Support: 1.4140/1.4126 Resistance: 1.4220/1.4240

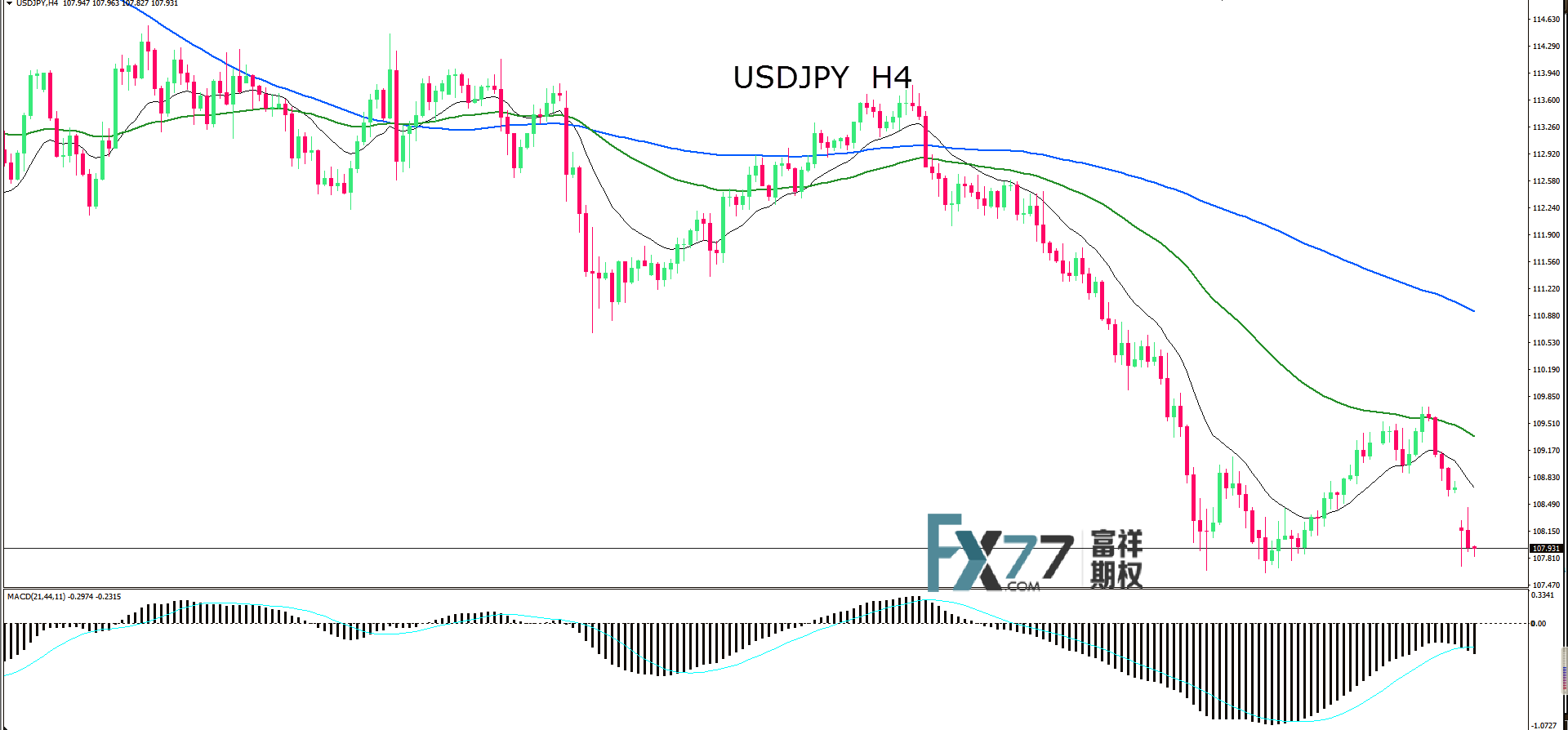

USD/JPY rapidly fell down after a small new high was created. To the morning session today, the price has arrived near the recent low area of 107.62 and a gap has showed up in the meanwhile. In the morning session, it is possible to rally from the support and to recover the gap. However, seen from MACD, the bearish momentum is still strong and it is more likely to break below the support and go to a new low. As a result, we are mainly put options buyers overall during the daytime session.(HKT)

Support: 107.62/107.00 Resistance: 108.60/109.00

DISCLAIMER: All the information mentioned above is for reference only.