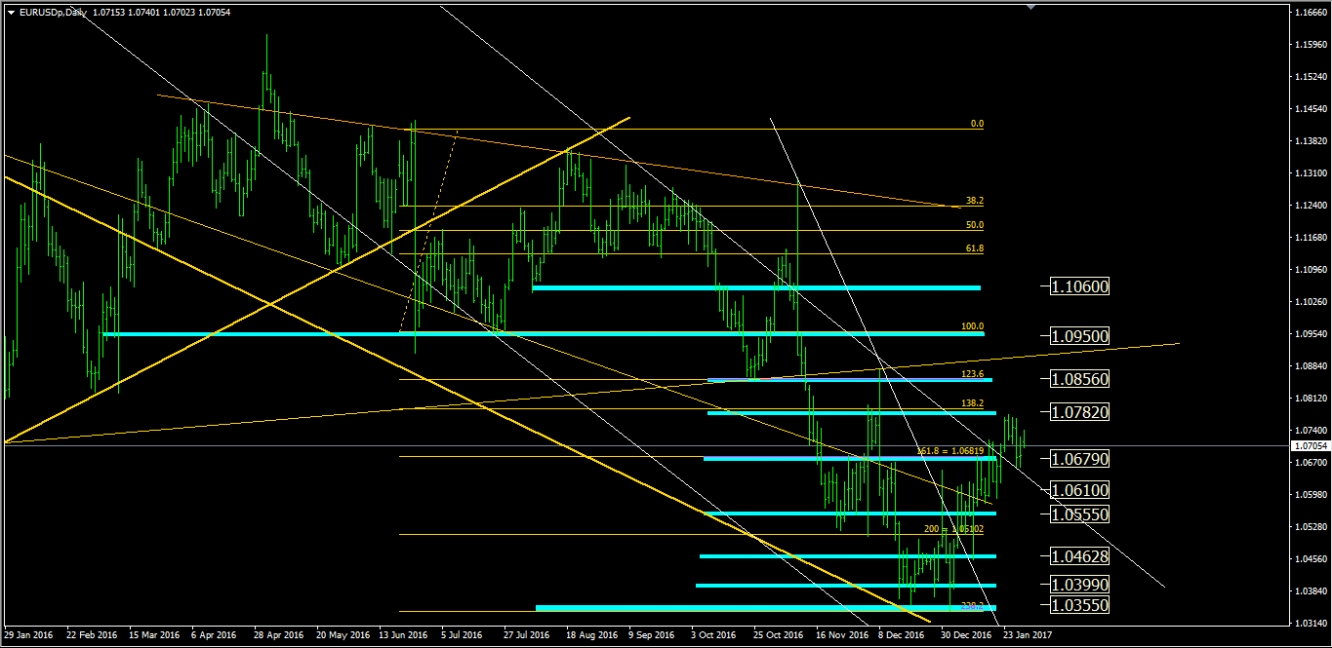

EUR/USD

Eyes on U.S. GDP which was released on Friday as significantly lower than expected.

The weakness in the dollar reflected concerns over a lack of clarity on Trump’s economic policies and fears that his protectionist stance could hit corporate profits and act as a drag on growth. The dollar fell in Asia on Monday as the fallout from President Donald Trump's move to ban travellers from seven Muslim-majority countries sparked concerns of a backlash and investors looked ahead this week to central bank decisions in the U.S., U.K. Japan and Australia.

As per our previous commentaries, we still expect EUR/USD to fall to 1.06 area.

ECB President stated: Rates seen at current or lower levels for an extended period of time. No convincing upward trend in underlying inflation. Headline inflation is likely to pick up further near term. Underlying inflation is expected to rise more gradually in the medium term.

Our special Fibo Retracement is confirming the following S/R levels against the Monthly and Weekly trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Overbought

1st Resistance: 1.0782

2nd Resistance: 1.0856

1st Support: 1.0679

2nd Support: 1.0610

EUR

Recent Facts:

1st of December, French and German Manufacturing PMI (it measures the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below indicates contraction)

French Manufacturing PMI better than expected, German Manufacturing PMI slightly worse than expected.

