In 2011, Scott’s Investments began tracking a momentum portfolio which ranks a basket of ETFs based on price momentum and volatility. In 2014, I also introduced a pure momentum system, which ranked the same basket of ETFs based solely on price momentum. Both strategies have undergone minor revisions over the years but the key elements remain.

The strategies in their current form begin by screening a basket of these 10 ETFs:

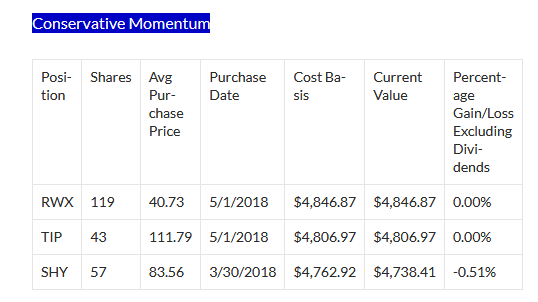

The ETFs in the “Conservative Momentum” system are still ranked by 6 month total returns (weighted 34%), 3 month total returns (weighted 33%), and 3 month price volatility (weighted 33%). The top 3 are purchased at the beginning of each month and if a holding drops out of the top 3 at the next month’s rebalance it is replaced.

Pure Momentum System

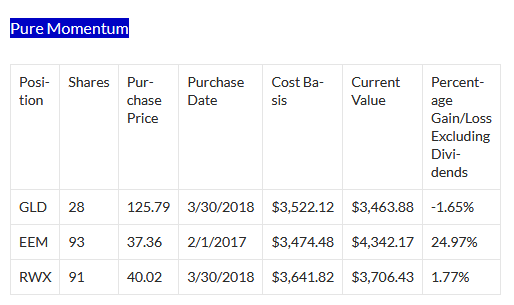

The pure momentum system ranks ETFs based on 5 month price momentum. There is no cash filter in the pure momentum system, volatility ranking, or requirement to limit turnover. The portfolio and rankings are posted on the same spreadsheet as the Conservative Momentum strategy.

A free option for backtesting these strategies is available at Portfolio Visualizer.

The conservative momentum system has turnover in two positions this month. EEM) was sold for a capital gain of 12.15% and original purchase date of 7/3/2017. GLD was sold for a capital loss of .81% and original purchase date of 3/1/2018. The proceeds were used to purchase RWX and TIP.

The pure momentum system has no turnover this month.

The current portfolios are below: