Maintaining strong operational momentum

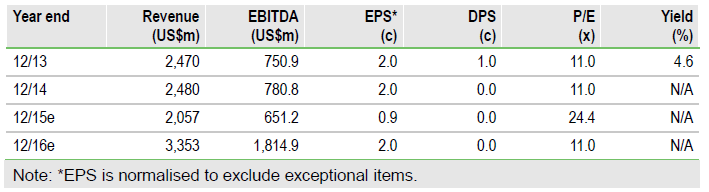

MMG Ltd (HK:1208) reported positive Q315 production results, with total copper and zinc output rising 8% and 6% year-on-year. Despite the recent social unrest near Las Bambas, we currently view the risk of the project being affected as very low. MMG’s strong operational performance warrants a moderate valuation upgrade to HK$3.1/share. In our view, the stock continues to represent an attractive investment opportunity.

Positive Q315 production results

In Q315, MMG’s overall copper output rose 8% both q-o-q and y-o-y. While copper sales slightly undershot production, they jumped 14% vs Q314. Both Kinsevere and Sepon delivered strong results, with copper cathode output rising 20% and 11% vs Q314 and 9% and 3% vs Q215, respectively. Due to the strong performance at Kinsevere, the company increased the project’s FY15 copper production guidance by 3kt to 73-78kt and the overall copper guidance to 174-189kt. MMG's total zinc production was up 6% y-o-y to 130kt in Q315, but down 17% q-o-q due to a strong Q215 at Golden Grove. FY15 zinc guidance remains unchanged at 440-510kt.

To Read the Entire Report Please Click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.