4th of December, Italy Constitutional Referendum

Prime Minister quits as vote defeat deepens Europe’s turmoil.

8th of December, Interest Rate Decision + ECB Press Conference

Interest Rate unchanged but the European Central Bank wants to extend its asset purchase program for an additional nine months.

13th of December, Eurozone CPI + German ZEW Economic Sentiment

Eurozone CPI pared the expectations, German ZEW contrasted.

15th of December, German Manufacturing (Preliminary release)

Better than expected.

2nd of January, Eurozone Manufacturing PMI

Better than expected.

3rd of January, German Unemployment + German CPI

Better than expected.

4th of January, Spanish Unemployment + Eurozone Services PMI + Eurozone CPI

Higher than expected.

19th of January, ECB Interest Rates + Press Conference

Rates unchanged.

24th of January, German Manufacturing PMI + Services PMI

Manufacturing PMI better than expected, Services PMI worse than expected.

USD

Recent Facts:

16th of November, U.S. Producer Price Index (PPI)

Worse than expected.

17th of November, CPI + Housing Starts + Philadelphia Fed Manufacturing

CPI Worse than expected, Building Permits and Housing Starts better than expected, Philadelphia Fed Manufacturing worse than expected.

22nd of November, Existing Home Sales

Better than expected.

23rd of November, Durable Goods Orders + New Home Sales + FOMC Minute Meeting

Durable Goods Orders better than expected, FOMC Minute Meeting didn’t say anything new (a rate hike appropriate relatively soon as long as data cooperates).

29th of November, GDP (Preliminary release) + CB Consumer Confidence

GDP better than expected, CB Consumer Confidence better than expected.

30th of November, ADP Nonfarm Employment Change

Better than expected (new high since January 2016).

1st of December, ISM Manufacturing PMI (it is based on data compiled from monthly replies to questions asked of purchasing and supply executives in over 400 industrial companies)

Better than expected.

2nd of December: Nonfarm Payrolls + Unemployment Rate

Better than expected.

14th of December, Fed Interest rate decision + FOMC Meeting

USD Interest Rate hike happened as expected.

15th of December, Core CPI + Philadelphia Fed Manufacturing Index

Core CPI slightly worse than expected, Philadelphia Fed Manufacturing Index better than expected.

22nd of December, Core Durable Goods Orders + GDP

Better than expected.

28th of December, Pending Home Sales

Worse than expected.

4th of January, FOMC Meeting Minutes

The forecast of as many as three rate hikes in 2017 is highly variable on President-elect Donald Trump getting an aggressive tax cut and spending plan through Congress.

6th of January, Nonfarm Payrolls + Unemployment Rate

Worse than expected (over the last 6 months, 4 were below the expectations).

13th of January, Producer Price Index + Retail Sales

Producer Price Index higher than expected, Retail Sales slightly worse than expected.

24th of January, Manufacturing PMI + Existing Home Sales

Manufacturing PMI better than expected, Existing Home Sales worse than expected.

27th of January, GDP + Durable Good Orders

GDP significantly worse than expected, Durable Good Orders as expected.

