MobileIron’s (NASDAQ:MOBL) cloud-based unified endpoint management (“UEM”) offering which comprises MobileIron Threat Defense and MobileIron Access was recently selected by Montagu Evans.

Montagu Evans is a partnership firm of property consultants and chartered surveyors engaged primarily in real estate in the U.K.

With MobileIron Access, users can seamlessly access and download the required applications, in turn enhancing productivity. Meanwhile, MobileIron Threat Defense ensures data security on the go.

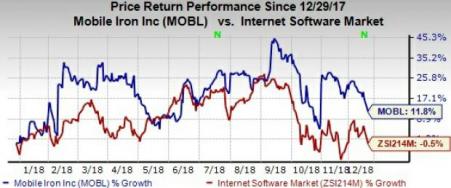

Notably, MobileIron stock has returned 11.8% year to date, outperforming industry's decline of 0.5%.

Cyber Security & Easy Access to Mobile Data Hold Key

The growing focus on client satisfaction is increasing mobility among employees of an organization. The job requires employees to switch between client site and office which in turn leads to increased use of devices including smartphones, enabling employees to access client data on the go.

The aforementioned factors increase the risk of losing or compromising valuable client data to unsecured networks, for instance. This calls for a secure platform ensuring seamless access to client data irrespective of employee location and time, which is where MobileIron’s UEM solutions come handy.

In the words of the head of IT at Montagu Evans, Mark Sedgwick, “MobileIron is the perfect solution to meet the demands of our ongoing progressive IT strategy, significantly improving our cyber security posture.”

Rapid Adoption to Benefit Top-Line

MobileIron appears to be benefiting from growing clout of its UEM solution, which was recently recognized as a leading solution in the market by Gartner and Forrester, among other research firms.

The company’s products, particularly MobileIron Cloud and MobileIron Access enjoy steady demand particularly from federal governments worldwide. Previous contract wins from Slovenian railways and the Public Health Agency of Sweden bode well for the company’s growth prospects.

Robust adoption of UEM suite of solutions is expected to favor top-line growth, going ahead. Moreover, MobileIron continues to gain from its product selections by wireless carriers like Verizon Communications (NYSE:VZ) and T-Mobile. Notably, MobileIron revenues of $49.25 million for the third quarter 2018 improved 15.3% from the year-ago quarter.

Additionally, the company’s strength in UEM solution is enabling it to rapidly penetrate into high growth Enterprise Mobile Management (“EMM”) and Cloud Security markets. Per a Stratistics MRC report as revealed by Reuters, worldwide enterprise mobility market is envisioned to witness a CAGR of 21.9% to reach approximately $1225.8 billion in 2026 from $206.13 billion in 2017.

Furthermore, per ReportsnReports estimates, the cloud security market will witness a CAGR of 25.5% to reach around $12.73 billion by 2022 from approximately $4.1 billion in 2017.

Apart from the aforementioned reports, increasing IT management spending indicate strong growth prospects for MobileIron.

Zacks Rank & Other Key Picks

MobileIron carries a Zacks Rank #2 (Buy). Twitter, Inc. (NYSE:TWTR) , Upland Software (NASDAQ:UPLD) and Intel (NASDAQ:INTC) are some other stocks worth considering in the broader technology sector. All the three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Twitter, Upland Software and Intel is currently pegged at 22.1%, 20% and 8.4%, respectively.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

Twitter, Inc. (TWTR): Free Stock Analysis Report

Upland Software, Inc. (UPLD): Free Stock Analysis Report

MobileIron, Inc. (MOBL): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research