Molson Coors Brewing Company (NYSE:TAP) is set to report fourth-quarter 2017 results before the opening bell on Feb 14.

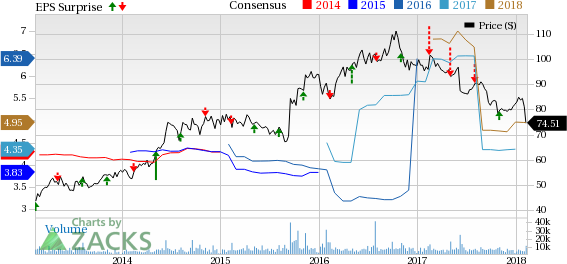

The question lingering in investors’ minds is, whether this leading brewing company will be able to pull off a positive earnings surprise in the to-be-reported quarter. The company’s bottom line has lagged the Zacks Consensus Estimate in three of the trailing four quarters, with an average miss of 27.8%. Let’s see how things are shaping up prior to the earnings announcement.

For the fourth quarter, the consensus estimate of 56 cents moved down by a penny in the last 30 days. However, the estimate shows a year-over-year growth of 21.7% from 46 cents recorded in the prior-year quarter.

Factors Likely to Impact 4Q17

Molson Coors has been focusing on strengthening its brand portfolio, besides being one of the largest brewers in the world. Armed with a robust portfolio of well-established brands, it has been steadily progressing with growth of its above-premium segment. Impressively, the company has also been gaining share in the premium light segment in the United States through Coors Light and Miller Lite brands. We believe the company’s shift of focus on expanding the above premium category along with solid innovation program is likely to positively impact the upcoming quarter.

Additionally, Molson Coors has undertaken restructuring initiatives to reduce overhead costs and boost profitability. Further, management has been focusing on initiatives to improve its supply chain network and build on efficiencies across the business to generate additional resources for investing in brand building and innovation. In 2017, the company plans to deliver more than $175 million in cost savings.

Meanwhile, Molson Coors is expanding its global footprint and accelerating its international business through acquisitions and agreements. All these afore-mentioned initiatives are likely to drive the company’s top line. Analysts polled by Zacks expect sales of $2,597 million, up 13.2% from the year-ago period.

Though the acquisition of the Miller global brands and improvements in some of the company’s key brands boosted sales in Europe and international regions, volumes continued to decline in Canada and in the United States in the previous quarter. Also, the company has been posting negative beer volumes in the United States and Canada for quite some time owing to tough industry conditions. Notably, aging population and strong competition from other alcohol beverages have been the main contributors to the declining state of the beer industry, which remains a concern for the quarter to be reported too.

These headwinds have largely weighed upon the company’s share price movement. The stock has declined 22.9% against the industry’s growth of 11.2% in a year.

What Does the Zacks Model Unveil?

Nonetheless, our proven model shows that Molson Coors is likely to beat earnings estimates this quarter. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to be confident of an earnings surprise call. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Molson Coors has an Earnings ESP of +6.51% and a Zacks Rank #3, making us reasonably confident of an earnings beat.

Stocks With Favorable Combinations

Here are some other companies which, according to our model, have the right combination of elements to deliver an earnings beat.

The Boston Beer Company, Inc. (NYSE:SAM) has an Earnings ESP of +29.18% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Craft Brew Alliance, Inc. (NASDAQ:BREW) has an Earnings ESP of +42.86% and a Zacks Rank of 2.

Lowe's Companies, Inc. (NYSE:LOW) has an Earnings ESP of +3.25% and a Zacks Rank #2.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Molson Coors Brewing Company (TAP): Free Stock Analysis Report

Craft Brew Alliance, Inc. (BREW): Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM): Free Stock Analysis Report

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

Original post