The markets rallied this past week with the bright spot being the Dow Transports, which were up 2.82% over the course of the week with strong performances from railroads and carriers. Earnings overall have come in ahead of expectations with 76% of companies beating earnings and showing an average positive surprise of 4.87%. Several major market indexes like the S&P 500 hit all-time highs this past week and there is a lot to be bullish about as the market continues to strengthen, but therein lies a potential problem as sentiment becomes overly bullish. The market is overbought and suggests a short-term top may be near and with sentiment near bullish extremes short-term caution is warranted.

S&P 500 Member Trend Strength

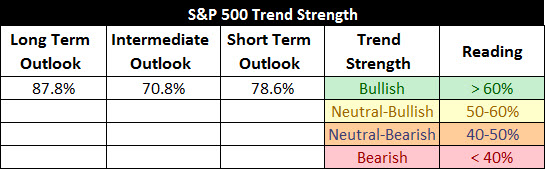

As shown below, the long-term outlook for the S&P 500 is clearly bullish as 87.8% of the 500 stocks in the index have bullish long-term trends, up from a reading of 85% three weeks ago. The market's intermediate-term outlook has also improved, jumping from 50.4% three weeks ago to 70.8%, pushing it into bullish territory. The market’s short-term outlook also strengthened this past week to 78.6%, moving it into bullish territory. What is most important is the market’s strong long-term outlook, which is still deep into bullish territory and does not suggest a major market top is forming.

* Note: Numbers reflect the percentage of members with rising moving averages: 200-day moving average (or 200d MA) is used for long-term outlook, 50d MA is used for intermediate outlook, and 20d MA is used for short-term outlook.

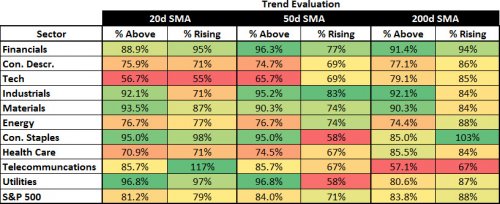

The most important section of the table below is the 200d SMA column, which sheds light on the market’s long-term health. As seen in the far right columns, you have 88% of stocks in the S&P 500 with rising 200d SMAs and 83.8% of stocks above their 200d SMA. Also, all ten sectors are in long-term bullish territory with more than 60% of their members having rising 200d SMAs.

S&P 500 Market Momentum

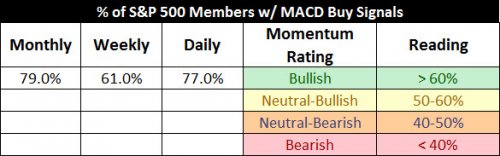

The Moving Average Convergence/Divergence (MACD) technical indicator is used to gauge the S&P 500’s momentum on a daily, weekly, and monthly basis. As indicated last week, with the weekly MACD having moved to a buy, the strength of the market's momentum is confirmed in all three time frames.

Digging into the details for the 500 stocks within the S&P 500 we can see that the daily momentum for the market remains elevated at 77.0%, down slightly from last week’s 82% reading though still in bullish territory.

The intermediate momentum of the market also improved from last week’s 22% reading to this weeks 61% reading, with the market’s intermediate momentum upgraded to bullish territory.

The market’s long-term momentum remains solid at a strong 79% this week, putting it well into bullish territory.