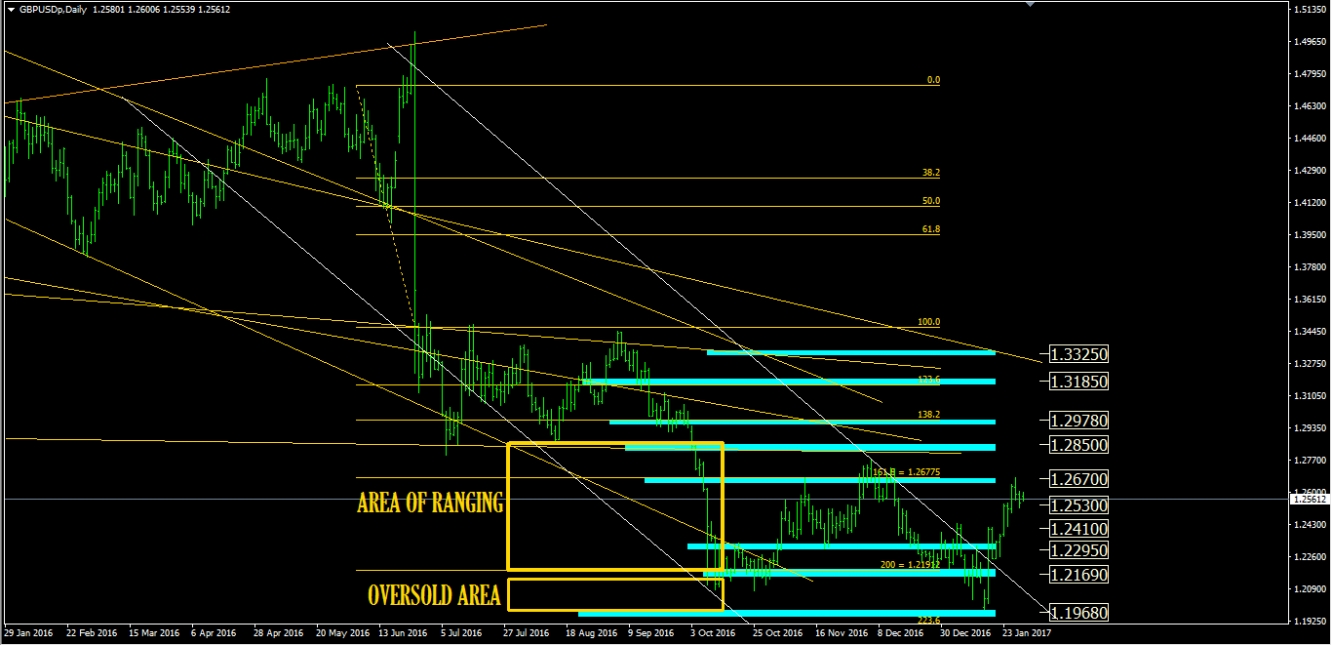

GBP/USD

GDP data released was better than expected. Over the past 6 months no one reading was below the forecast and 4 were better then expected. Nonetheless, at this present point with the unrealistic peaks recently marked by GBP, we are bearish on GBP, mostly due to EA-related problems, which will generate broad reversals.

EU Banking System set as a condition for any cooperation with the financial institutions in the UK that of having them fully aligned with European policies.

Trump’s setup will probably create a positive resonance in the economy of UK, but not in the short term. We expect GBP/USD to go down to 1.25 area.

Our special Fibo Retracement is confirming the following S/R levels against the monthly and weekly trendlines obtained by connecting the relevant highs and lows back to 2001:

Weekly Trend: Overbought

1st Resistance: 1.2670

2nd Resistance: 1.2850

1st Support: 1.2530

2nd Support: 1.2410

GBP

Recent Facts:

4th of August, Bank of England Interest Rates decision (expected a cut)

Bank of England lowers Interest Rates as expected (record low of 0.25%) and increases purchase program.

9th of August, Manufacturing Production (measures the change in the total inflation-adjusted value of output produced by manufacturers)

Slightly worse than expected.

9th of August, Trade Balance

Worse than expected. Setting a new historical low.

16th of August, UK Consumer Price Index (measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation)

Higher than expected. Setting a new high since January 2015.

18th of August, UK Retail Sales

Better than expected. Core Retail Sales YoY at the highest since November 2015

1st of September, UK Manufacturing PMI (key indicator of the activity level of purchasing managers in the services sector)

Better than expected. Setting a new historical high since December 2015.

5th of September, UK Services PMI

Better than expected.

30th of September, Gross Domestic Product

Pared the Expectations

4th of October, Construction PMI

Better than expected.

18th of October, CPI (UK Price Inflation)

Higher than expected.

