Some calm seems to have returned to global markets overnight with moderate gains in both US and Asian stocks markets. However, there is certainly no feeling that things have fundamentally improved and the euro crisis continues to be firmly on top of the agenda for global markets.

This morning the Reserve Bank of Australia (RBA) has once again moved to cut its key policy rate by another 25bp to 3.50%. There is no doubt that the RBA is worried about the effect on the Australian economy of the cooling of Chinese economy and more rate cuts could certainly be in the pipeline for the RBA going forward.

It has been relatively calm on the global FX and fixed income markets overnight. The euro has seen some moderate gains against the other major currencies, but again it does not look like a "determined" strengthening of the euro.

Global Daily

Focus in the markets will continue to be on the European situation and there is no doubt that market participants await a policy response from global central banks in particular – but for now it is just waiting. Finance ministers and central bank governors from the G7 countries will today participate in a conference call to discuss the European crisis.

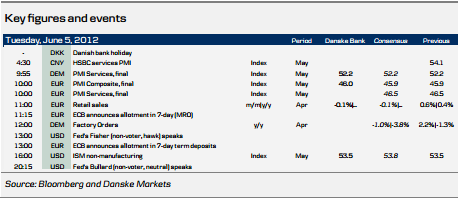

On the macroeconomic front, focus will be on PMI (ISM) numbers for the nonmanufacturing sector in both Europe and the US.

Scandi Daily

Swedish services PMI probably dropped further in May from the already sub-par 48.6 recorded for April. Other data suggests this is the case: service production dropped sharply in April according to Statistics Sweden, down 2% m/m, and private services confidence showed a significant decline in May according to the monthly NIER business survey. Hence, a further decline should come as no surprise. Riksbank Governor Ingves is due to speak about financial stability and banking regulation at the International Monetary Conference in Stockholm, 09:00 local time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Moderate Gains In US And Asian Markets Bring Some Calm

Published 06/05/2012, 05:13 AM

Updated 05/14/2017, 06:45 AM

Moderate Gains In US And Asian Markets Bring Some Calm

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.