Shares of Momenta Pharmaceuticals Inc. (NASDAQ:MNTA) were down 12.6% after the company reported disappointing results from a phase I study on M834, which it was conducting with partner Mylan N.V. (NASDAQ:MYL) for the proposed biosimilar of Orencia.

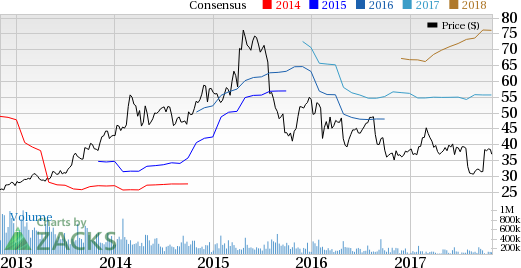

The company also reported a loss of 44 cents per share in the third quarter, narrower than the Zacks Consensus Estimate of 46 cents. The reported loss was, however, wider than the year-ago loss of 26 cents.

Revenues in the quarter came in at $24.1 million and topped the Zacks Consensus Estimate of loss of $23.2 million. However, revenues were down 17.3% from the year-ago quarter.

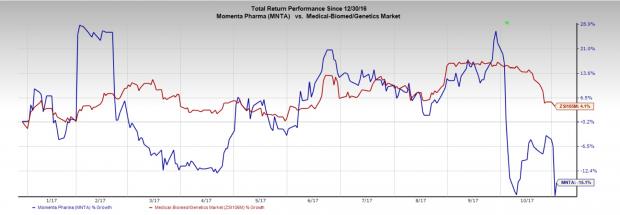

Momenta’s stock has decreased 15.1% year to date compared with the industry’s rally of 4.1%.

Quarter in Detail

Momenta’s top line comprises product revenues of $10.9 million earned from Sandoz’s sales of Glatopa, a generic version of Copaxone (20 mg), compared with $23.4 million in the year-ago quarter. The 53% decrease was primarily due to higher sales deductions, inventory price adjustments owing to Mylan's entry into the Copaxone market along with a deduction of $0.2 million for reimbursing the company’s share of Glatopa-related legal expenses to Sandoz.

Collaborative research and development revenues came in at $13.2 million, up from $5.8 million in the year-ago quarter. The increase was due to a $10-million commercial milestone payment earned in connection with Glatopa 20mg/mL. However, the upside in sales was partially offset by less revenues due to the termination of the Baxalta Collaboration Agreement, effective Dec 31, 2016.

While, research and development expenses were up to $37.9 million from $31.6 million, general and administrative expenses increased 31% to $20.7 million.

Outlook Updated

Momenta now expects operating expenses (excluding stock-based compensation and net of collaborative revenues) in the range of $200-$210 million, compared with the previous guidance of $210-$230 million in 2017. The guidance also includes approximately $50 million of capital expenditure on M923. Operating expenses in third-quarter 2017 are projected around $43-$53 million.

Momenta expect to generate revenues of $45 million from Mylan as upfront payment on a quarterly basis.

Pipeline Update

Sandoz’s abbreviated New Drug Application (ANDA) for the 40-mg thrice-weekly formulation of Copaxone (Glatopa 40mg) was under the FDA review. However, Momenta suffered a setback with the FDA issuing a warning letter to Pfizer Inc. (NYSE:PFE) in February 2017, which is Sandoz’s contracted fill/finish manufacturing partner for Glatopa.

Pfizer has submitted a comprehensive response to the observations cited in the warning letter. The ANDA approval is now contingent on the satisfactory resolution of the compliance observations stated in the warning letter issued to Pfizer.

Meanwhile, Momenta continues to progress with its other pipeline candidates. Currently, Momenta’s M923, a biosimilar version of AbbVie, Inc. ABBV Humira, is being evaluated in a phase III study in patients suffering from moderate-to-severe chronic plaque psoriasis. Moving ahead, the company plans to submit the candidate for approval to regulatory bodies.

However, Momenta announced that M834 did not meet its primary pharmacokinetic end points in a phase I study to compare the pharmacokinetics, safety and immunogenicity of M834 to Orencia in normal healthy volunteers. Hence, Momenta and partner Mylan will evaluate the next course of action.

Furthermore, Momenta’s novel autoimmune portfolio includes: M230, a Selective Immunomodulator of Fc receptors (SIF3) and M281, an anti-FcRn monoclonal antibody. Momenta successfully completed a phase I single ascending dose study in healthy volunteers for M281. The multiple ascending dose portion of the study was initiated in January 2017 and completed in August 2017. Top-line data is expected in fourth-quarter 2017.

Our Take

Momenta’s third-quarter results were overshadowed by the disappointing results from a phase I study on the proposed biosimilar verison of Orencia.

Momenta has already suffered a blow. We note that Mylan has already won FDA approval for a generic version of Teva Pharmaceuticals (NYSE:TEVA) Copaxone 40 mg. Notably, this is the first generic of Copaxone that has been approved.

Since Mylan was one of the first applicants to submit a substantially complete ANDA for glatiramer acetate Injection, 40 mg/mL, containing a Paragraph IV certification, the company and other first filers may be eligible for 180 days of generic drug exclusivity. On the other hand, Momenta’s ANDA approval for Glatopa is contingent on the satisfactory resolution of the compliance observations stated in the warning letter issued by the FDA, resulting in a delay of approval.

Zacks Rank

Momenta currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

Pfizer, Inc. (PFE): Free Stock Analysis Report

Momenta Pharmaceuticals, Inc. (MNTA): Free Stock Analysis Report

Teva Pharmaceutical Industries Limited (TEVA): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research