19th of October, Job Market (Average Earnings Index + Claimant Count Change + Unemployment Rate)

Average Earnings Index + Claimant Count Change + Unemployment Rate as expected.

Claimant Count change better than expected.

20th of October, Retail Sales

Worse than expected.

27th of October, GDP Q3 (Preliminary release)

Better than expected.

2nd of November, Construction PMI

Better than expected.

3rd of November, Services PMI + BoE Monetary Policy votes + Interest Rates Decision

Services PMI better than expected, Interest Rates unchanged and no clues about future change.

8th of November, ELECTION OF THE 45th PRESIDENT OF THE UNITED STATES

Donald Trump elected President

9th of November, Trade Balance

Worse than expected.

15th of November, CPI

Worse than expected.

16th of November, Job Market

Claimant Count change (which measures the change in the number of unemployed people in the UK during the reported month) worse than expected.

17th of November, Retail Sales

Better than expected.

1st of December, Manufacturing PMI (it measures the activity level of purchasing managers in the manufacturing sector)

Worse than expected.

7th of December, Manufacturing Production

Worse than expected.

9th of December, Consumer Inflation Expectations + Trade Balance (EU and non-EU)

Consumer Inflation Expectations higher then expected, Trade Balance better than expected.

13th of December, CPI (UK Price Inflation)

Higher than expected.

14th of December, Job Market

Better than expected.

3rd of January, Manufacturing PMI

Better than expected (setting a new high since August 2014)

4th of January, Construction PMI

Better than Expected

11th of January, Manufacturing Production

Better than Expected

17th of January, UK Prime Minister May speaks

May confirmed that the UK will leave Europe's single market, but will seek a deal that gives the greatest possible access, Both the divorce and the new trading environment with the EU can be agreed within the 2 year window set under Article 50.

18th of January, Job Market

Better than expected.

20th of January, Retail Sales

Worse than expected.

26th of January, GDP (Preliminary release)

Better than expected.

USD

Recent Facts:

See above.

