Earlier in the week, Gavyn Davies at the FT published a story that theorized about potential ways that the latest expansion could end. According to him, these three options represent the highest possibilities:

- Demand side secular stagnation (associated with the ideas of Lawrence Summers);

- Positive demand shocks combined with supply side weakness, leading to inflation pressure (associated with concerns expressed by Janet Yellen about the risk of raising US interest rates too slowly); and

- A downturn in the financial super cycle (associated with the thinking of Claudio Borio at the BIS).

Davies compares and contrasts all three, offering the reader insight into what might be in store. The article is very thought provoking and well worth your time.

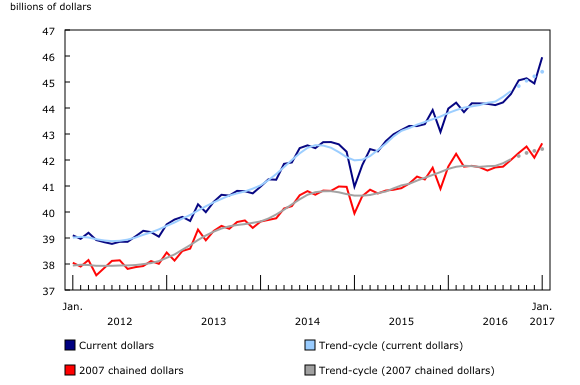

Canadian retail sales increased 2.2% M/M/1.7% ex-auto. 10 of 11 sub-sectors grew. Most importantly, auto sales, which increased in 4 of the last 5 months, rose 3.8%.

This shows increasing confidence on the part of the Canadian consumer. Growing consumer expenditures are consistent with the solid M/M increase in disposable personal income that has occurred over the last 6 months.

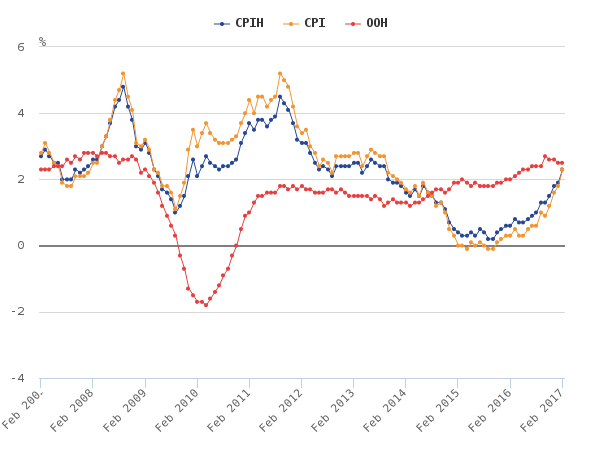

UK inflation broached the critical 2% level, rising by 2.3% Y/Y in the latest report. The pace of increases has been fairly sharp for the last 4-6 months:

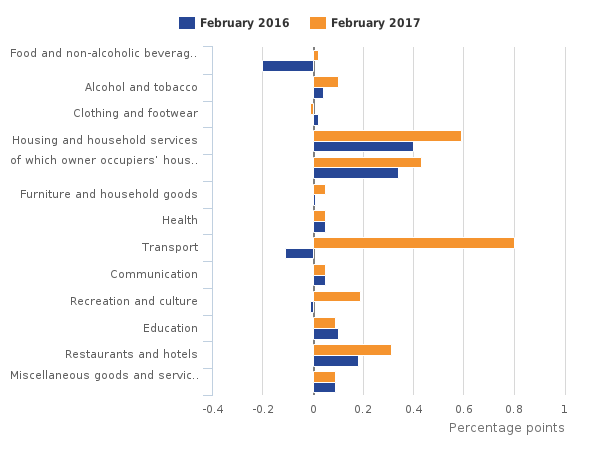

Fuel and transportation costs were the primary reason for the increase, although other price categories contributed:

As of now, normalizing oil costs are the primary reason for current inflationary pressures. If oil’s recent price drop continues, it should start to impact prices in the medium term. But if price upward pressures continue, the BOE may find itself in a very uncomfortable policy position of having to raise rates in a slowing economy in order to stave off the impact of higher inflation.

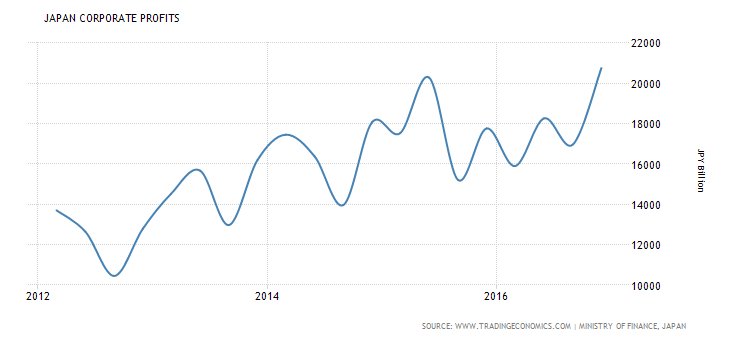

The Bank of Japan released their latest minutes, which showcased the bank’s belief that rising household and corporate income will translate into higher spending, thereby leading to demand-pull inflation. Regarding business spending, the report observed:

Business fixed investment had been on a moderate increasing trend as corporate profits had been at high levels. Machinery orders and construction starts in terms of planned expenses for private and nondwelling construction -- both of which were leading indicators of business fixed investment -- continued a moderate increasing trend, albeit with some fluctuations.”

According to Japanese national accounts, in the last 4 quarters, fixed investment rose -.4%, 2.1%, .9% and 3.4% on a Y/Y basis. A recent increase in corporate profits will hopefully translate into future investment spending:

In the last 4 quarters, household consumption increased -.3%, .3%, .3% and .9% on a Y/Y basis. This GDP component is still growing at slow rates thanks to the impact of the retail sales tax hike in 2014. Hopefully, the low unemployment rate will translate into higher wages which will lead to rising spending. However, the BOJ’s hopeful tone regarding business and household purchases is as much aspirational as based on the current data.

Overall, global data continues to be slightly more bullish than that reported at the end of last year. However, we're still not seeing data strong enough to be described as "escape velocity." Still, it's good to see things edging higher.