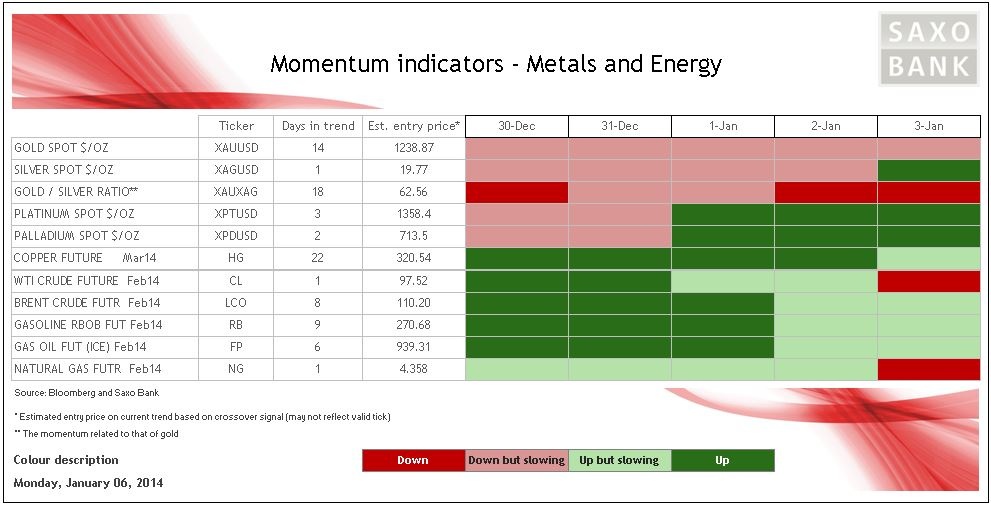

The first week of 2014 has so far seen a reversal of fortune between the best and worst performing sectors of 2013. Precious metals led by platinum and palladium have begun the year strongly after suffering a major setback last year and this has resulted in the return of positive momentum across all four metals in our table with gold turning today. The energy sector meanwhile has seen positive momentum slow in response to the sharp sell-off last week. WTI crude and natural gas turned negative on Friday and, at current levels, Brent crude and gas oil will join them today.

Raised growth expectations and a speculative community running ahead of itself in terms of net-long positioning ensured a strong finish for crude oil in 2013, but since then, the news about increased supply from Libya and a stronger dollar have offset worrying news from Iraq and a North American cold spell raising demand and reducing supply.

The metal sector led by those primarily finding an industrial use, such as copper and platinum, have seen a decent recovery over the last week despite the headwind being created by the stronger dollar. Further upside from here may short term prove difficult to achieve, not least considering doubts about strength of demand from emerging economies at a time of rising supplies. Perhaps with the exception of platinum where some geopolitical concerns related to the world's largest producer South Africa, make production levels difficult to estimate at a time of healthy pickup in demand.

Copper has retraced after once again failing to negotiate resistance in the USD 3.4 per pound area on High Grade and USD 7,500 per tons on LME Copper. The weakness has been driven by a couple of weaker-than-expected economic data points from China over the past week both of which have raised some concerns about economic growth in the world's largest buyer of industrial commodities.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Momentum Highlights Changing Strengths Between Energy And Metals

Published 01/07/2014, 02:55 AM

Updated 03/19/2019, 04:00 AM

Momentum Highlights Changing Strengths Between Energy And Metals

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.