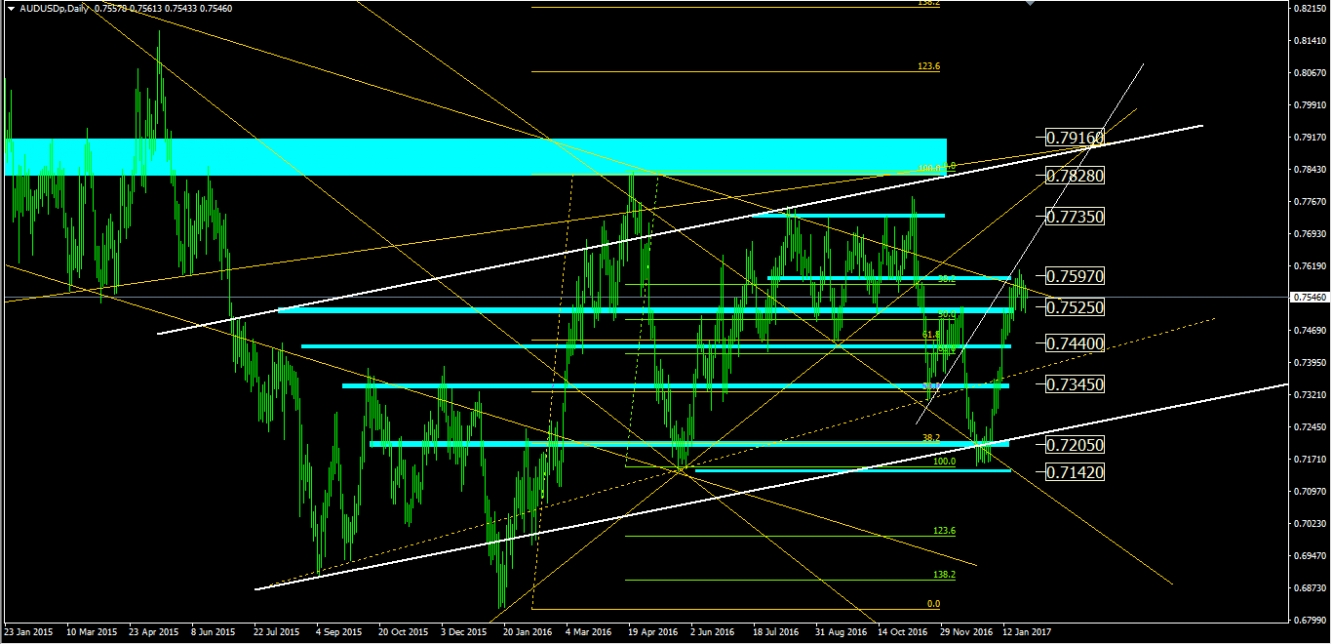

AUD/USD

Earlier Wednesday, the Australian Bureau of Statistics reported that the consumer price index rose 0.5% in the fourth quarter of 2016, disappointing expectations for an increase of 0.7%. Now AUD gets tightly linked to oil prices.

Now we are testing a resistance in 0.756 area. On the long-term, we project an overshoot on 0.77 area in order to exhaust the overbought impulse.

Our special Fibo Retracements are confirming the following S/R levels against the Monthly and Weekly Trendlines obtained by connecting the relevant highs and lows back to 2012:

Weekly Trend: Neutral

1st Resistance: 0.7597

2nd Resistance: 0.7735

1st Support: 0.7525

2nd Support: 0.7440

AUD

Recent Facts:

2nd of August, Interest Rates decision cut to from 1.75% to 1.50% as expected.

4th of August, Retail Sales (Jun)

Worse than expected.

11th of August, Reserve Bank of New Zealand's rate statement

Interest rates cut (to 2%) as expected.

18th of August, Employment Change

Better than expected. Highest since the beginning of this year.

15th of September, Employment Change

Worse than expected.

18th of October, Reserve Bank of Australia Meeting Minutes

RBA's Governor Philip Lowe said that Inflation expectations declined, but not that much and that current level of AUD and rates is suitable for economy.

In the meantime New Zealand Consumer Price Index came in at 0.2%, above expectations (0%) in 3Q.

20th of October, Job Market Data

Worse than expected.

26th of October, Inflation Data (CPI)

Higher than expected.

1st of November, RBA Interest Rates Statement

RBA’s Governor Lowe signals tolerance for weak inflation and bets seem off for future rate cuts.

3rd of November, RBA Monetary Policy Statement + Retail Sales

RBA said it is focused on the medium-term inflation target

Retail Sales better than expected.

8th of November, ELECTION OF THE 45th PRESIDENT OF THE UNITED STATES

Donald Trump elected President.

9th of November, Reserve Bank of New Zealand Interest Rate Decision + Monetary Policy Statement

Interest Rates cut to 1.75% from 2.00% as expected.

17th of November, Employment Change

Slightly worse than expected.

23rd of November, Australia Construction Work Done

Worse than expected (for the 5th Quarter in a row).

30th of November, Building Approvals + Australia Private Sector Credit

Building Approvals worse than expected, Private Sector Credit better than expected.

2nd of December, Retail Sales

Better than expected (for the 3rd Month in a row).

6th of December, Interest Rate Decision + RBA Statement

The Reserve Bank of Australia held its benchmark cash rate at a record low 1.50% as expected, while noting a stronger Aussie could complicate efforts to rebalance the economy.

7th of December, Gross Domestic Product (GDP)

Worse than expected.

15th of December, Employment Change

Better than expected.

19th of December, Mid-Year Economic and Fiscal Outlook

Scott Morrison announced lower than an original prediction of A$37.1 billion, investors see it as promising to stave off a downgrade of its AAA (triple A) rating from S&P Global.

9th of January, Retail Sales

Worse than expected.

19th of January, Employment Change

Better than expected.

25th of January, CPI (Consumer Price Index measures the change in the price of goods and services from the perspective of the consumer)

Lower than expected.

USD

Recent Facts:

See above.