Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) reported positive top-line data on pipeline candidate, M281 from a phase I single ascending dose (SAD) and multiple ascending dose (MAD) study of normal human volunteers.

The phase I randomized, double-blind, placebo-controlled study evaluated the safety, tolerability, pharmacokinetics and pharmacodynamics of M281.

M281 is a fully human anti-neonatal Fc receptor (FcRn) aglycosylated immunoglobulin G (IgG1) monoclonal antibody, engineered to reduce circulating pathogenic IgG antibodies, in excess of that achieved by any current treatments, by completely blocking endogenous IgG recycling via FcRn.

The candidate did not exhibit any adverse event, was well tolerated, and decreased circulating IgG levels up to 89% with a mean reduction of 84% over the 98-day MAD study. In addition, the SAD portion of the study enrolled five cohorts with a total of 34 healthy adult volunteers and showed that a single dose of M281 achieved up to an 80% reduction of circulating IgG antibodies.

We remind investors that Momenta plans to present the top line results at a future conference.

Momenta’s novel therapeutics portfolio has three pipeline candidates — M281, M254, and M230.

Meanwhile, the company is also trying hard to bring biosimilars to the market. Last week, Momenta and partner Mylan N.V. (NASDAQ:MYL) announced that the companies will initiate a patient clinical trial of M710 — a proposed biosimilar of Regeneron Pharmaceuticals’ (NASDAQ:REGN) Eylea — in the first half of 2018. The commercial opportunity is significant. The company has collaborated with Mylan to develop, manufacture and commercialize six of its current biosimilar candidates.

Momenta and Mylan have entered into an agreement to develop, manufacture and commercialize six of Momenta’s biosimilar candidates, including M834, a proposed biosimilar of Orencia.

Concurrent with the third-quarter earnings, Momenta announced that M834 did not meet its primary pharmacokinetic end points in a phase I study to compare the pharmacokinetics, safety and immunogenicity of M834 to Orencia in normal healthy volunteers.

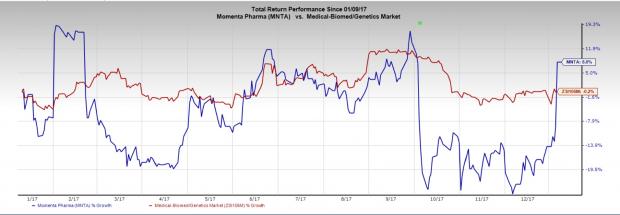

Momenta’s stock have increased 8% in the last twelve months as against the industry’s loss of 0.2%.

Momenta has had a rough ride, of late. The company suffered a setback when Mylan won the FDA approval for a generic version of Teva Pharmaceuticals (NYSE:TEVA) Copaxone 40 mg. Notably, this is the first generic of Copaxone that has been approved.

Since Mylan was one of the first applicants to submit a substantially complete ANDA for glatiramer acetate Injection, 40 mg/mL, containing a Paragraph IV certification, the company and other first filers might be eligible for 180 days of generic drug exclusivity. On the other hand, Momenta’s ANDA approval is contingent on the satisfactory resolution of the compliance observations stated in the warning letter issued by the FDA, resulting in a delay of approval.

Zacks Rank

Momenta currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits. Click here to see the 5 stocks >>

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Momenta Pharmaceuticals, Inc. (MNTA): Free Stock Analysis Report

Teva Pharmaceutical Industries Limited (TEVA): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Original post

Zacks Investment Research