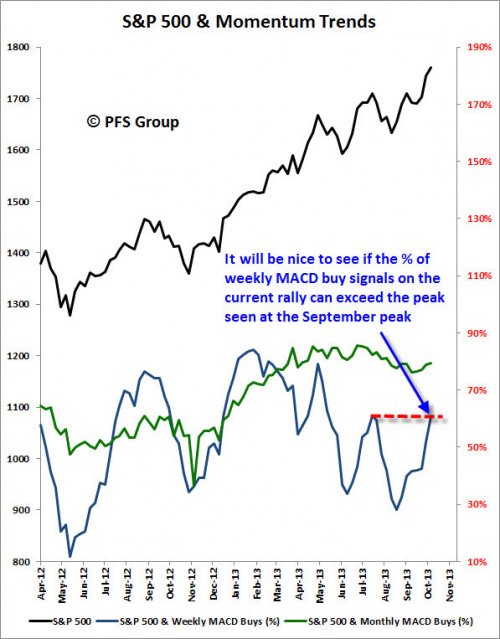

While it is encouraging to see the market’s long-term momentum remains in bullish territory, it has been a concern that the market’s weekly momentum had been diverging with the S&P 500’s advance with a series of lower highs. Currently the weekly numbers are matching those seen at the September market peak and may break the series of lower highs. The bulk of the weakness in the weekly numbers have been in the defensive sectors and financials, and both market segments have seen some of the most improvement and may have broken the divergence we’ve seen over the last several months.

52-Week Highs and Lows Data

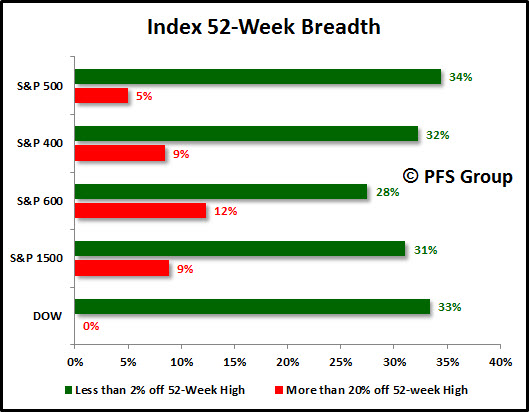

The insightful Lowry Research Corporation conducted a study on market tops recently (click for link) in which they looked at all major market tops since the Great Depression and found selectivity is a hallmark of all market tops. Simply put, participation in the bull market fades as individual stocks enter their own private bear markets well before the market peaks. On average, 17.26% of stocks were at or within 2% of their 52-week highs on the day the market peaked while 22.26% were off by 20% or more from their highs, indicating more stocks were experiencing bear markets than were participating in rallying to new highs. For this reason, a look at 52-week breadth of the markets is helpful in detecting an approaching bull market top.

The market continues to display impressive internals and does not suggest a market in danger of rolling over into a bear market. For example, there are 31% of stocks within the S&P 1500 that are within 2% of their 52-week highs while only 9% are experiencing bear markets, a comfortable margin relative to the average found by Lowry Research. The S&P 500 (large caps) shows the strongest margin between those near new highs (34%) and those in bear markets (5%) with the S&P 600 (small caps) showing the weakest margin between those near new highs (28%) and those in bear markets (12%), though still showing a very healthy spread.

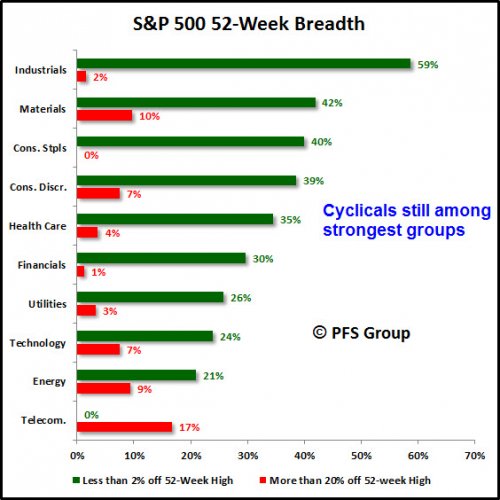

The current market leaders are industrials, materials, and consumer staples as these sectors have the highest percentage of members within their group that are within 2% of a new 52-week high and very few members who are currently experiencing a bear market (20% + decline), if any new 52-week lows. This is bullish as the top two sectors are cyclical stocks that tend to peak ahead of the market, and the fact that these are the strongest sectors is encouraging. The industrial and material sectors also benefit from stronger global growth and a weak USD, and their leadership suggests that global growth is picking up as are US exports.

