The National Retail Federation (NRF) remains upbeat on the outlook for U.S. consumer spending in 2019. The trade group forecasts that retail sales will rise between 3.8% to 4.4% this year, roughly in line with the annual pace of growth in recent history.

“We believe the underlying state of the economy is sound,” NRF President and CEO Matthew Shay said in a statement last week. “More people are working, they’re making more money, their taxes are lower and their confidence remains high.”

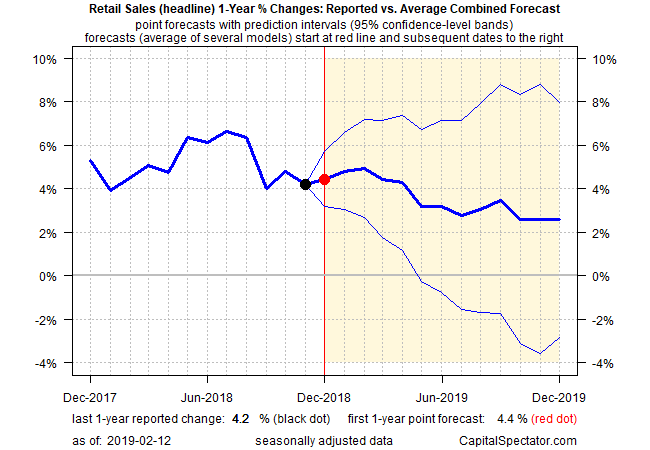

The strong gain in U.S. payrolls in January certainly supports Shay’s optimism. As for the numbers directly linked with consumer decisions on spending, the first test of NRF’s optimism arrives on Thursday (February 14), when the U.S. Census Bureau publishes the December retail sales report, which was delayed due to the government shutdown. Economists are expecting a fractional 0.1% increase in the monthly comparison for the headline number, based on Econoday.com’s consensus forecast. Although that reflects a softer gain from the previous month’s 0.2% rise, the implied one-year trend outlook for December indicates an uptick to 4.2%, a touch faster vs. November’s year-over-year advance.

If the crowd’s forecast is right, the initial data will fall in line with NRF’s outlook. Estimates for spending by Customer Growth Partners, a research firm, suggest as much.

“Unlike the debt-fueled bubble economy of the mid-2000s, today’s retail growth is based on strong fundamentals, suggesting that consumers — almost 70% of the economy — will continue healthy spending on a healthy pace at least through 2019,” CGP President Craig Johnson said in a statement recently.

The Capital Spectator’s projection for December’s year-over-year change in retail spending also points to a slight uptick in the growth trend, based on the point forecast via the average of nine forecasting models. According to this estimate, sales are on track to increase 4.4% for the year through December, modestly above the 4.2% gain in the previous month.

In short, this week’s December update on retail spending appears set to offer new support for expecting a moderate rate of growth in the upcoming fourth-quarter report on the gross domestic product (which has been rescheduled for Feb. 28).

Recent estimates for Q4 growth reflect a downshift in output – the Atlanta Fed’s GDPNow model, for instance, is projecting a 2.7% gain (as of Feb. 6). Although that’s down from Q3’s 3.4% rise, the numbers generally continue to point to a softer but still healthy tailwind and Thursday’s retail sales data for December is expected to fall in line with that analysis.