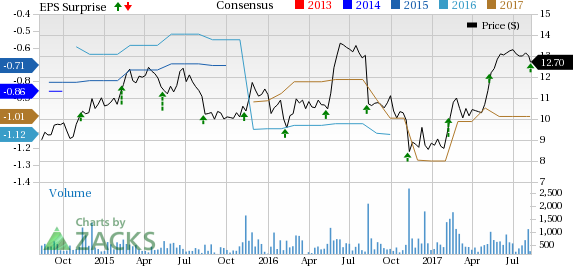

Model N, Inc. (NYSE:MODN) reported fiscal third-quarter 2017 adjusted loss of 14 cents per share, which was narrower than the year-ago quarter loss of 16 cents.

Including stock-based compensation, the company incurred loss of 23 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 27 cents.

Revenues of $34.2 million increased 22.7% year over year but missed the Zacks Consensus Estimate of $35 million.

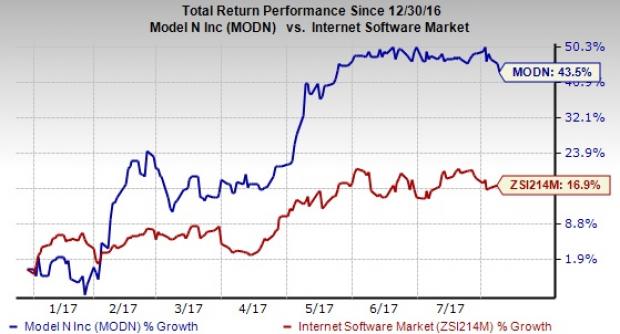

Notably, Model N stock has rallied 43.5% year to date, substantially outperforming the 16.9% gain of the industry it belongs to.

Quarter in Detail

Model N has two reportable segments namely License & Implementation and SaaS & Maintenance.

License & Implementation revenues (20% of total revenues) of $5.7 million grew 11.6% on a year-over-year basis. The company no longer sells on-premise perpetual licenses. Management expects this revenue line to continue to decline into fiscal 2018.

SaaS & Maintenance revenues (80% of total revenues) of $28.5 million grew 25.1% year over year. Model N is on track to shift its business to a 100% SaaS and Maintenance revenue model.

Revitas contributed approximately $6 million to SaaS and Maintenance revenues and approximately $2 million to the company’s license and implementation revenues.

Model N’s revenue management platform continues to attract prominent names from the life sciences and high tech field.

During the quarter, Ampleon, a radio frequency (RF) power provider, selected Model N revenue cloud services. A significant number of systems became operational in the third quarter, including Smith & Nephew (LON:SN), Edwards Lifesciences (NYSE:EW) , J&J Japan, Stryker (NYSE:SYK) and Shire.

ICU Medical, a Medtech company was added to the customer base during the quarter. A high-tech company called Diodes also adopted Model N’s revenue cloud model in the third quarter.

Adjusted gross profit increased 44% year over year to $21.4 million while margin increased to 59.6% from 53.3%. Gross margin benefited from higher percentage of SaaS & Maintenance revenues.

Adjusted EBITDA was ($1.1) million compared with ($3.2) million in the year-ago quarter. Adjusted operating loss was $2.4 million compared with the year-ago loss of $4.3 million.

The improved results reflect shrinking cost base post Revitas acquisition. Management stated that it has eliminated duplicated general & administrative and sales & marketing costs as well as redundant products outside the life sciences vertical post the acquisition.

Model N ended the quarter with annual expense synergy run rate of $13 million, which was in line with the high end of its expectations.

Balance Sheet

Model N exited the quarter with cash and cash equivalent balance of $51.8 million, up from $53.6 million at the end of second quarter fiscal 2017.

Guidance

Model N provided guidance for the fourth quarter of fiscal 2017. It expects fourth-quarter GAAP revenues to come in the range of $34.6 million to $35.1 million.

Non-GAAP operating loss is projected to be between $0.5 million and $1 million. Non-GAAP net loss is likely to be between 8 cents and 9 cents per share for the fourth quarter.

For fiscal 2017, GAAP revenues, after deferred revenue adjustment, are expected to be in the range of $130.2-130.7 million. Management continues to expect annualized recurring revenue (ARR) to be between $46 million and $48 million. This represents 31% to 36% year-over-year growth.

Non-GAAP loss from operations is expected to be in the range of $12.5 million to $13 million, better than the previous guidance of a loss of $14 to $14.5 million.

Non-GAAP net loss is expected to be in the range of 62 cents to 63 cents per share for the fiscal year, narrower than the previous guided range of a loss of 68–66 cents per share.

Management still forecasts an ending cash balance $50 million to $52 million as of Sep 30, 2017. Model N now expects cash flow from operations to be breakeven or slightly positive in the fourth-quarter.

Model N expects EBITDA to be positive throughout fiscal 2018. Management expects to be cash flow positive from operations in the back half of 2018. The company also plans to payback a portion of its debt related to the Revitas acquisition in fiscal 2018.

Zacks Rank and Stocks to Consider

Currently, Model N has Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Alibaba Group (NYSE:BABA) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Alibaba is projected at 28.97%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

See these stocks now>>

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Model N, Inc. (MODN): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Original post

Zacks Investment Research