Market Indicator Summary

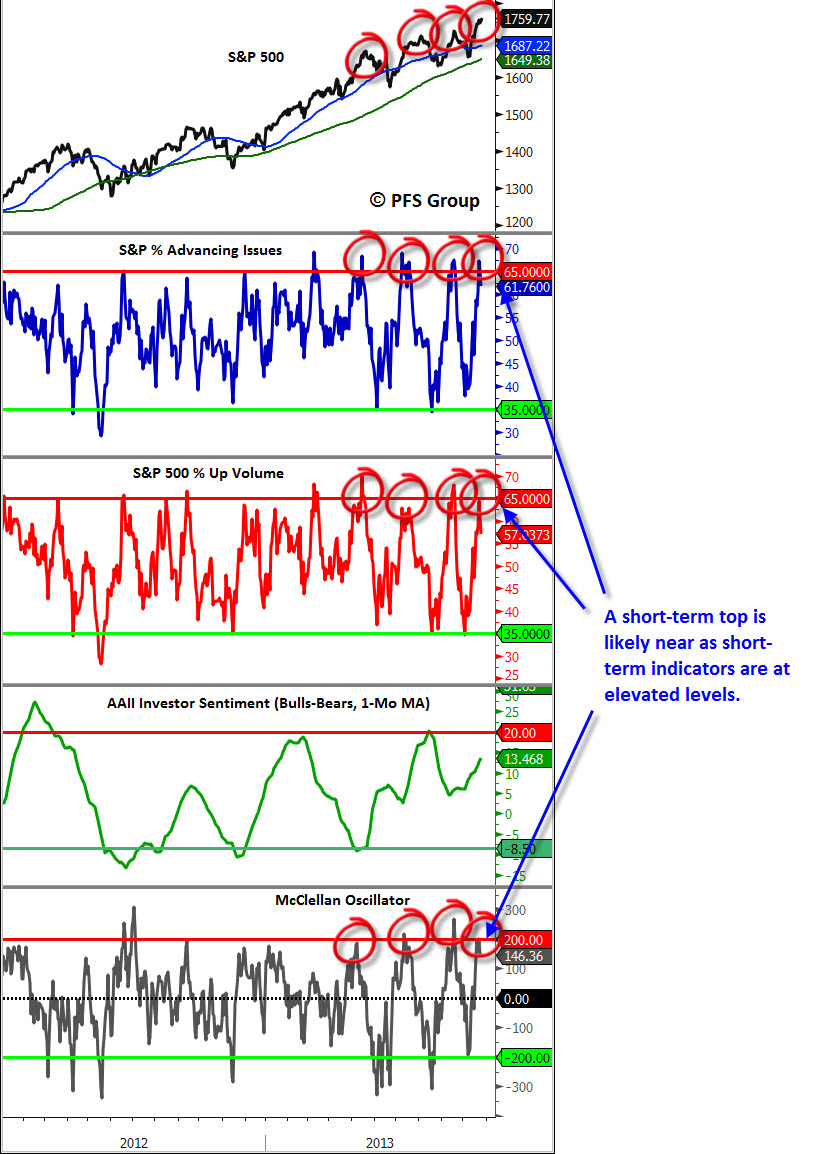

Below is a multi-indicator chart of the S&P 500 that measures breadth and momentum. The second, third, and fourth panels show the market has reached overbought territory and may be near a short-term top.

In addition to the market hitting levels that have marked short-term tops in the past, market sentiment in entering frothy levels that suggest caution ahead. The National Association of Active Investment Managers (NAAIM) sentiment survey shows money managers are the most bullish they have been since the July top. Also, the bull to bear spread from the American Association of Individual Investors (AAII) is at the highest level in nearly two years. With both institutional and retail investors overly bullish on the markets, a pause or pullback may be in store ahead.

Summary

The market’s trend and momentum remain firmly in bullish territory and the strength of breadth levels indicate a market nowhere close to forming a bull market top. That said, the market remains overbought and sentiment levels have become elevated with near-term caution is advised.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Momentum Still Bullish (But Market Overbought)

Published 10/27/2013, 01:44 AM

Updated 12/08/2023, 05:55 AM

Momentum Still Bullish (But Market Overbought)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.