Premium scientific & technical instruments company, MKS Instruments, Inc. (NASDAQ:MKSI) reported in-line earnings for second-quarter 2017.

This Zacks Rank #3 (Hold) noted that the successful integration of Newport Corporation (acquired in Apr 2016) significantly boosted its top- and bottom-line performance in the reported quarter.

Earnings and Revenues

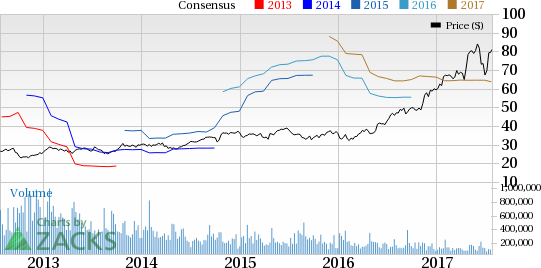

Quarterly adjusted earnings came in at $1.41 per share, in line with the Zacks Consensus Estimate. However, the bottom line came in higher than the year-ago tally of 72 cents per share.

Quarterly revenues were $480.8 million, outpacing the Zacks Consensus Estimate of $464 million. The top line also came in 47.5% higher than the prior-year figure.

Sales of Products during the quarter came in at $432 million, remarkably up from the year-ago number of $285.5 million. Sales of Services during the reported quarter totaled $48.8 million compared to $40.4 million recorded in the year-earlier period.

Costs and Margins

Total cost of revenues during the quarter was $261.2 million, up from $189.9 million recorded in the prior-year quarter. Adjusted gross profit margin during the quarter came in at 45.9%, expanding 110 basis points (bps) year over year.

Selling, general and administrative expenses were $72 million, higher than $59.6 million incurred in the year-ago quarter. Also, research and development expenses came in at $33.7 million, up from $28.2 million incurred in second-quarter 2016.

Adjusted operating margin in the reported quarter was 24.0%, up 590 basis points year over year.

Balance Sheet

Exiting the second quarter, MKS Instruments had cash and cash equivalents of $422.8 million, up from $228.6 million recorded at the end of 2016. Long-term debt came in at $551.8 million, down from $601.2 million recorded on Dec 31, 2016.

Outlook

MSK Instruments intends to deleverage its balance sheet by lowering interest expenses, through prepayment of term-loans. The company believes that the acquisition of Newport Corporation would continue to bolster its revenues and profitability in the quarters ahead.

Based on the existing market conditions, the company anticipates to report revenues within the range of $450–$490 million and earnings in the band of $1.32–$1.56 per share for third-quarter 2017.

Key Picks

A few better-ranked stocks in the industry are listed below:

Applied Optoelectronics, Inc. (NASDAQ:AAOI) has an impressive average positive earnings surprise of 118.33% for the last four quarters and currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axcelis Technologies, Inc. (NASDAQ:ACLS) carries a Zacks Rank #2 (Buy) and has an outstanding average positive earnings surprise of 135.78% for the past four quarters.

Adobe Systems Incorporated (NASDAQ:ADBE) , which also carries a Zacks Rank #2 at present, generated an average positive earnings surprise of 8.06% over the trailing four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

MKS Instruments, Inc. (MKSI): Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post