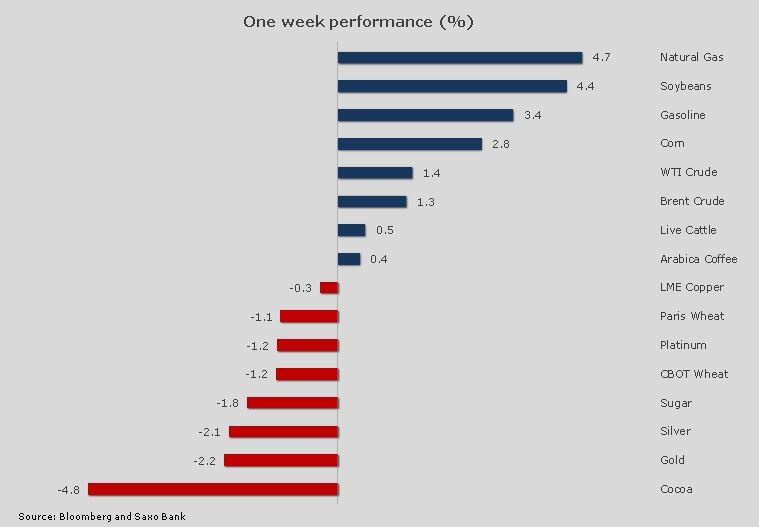

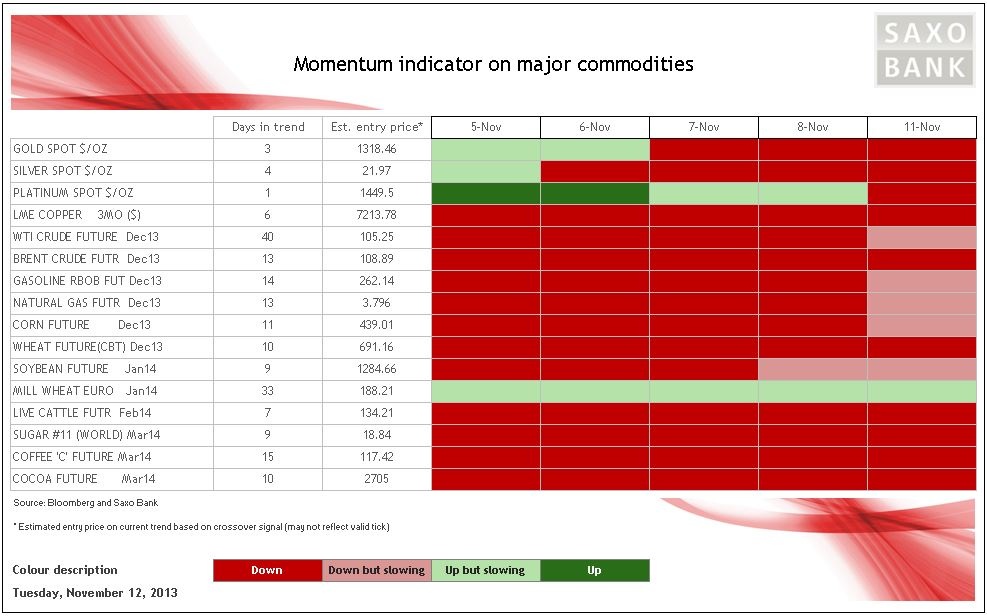

Negative momentum prevails across most of the major commodities with the pick-up in US data last week being offset by a rising US dollar and worries about disinflation. Crude oil and natural gas prices, which have been on the defensive recently, are now showing signs of potentially bottoming out as negative momentum is showing signs of slowing and this pattern also goes for corn and soybeans.

Brent crude has recovered sharply after reaching USD 103/barrel last Friday on a combination of supporting economic and geopolitical news. The negotiations with Iran seems to be going nowhere so the return of oil from the embargoed country is not going to be seen anytime soon, not even if some breakthrough can be achieved. The speculative position remains net-long but has been sharply reduced since September not least due to increased positioning on the sell side. This now leaves the price much more exposed to a sudden jolt to the upside—such as we have seen over the past 48 hours.

Shale oil

In its 2013 World Energy Outlook, the International Energy Agency (IEA) points towards a worry that OPEC producers are becoming complacent due to the continued strong rise in shale oil production in the US. The IEA does, however, see US production peak already in 2020. And with world demand expected to continue to grow and reach 101 million barrels per day in 2035 ,the risk is that OPEC producers may delay investments due to increased shale oil production, thus raising the risk of a future supply crunch.

Price developments, however, are still expected to be very benign with the price rising, but in real terms actually falling up until 2035 while China's role as the primary contributor to oil demand growth will be replaced by India after 2020.

Near-term, both crude oils will be in consolidation mode but weekly inventory data from the US on Wednesday is expected to show an eighth week in row of rising crude stockpiles. This has kept WTI under relative pressure, resulting in its discount to Brent widening back out to USD 12/barrel.

Precious metals

Gold and silver are both showing negative momentum as they have both been struggling with the sharp rise in bond yields since last Friday. Silver has reached and found support at USD 21.08/oz which is trendline support from the June low while gold has done slightly better with buyers returning ahead of key support at USD 1,270/oz and 1,252/oz. ETP flows into gold have been positive for the past four days with some investors looking to take advantage of the recent weakness. The selling looks exhausted at this stage and i will be looking for a small bounce back towards resistance ahead of 1,300 while only a move back above could trigger short covering and renewed consolidation within the established range.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Momentum: Energy Sector Showing Signs Of Life

Published 11/13/2013, 01:23 AM

Updated 03/19/2019, 04:00 AM

Momentum: Energy Sector Showing Signs Of Life

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.