The deleveraging in the energy space continues in earnest and one area that is going down with the ship is Master Limited Partnerships (MLPs). These high yield energy-related securities fell heavily during the October sell off and are once again finding themselves in trouble over the glut of energy stock piles and plunging crude oil prices.

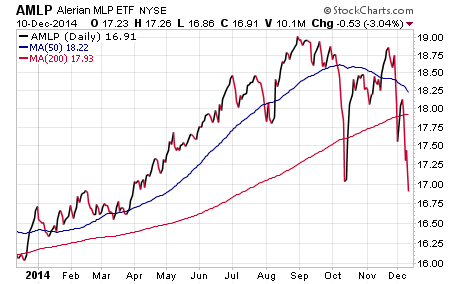

A quick check of the industry titan Alerian MLP ETF (NYSE:AMLP) shows this $9 billion fund that tracks 25 of the largest MLPs in the marketplace has erased nearly all its gains for the year. That’s a steep slide in a relatively short period of time when the majority of these companies’ profits are based on a toll-road style business model rather than direct correlation to commodity prices.

Such is the way of the markets that tend to overshoot their boundaries when a specific sector is under fire. In the case of MLPs, they face the stigma of being energy-related AND carry a high yield component. Their tax structure allows them to pass the majority of profits to shareholders in the form of dividend payments. AMLP has a current yield of 6.6%, which was as low as 6% at the highs.

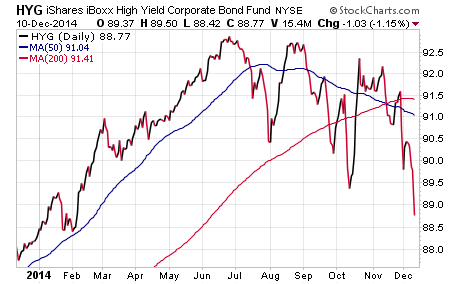

In effect, this niche area of the income-generating market is guilty by association in a credit and energy deflation environment.

The iShares High Yield Corporate Bond ETF (ARCA:HYG) has been pacing steady declines as investors worry about the global deleveraging of junk bonds. Oil & Gas debt makes up approximately 14% of HYG at this time and has been a significant drag on the credit sector.

So where does this sector go from here and how can you play it?

If you have been holding MLPs for some time you are likely in a well-established cost basis and are more interested in the income rather than the short-term price fluctuations. It’s too early to say whether there is cause for greater concern or if this is another fast blip like we saw in October.

Investors looking to establish new positions should be watching this sector closely at this juncture. Commodity prices have slid significantly off their highs and valuations are more attractive than they have been in quite some time. While these funds can be volatile, they offer attractive yields and non-correlated price action that may appeal to a diversified income portfolio with a more aggressive slant.

Those with more conservative tastes may want to take a look at the First Trust North American Energy Infrastructure Fund (NYSE:EMLP). This actively-managed ETF takes a unique approach by combining both traditional utility stocks and MLPs. The defensive aspect of utilities and their continued outperformance has made this a less volatile play this year. The tradeoff is that a broader energy infrastructure focus begets a lower yield of just 2.39%.

This alternative asset class is certainly one to watch through the remainder of the year and into 2015 as the situation in energy prices continues to shake out.