Molson Coors Brewing Company (NYSE:TAP) has been witnessing sluggish beer volumes in the U.S. and Canada for quite some time. The company is now focused to improve its beer volume and as a result has shifted focus to expanding the above premium category that will bear fruits in the future.

Molson Coors’ subsidiary MillerCoors is reportedly hoping to strengthen the marketing campaign for its Coors Banquet beer, one of the best-selling brands in the United States. It is to be noted that Coors Banquet has managed to increase its sales for the past nine years, amid a scenario when most major domestic beers are losing sales and share of the market to craft beer.

Per reports, MillerCoors will increased its marketing marketing expenditure by 5% compared with the last year, in order to gain significant market share in the American beer market. The efforts are also directed toward capturing sales from full-calorie competitors like Budweiser and Mexican imports.

In addition, the brewery expects to sell its beer at on-premises locations, which will also help in creating customer loyalty.

MillerCoors currently is a joint venture of Denver-based Molson Coors and London-based SABMiller (LON:SAB) plc (OTC:SBMRY) that sells both companies' products in the U.S. Molson Coors will soon complete the acquisition of SABMiller's 58% share of MillerCoors, after the closing of Anheuser-Busch InBev’s (NYSE:BUD) $107 billion takeover of SABMiller, which is expected in the second half of 2016.

Anheuser Busch reached a deal to acquire London-based SABMiller in Oct 2015. On May 25, 2016, the two big global beer companies received approval to merge from the European Union's (EU) competition regulator, the European Commission. Per the deal, AB InBev is offering common SABMiller shareholders $67.59 per share, while SABMiller’s two biggest investors, Altria Group, Inc. (NYSE:MO) and the Santo Domingo family from Columbia will be offered cash and shares alternative worth about $60 per share. However, the deal is yet to receive shareholders’ and regulatory approval.

Besides purchasing, SABMiller’s 58% stake in MillerCoors, Molson Coors plans to buy the Miller brand portfolio globally and retain the rights to all the brands currently in the MillerCoors portfolio for the U.S. market, including Redd’s and import brands such as Peroni and Pilsner Urquell.

Molson Coors’ purchase of SABMiller’s stake would allow it to take strategic control of its operations in its biggest market. Molson Coors would also be in a position to gain significant synergies, which would allow the company to cut costs quickly. As the U.S. beer market grows slowly, lower costs will help Molson Coors to increase its profits in the coming years.

Per the Wall Street Journal, the purchase of SABMiller’s stake in the joint venture could add nearly 50% to Molson Coors’ earnings per share, besides allowing the company to cut nearly $400 million in costs.

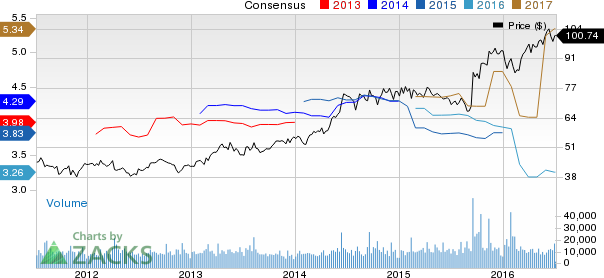

MOLSON COORS-B (TAP): Free Stock Analysis Report

ANHEUSER-BU ADR (BUD): Free Stock Analysis Report

SABMILLER PLC (SBMRY): Free Stock Analysis Report

ALTRIA GROUP (MO): Free Stock Analysis Report

Original post