We look at factors which could push EUR/USD FX forwards higher in the short-term.

We expect a Fed hike in June and note that a repricing could come swiftly. The premium on O/N EURUSD OIS basis over Q1 and Q2 has dropped back and USD liquidity is set to tighten further over the coming months following a brief pause.

As we argued in FX Edge Fed tightening to push EUR/USD FX forwards up again 1Y EUR/USD FX forward is currently priced about 15bp too low.

Short-term drivers for EUR/USD FX forwards

Last week in FX Edge: Fed tightening to push EUR/USD FX forwards up again , we argued that EUR/USD FX forwards are currently priced 15bp too low given our outlook for Federal Reserve (Fed) rate hikes and quantitative tightening (QT). We further argued that EUR- and DKK-based clients with USD assets should consider extending existing hedges out to 1Y. Below we provide some additional arguments for why momentum could be starting to turn around for EUR/USD FX forwards.

Re-pricing of Fed could come swiftly

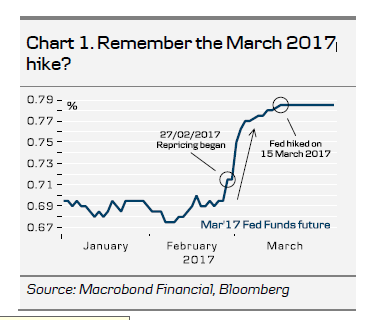

We expect the Fed to hike 25bp in both June and December. The Fed has communicated that it is on hold for now and the market is pricing the Fed to stay on hold for the rest of the year. However, a change in Fed communication and a repricing could happen swiftly. The rate hike in March 2017 is a good reminder of this. The market was not expecting a rate hike in March until the Fed preannounced it at the end of February (see chart 1).

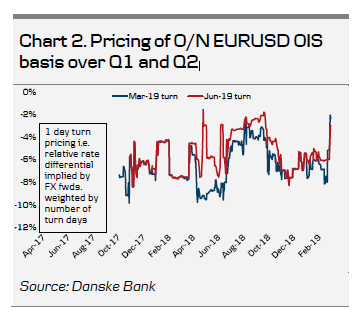

Q1 and Q2 turns have cheapened

The market has priced the overnight EURUSD OIS basis around 6-8% over Q1 and Q2 (when adjusting for the length of the turn) during the past couple of months. Towards the end of last week, the premium dropped closer to 2% (see chart 2), which leaves pricing within the range of realised pricing over the past couple of years. In 2017-18, overnight EURUSD OIS basis ended up trading in a range of around 1-3.5% during Q1-Q3 turns (adjusted for length of turn).

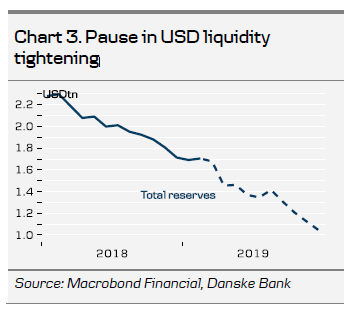

Tightening of USD liquidity has paused

Due to the debt ceiling effect (the US Treasury has drawn down its cash balance with the Fed), the ongoing squeeze in USD liquidity (due to the Fed's QT) has paused. It has probably contributed something to the tightening of EURUSD OIS basis that we have seen recently. However, the tightening of USD liquidity is set to accelerate over the coming months (see chart 3), which could reverse the recent trend for EURUSD OIS basis. QT will withdraw USD22bn and USD30bn at the end of March and April respectively, while tax day on 15 April will push the cash balance up again - over the past couple of years the cash balance has increased by USD100-250bn in April.