The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday higher.

- ES pivot 2062.33. Holding above is bullish..

- Rest of week bias higher technically.

- Monthly outlook: bias lower.

- YM futures trader: no trade tonight.

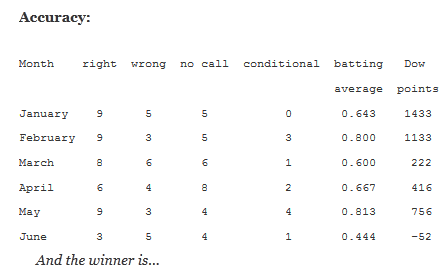

Last Thursday night I noted that it was risky to call op-ex days, but I'd already called Wednesday as uncertain, it being a Fed day. So I sowed the wind, calling the market higher Friday, and then proceeded to reap the whirlwind as the Dow sank 58 points, putatively on more Brexit worries. Not a big loss to be sure, but I never like being wrong. Let's see if we can't do a bit better moving on into the last full week of June.

The technicals

The Dow: On Friday the Dow tried to recover from its early losses but in the end didn't quite manage to, finishing with a second hammer in a row, sitting near the top of Thursday's candle. Indicators continue quite oversold though so I can't help but thinking there's more upside to come here.

The VIX: And on Friday the VIX gained a tiny 0.21% on a small doji star But with indicators still overbought and a completed bearish stochastic crossover, it's hard to see a reversal higher form here.

Market index futures: Tonight, all three futures are higher at 12:17 AM EDT with ES up a a strong 1.19%. On Friday, despite a move lower, ES put in a classic bullish piercing pattern that left indicators quite oversold. The new Sunday overnight seems to be confirming that as it is gapping higher in non-trivial fashion. That would bode well for an advance on Monday.

ES daily pivot: Tonight the ES daily pivot edges up from 2060.92 to 2062.33. That leaves ES well above its new pivot so this indicator continues bullish. Reminder - we are now running the "U" contrat.

Dollar index: After an inverted hammer last Thursday the dollar confirmed it with a gap-down red spinning top for a 0.39% loss to complete a bearish stochastic crossover. This looks like more downside ahead to me.

Euro: After a bullish engulfing candle last Friday the euro is taking a big leap higher in the Sunday overnight with 0.70% gap-up jump almost back to resistance at 1.14. That's sending all the indicators higher along with a neatly completed bullish stochasti corssover. It looks now like the euro is going higher on Monday.

Transportation: And finally, this is more what I was looking for on Friday. On a day the rest of the market fell, the trans put in a solid 0.58% advance confirming Thursday's dagger-like hammer that tested their lower BB. This gave us a bullish setup on a descending RTC exit and with the indicators still all oversold, I'll bet there's more upside left on Monday.

All the bullish signs I noted last Thursday are still in play only more so. I don't know what happened Friday - I'll just chalk it up to op-ex games. But continuing bullish charts plus some strong guidance form the futures tonight leads me to try again and call Monday higher.

YM Futures Trader

No trade tonight.