Mohawk Industries, Inc.’s (NYSE:MHK) adjusted earnings per share (EPS) of $3.72 beat the Zacks Consensus Estimate of $3.61 by 3.1%. Earnings also increased 7% year over year.

Total revenue of $2.45 billion missed the Zacks Consensus Estimate of $2.46 billion by 0.4%. Revenues however increased 6% year over year on higher sales across all segments.

Operating Highlights

Adjusted gross profit of $801.7 million increased 5.7% year over year. Adjusted operating income rose 6.9% to $381.3 million.

Adjusted selling, general and administrative (SG&A) expenses were down 4.7% to $420.5 million from the prior-year quarter.

Segment Details

Global Ceramic: Net sales at this segment amounted to $902.7 million, up 9% year over year on a reported as well as constant days and constant currency basis. The growth rate can be attributed to two European ceramic acquisitions that boosted sales by 6%.

Flooring North America: Net sales at this segment totaled $1.04 billion, up 6% year over year on strong residential and hard surface products sales.

Flooring Rest of the World: Net sales increased 2% year over year to $510.1 million. On a constant days and currency basis, sales improved 8.5% on solid sales of LVT products.

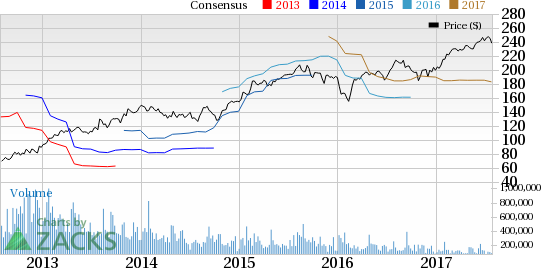

Mohawk Industries, Inc. Price, Consensus and EPS Surprise

Q3 Guidance

The EPS guidance for the third quarter is pegged in the $3.70 to $3.79 range.

Zacks Rank

Mohawk Industries carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks to Consider

Other top-ranked stocks in the Consumer Discretionary sector that deserve a look include Adidas (DE:ADSGN) AG (OTC:ADDYY) , TAL Education Group (NYSE:TAL) and Barnes & Noble (NYSE:BKS) Education, Inc (NYSE:BNED) .

Adidas sports a Zacks Rank #1 (Strong Buy). Full-year 2017 earnings for the company are expected to increase 22.7%.

TAL Education, also a Zacks Rank #1 stock, is likely to witness 51.5% earnings growth in fiscal 2018.

Barnes & Noble, a Zacks Rank #2 stock, is expected to see 172.7% growth in fiscal 2018 earnings.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

TAL Education Group (TAL): Free Stock Analysis Report

Barnes & Noble Education, Inc (BNED): Free Stock Analysis Report

Adidas AG (ADDYY): Free Stock Analysis Report

Mohawk Industries, Inc. (MHK): Free Stock Analysis Report

Original post