The coronavirus that’s roiling China and beyond is creating uncertainty about global economic activity in early 2020, but this week’s initial estimate of US GDP for last year’s fourth quarter is on track to post a gain that’s comparable to Q3’s moderate rise.

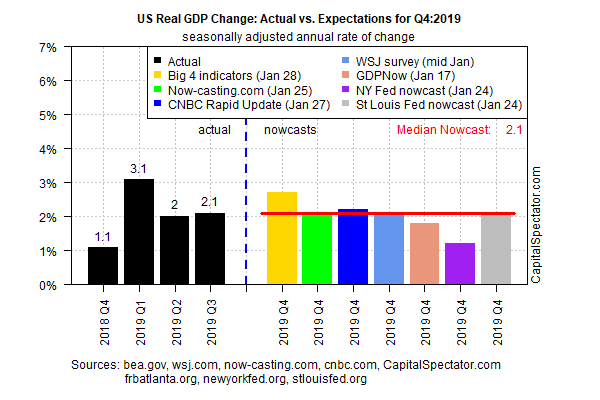

Output is expected to show a 2.1% gain in Thursday’s GDP report (Jan. 30), based on a median nowcast for a set of estimates compiled by The Capital Spectator. The projection matches Q3’s increase, which suggests that recession risk is still low as a softer-but-stable run of economic activity prevails.

Today’s revised Q4 estimate marks an improvement over the previous 1.8% median nowcast for 2019’s final three months, published on Jan. 8. Note, too, that Econoday.com’s consensus point forecast for Thursday’s release from the Bureau of Economic Analysis is also 2.1%.

The modest improvement in economic expectations of late has been showing up in recent business-cycle trend analytics. As reported last week, a broad mix of indicators point to a degree of stabilization and perhaps firmer growth for the US in early 2020, based on forward estimates of The Capital Spectator’s proprietary economic indexes through February.

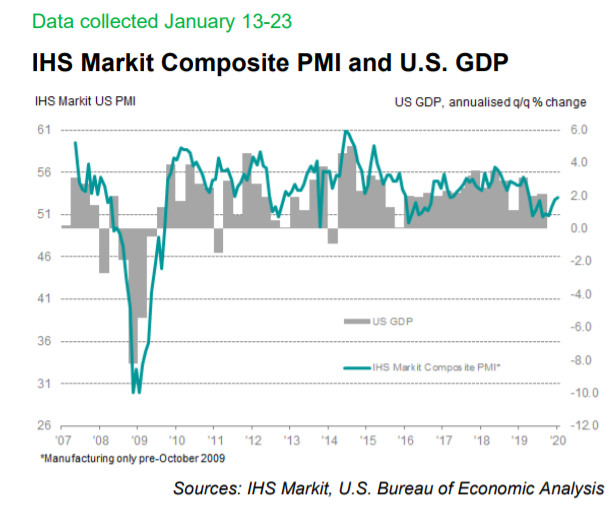

Sentiment data is also showing signs of firmer economic activity in the new year. The US Composite PMI for January rose to a ten-month high in last week’s update. “The recovery of growth momentum across the US private sector continued to quicken at the start of 2020, with overall output rising at the sharpest pace since last March,” says Siân Jones, an economist at IHS Markit, which publishes the PMI numbers.

Just when it appears that the US economy may be moving beyond the recent soft patch, a new risk could be emerging: the potential blowback from the China coronavirus that’s roiling Asia. At this point, there are still more questions than answers.

“It’s the uncertainty of how the global economy is going to respond to the outbreak,” says Philip Shaw, chief economist at Investec, a bank in London. The days and weeks ahead will be telling. Meantime, “we don’t really know the answers to any of these questions.”

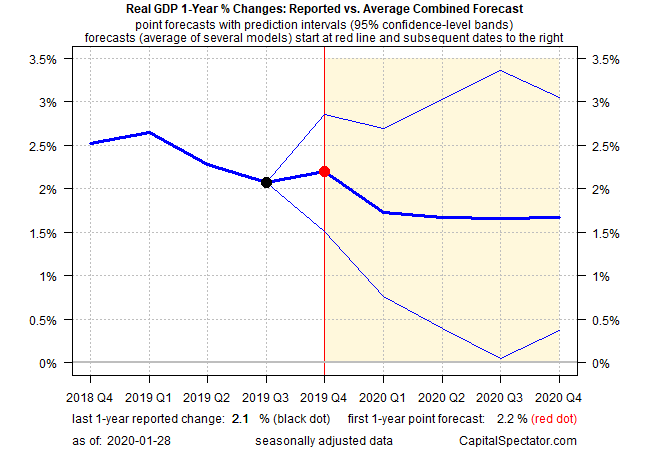

As for the here and now, the upbeat Q4 data also shows up in year-over-year estimates of economic activity, based on The Capital Spectator’s average point estimate via a set of combination forecasts. Today’s estimate shows output ticking up to 2.2% in Q4 vs. the year-ago level. That’s a touch above the annual 2.1% increase through Q3. The one-year trend is expected to weaken in 2020, however–and that’s before factoring any virus-related fallout.

Indeed, the question is whether US and global economic activity will weaken beyond current estimates due to the coronavirus? The main risk at the moment is centered in China and nearby countries. But infections are starting to show up around the world, including a few cases in the US.

“Over the past two decades, the rapid economic growth of China has made it a key export market for many Asia-Pacific nations,” notes Rajiv Biswas, Asia Pacific chief economist at IHS Markit. “However, China’s growing importance in Asia-Pacific trade and investment flows has also created considerable vulnerability for the Asia-Pacific region from this type of unpredictable ‘black swan’ event currently hitting the Chinese economy.”