Actionable ideas for the busy trader delivered daily right up front

- Monday lower, low confidence.

- ES pivot 1577.17. Holding below is bearish.

- Rest of week bias lower technically.

- Monthly outlook: bias lower.

- ES Fantasy Trader standing aside.

You've seen it, you can't unsee it. OK, this is very unsettling. Apparently, a slim majority of Americans elected the ghost of Moe Howard, leader of The Three Stooges, to run the greatest country on earth. Not once, but twice. Nyuk nyuk nyuk. Listen you mugs - it is left as an exercise to the reader to decide if Joe Biden looks more like Larry or Curley. Loser gets Harry Reid. Woo woo woo!

Recap

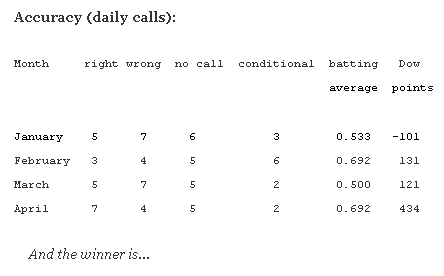

OK, all silliness aside, I know I called for the Dow to close lower on Friday and that was wrong, but only by 12 points. In any case, both the SPX and Nasdaq did close lower, so it wasn't a bad miss. On small-range days, it's always possible for that sort of thing to happen. Now let's see where Monday may be headed.

The technicals (daily)

The Dow: Friday's small gains were just not quite enough to prevent a bearish setup on a rising RTC exit. However, the indicators are still rising and the stochastic is still a ways from even starting a bearish crossover, so it's too early to call the Dow lower, especially considering the green candle on Friday.

The VIX: The VIX fell on Friday but only lost 0.07% on a red candle hanging above Thursday's perfect doji. Frustratingly, that sort of action neither confirms nor disproves the doji. We're simply left with the indicators which are now officially oversold and a stochastic very near to forming a bullish crossover. I'd \say the VIX is due for a bounce here, if not Monday then even more likely on Tuesday.

Market index futures:Tonight the futures are mixed at 12:56 AM EDT with NQ up 0.07%, YM just barely down 0.01% and ES down by just 0.05 %. On Friday, ES lost almost enough to exit its rising RTC. In the Sunday overnight, it has done that, so that becomes a bearish setup - unless ES can manage a gain up to 1582.50 on Monday. The indicators are now rather overbought and the stochastic has now just completed a bearish crossover. Thursday night I said this chart looked toppy. Friday's losses confirmed that. On Sunday night, I see no signs of a move higher so things continue to look bearish.

ES daily pivot: Tonight the pivot inches up from 1580.25 to 1577.17. The lackluster overnight action leaves us below the new pivot, though only by a point and a half. This is one of these cases where ES is going to have to break through the resistance offered by the pivot if it hopes to move higher on Monday. As it stands, it's a negative sign.

Dollar index: Th3 dollar dropped 0.32% on Friday on a small harami cross. This is a bullish reversal sign. However, the indicators are a bit out of sync here, being as they're still descending off overbought. So let's just say there's a possibility of a higher dollar on Monday, but not a certainty.

Euro: Last Thursday night I wrote "other signs seem to suggest more upside for the euro on Friday". And that's just what we got, with the euro closing at 1.3033 to break out of its descending RTC for a bullish setup. The Sunday overnight is trading higher, up 0.18% already after a gap-up open. With indicators just coming off oversold and a freshly completed bullish stochastic crossover, I'm looking for more gains here on Monday. Note once again that this conflicts with my guess for a higher dollar - if I had to bet, I'd bet on the euro moving higher.

Transportation: On Friday the trans gained a puny 0.08% on a spinning top. This keeps us in a rising RTC but also drove RSI to very overbought (97.03). And the stochastic is starting to flatten out in preparation for a bearish crossover, possibly by mid-week. But this isn't immediately bearish so we'll need to watch Monday for confirmation of Friday's doji.

Tonight I'm not getting a real good read from the charts either way. The overall feeling is more bearish than bullish though and there's no major economic news coming out to prop things up so I'm going to go out on a limb and call Monday lower.

ES Fantasy Trader

Portfolio stats: the account now rises to $107,750 after 11 trades (9 for 11 total, 4 for 4 longs, 5 for 7 short) starting from $100,000 on 1/1/13. Tonight we stand aside again because I'm not quite ready to pull the trigger. I think tomorrow will be a more reliable entry point.