Over the weekend, the world's favorite cryptocurrency has crossed a very important milestone of $9,000 per coin. It didn't stop there though and many speculate that it could cross the even rounder psychological barrier of $10,000, possibly very soon.

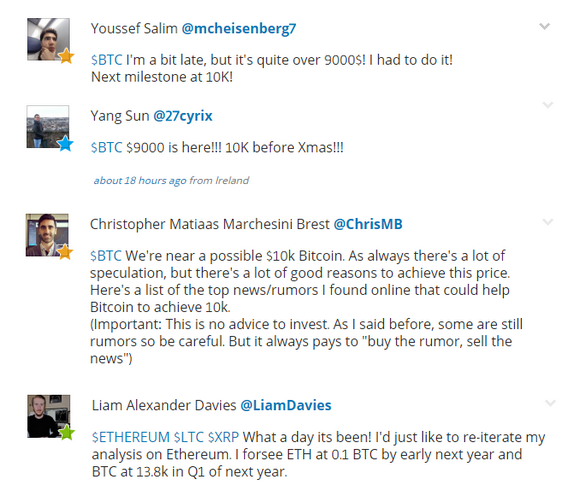

Here are but a few posts from the some of the more established traders on the eToro network.

Long term predictions are getting a lot more aggressive as we'll discover below.

Today's Highlights

Reminder Warning!!

When BTC $180k?

Please note: All data, figures & graphs are valid as of November 27th. All trading carries risk. Only risk capital you're prepared to lose.

Crypto Reminder

I remember the first time I saw an interview on Bloomberg television speaking about Ethereum and other cryptocurrencies, though I don't recall the exact date I believe it was around April of this year. It was so exciting to finally see some coverage from mainstream financial media.

By now it's become a thing to include crypto in almost every segment of every show and to get the opinion of just about every guest they have on. Today I even saw a quick price alert from the Financial Times noting Bitcoin's rise above $9,000. Exciting times indeed!

Though it's easy to get lost in crypto-land, I would like to gently remind everyone that this is still an extremely risky investment class. Though the industry is seeing massive expansion, blockchain technology is still highly experimental and has not yet stood the test of time.

Therefore, it is prudent to allocate your portfolio accordingly. Most advisors say to keep only a very small portion of your total investments in high risk assets. This is why I keep including 'boring things' like geopolitics and other markets in these daily updates.

Market Overview

Still, the crypto-market is still small enough to fly under the radar of traditional markets. At present, it is estimated that the total number of bitcoins in circulation is valued at about 2% of the total amount of gold in the world.

Stock markets are doing great. Not crypto-great but the larger the market the more money needed to push the needle. However, the increasingly low volatility and the markets seeming inability to even pull back a little is no less astounding.

Commodities are also seeing one of their most stable years of recent times. Take a look at gold, which has largely remained within $75 an ounce of the $1,250 level (yellow).

Of course, if and when inflation finally enters the market, gold has a long way to go before coming near the all time highs set at the peak of the financial crisis in 2011.

Oil has also been advancing steadily. OPEC will be meeting this Thursday to try and push the price up even further. Though with Western producers likely to ramp up their output, OPEC will likely settle for even keeping it where it is.

Like many other things. The fundamentals of this market have changed drastically in the last few years. To see $110 again would certainly be a dream come true for many participants but given the recent price action seems increasingly likely to happen.

Thinking Long-term

As the entire cryptocurrency market crosses $300 Billion this morning, the rate of growth continues to accelerate. Over the past week, the rise has averaged $9.5 Billion per day.

All traditional methods of gauging price movements are now off the table. Bitcoin was trading in a very normal looking channel (yellow lines) for most of the year but in the beginning of November it broke out the top of the channel.

Even still, for most of the month, it managed to keep to the laws of nature and formed a resistance (dotted blue) line but even that has been smashed in the past 48 hours.

So, we must search for other ways to look at things. This post on Twitter caught my eye. It was published by a guy who goes by @parabolictrav who claims to have been toying with these type of parabolic charts his entire life. Take a good look...

The implications are self-explanatory. If we continue with this type of price action and nobody finds some inherent flaw, we could be looking at $180k by the end of next year.

Let's have an awesome day!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.