Molina Healthcare, Inc.’s (NYSE:MOH) fourth-quarter 2018 adjusted earnings of $3.88 per share surpassed the Zacks Consensus Estimate of $1.52 by a whopping 155.3%. This upside was driven by higher premium revenues as well as decreasing expenses. The bottom line also reversed the year-ago period’s loss of 34 cents.

For the quarter under review, total revenues came in at $4.6 billion, beating the Zacks Consensus Estimate by 1.8%. However, the top line declined 5.7% year over year, mainly due to lower premium and service revenues.

Quarterly Operational Update

The company’s net income totaled $201 million against its year-earlier period's loss of $262 million.

Total operating expenses declined about 16.8% year over year to $4.3 billion. This improvement was attributable to lower medical care costs and cost of service revenues.

For the fourth quarter, medical care cost was down 11.2% year over year to nearly $3.8 billion.

Molina Healthcare’s interest expenses were down 27.2% year over year to $24 million.

In the quarter under review, the company sold its Pathways behavioral health subsidiary due to which it suffered a net loss of $32 million.

The total membership by Government Program for 2019 stands at 3.8 billion, down 14.2% year over year.

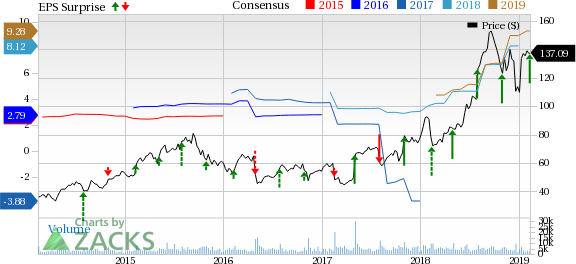

Molina Healthcare, Inc Price, Consensus and EPS Surprise

Financial Update

As of Dec 31, 2018, Molina Healthcare’s cash and cash equivalents saw a reduction of 11.3% to $2.8 billion from the level at year-end 2017.

Total assets fell 15.6% from 2017 end to $7.1 billion.

The company’s shareholder equity improved nearly 23.2% from the figure at year-end 2017 to $1.6 billion.

For the fourth quarter, net cash outflow from operating activities stands at $123 million, narrower than the year-ago period's net cash outflow of $153 million.

Full-Year Highlights

Total revenues for 2019 declined 5% to $18.9 billion. Net income per share stands at $10.61 against the prior-year period's net loss of $9.07.

2019 Guidance

For 2019, the company expects its premium revenues to be $15.8 billion.

Its total revenues are projected at $16.3 billion.

Moreover, Medicare costs are expected to be $13.7 billion. General and administrative expenses are estimated at $1.2 billion.

Net income of the company is anticipated in the band of $600-$630 million. EBITDA is projected in the bracket of $975-$1025 million.

Net income per share is predicted to be $9.25-$9.75.

Medicaid and Medicare membership is forecast to be around 3.2 million whereas Marketplace membership is estimated to be around 250-275 million.

Zacks Rank

Molina Healthcare sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Upcoming Releases From Medical Sector

Some other stocks worth considering from the medical sector are as follows:

Constellation Pharmaceuticals, Inc. (NASDAQ:CNST) is set to report fourth-quarter 2018 earnings performance on Feb 14. The stock has an Earnings ESP of +9.72% and a Zacks Rank of 1.

Tenet Healthcare Corporation (NYSE:THC) is slated to announce fourth-quarter earnings results on Feb 25. The company has an Earnings ESP of +5.63% and a Zacks Rank of 3.

Alder BioPharmaceuticals, Inc. (NASDAQ:ALDR) has an Earnings ESP of +13.52% and a Zacks Rank #3 (Hold). The company is scheduled to release fourth-quarter earnings numbers on Feb 25.

Zacks' Best Stock-Picking Strategy

It's hard to believe, even for us at Zacks. But from 2000-2018, while the market gained +4.8% per year, our top stock-picking strategy averaged +54.3% per year.

How has that screen done lately? From 2017-2018, it sextupled the market's +15.8% gain with a soaring +98.3% return.

Free – See the Stocks It Turned Up for Today >>

Alder BioPharmaceuticals, Inc. (ALDR): Free Stock Analysis Report

Molina Healthcare, Inc (MOH): Get Free Report

Tenet Healthcare Corporation (THC): Free Stock Analysis Report

Constellation Pharmaceuticals, Inc. (CNST): Free Stock Analysis Report

Original post