(MKR) Maker Price Prediction & Forecast

[Updated 4 March 2019]

Thinking of investing in MKR in March 2019? Here is our honest price prediction and forecast.

The Maker (MKR) token has prevailed throughout the crypto bear market of 2018 — even seeing positive growth in Q1 2019. MKR’s strong performance is possibly due to a well-designed platform which combines the solidity of a stablecoin with the flexibility of digital currencies. Additionally, the Maker network has been actively accruing strategic crypto partnerships. These partnerships have served to strengthen the viability of its stablecoin. MKR is currently in an upward trajectory, which began in early February 2019 and continues. MKR did see a sharp sell-off recently due, in large part, to the latest Bitcoin (BTC) price dump.

Utility token Maker (MKR) is a decentralized autonomous organization (DAO) that operates on the Ethereum blockchain.

The MKR token is a stablecoin digital currency used for voting and influencing on the DAI network. DAI is a stablecoin pegged to the USD.

The goal of the Maker network is to create a highly-decentralized, community-governed, and asset-pegged currency. A token of this nature holds the capability of withstanding extreme market volatility and would remain a legitimate unit of value within a variety of circumstances.

MKR has been a strong value option since its inception. The token even overtook Ethereum (ETH) in February 2018. The price, at that time, nearly reached $1,700 — with a market cap just over $1 billion.

The last year has been marked by relative stability for MKR in comparison to the extreme bear market of the Crypto Winter. The coin dipped as low as $325 near the end of November 2018 but has begun to recover substantially. February 2019 has seen 37 percent gains so far, with the price sitting around $665 in spite of the recent dip. The MKR token has held strong in the market and is currently ranked 16th in market capitalization.

Fundamental Analysis

As MKR is the utility token behind the DAI stablecoin, its fundamentals revolve around a stablecoin concept. However, MKR isn’t plagued by the same controversy which has hobbled the growth of many stablecoins. Because of its second-layer governance platform, the coin is removed from the direct trades that create such confusion.

The Maker platform has developed a smart contract-based collateralization system. This system operates on the margin trading principle so that MKR minimizes volatility for its parent network’s stablecoin token, DAI. Powered by smart contracts, the supply mechanics of the Maker token decrease volatility for DAI.

Using the MKR token and a complex smart contract system, Maker maintains the value of the adjacent DAI at around $1 USD. In other words, MKR bears the brunt of all the volatility of the crypto market, allowing DAI to retain a value more closely aligned with the mainstream market.

This is a unique, but functional, system — culminating in a cryptocurrency that is both decentralized and an excellent value proposition for use in everyday life and margin trading of the DAI token.

Technical Analysis

The MKR token is created or destroyed based on the price fluctuation of the stablecoin it backs, the DAI token, which is soft-pegged to the U.S. dollar. Therefore, its value is closely associated with DAI, as well as the Ethereum platform on which it was created.

From its 2017 inception, MKR has performed well compared to other coins. The token makes up nearly two percent of the total market supply of Ethereum (ETH).

At its height in January 2018, MKR approached $1700 USD. When the market began to correct, MKR dropped back down under $900. The remainder of 2018 brought massive fluctuation throughout cryptocurrency. MKR was not immune to this volatility. The token ranged between $325 USD and $1100 USD.

2019 has brought new upward mobility to MKR. It has seen substantial growth, starting the year at $483 and rising as high as $766 in recent weeks. Nevertheless, the coin has seen recent price declines back near $650 — in line with the dump in the price of Bitcoin (BTC).

The coin was likely overbought at the higher levels in February, as the market sentiment has become more bullish. The subsequent decline is more reflective of the true value of MKR and provides new stability at that level.

Specialists’ Perspective

Popular opinion throughout the market on MKR is resoundingly positive. Blockchain experts and stablecoin proponents alike tout the decentralized nature of the platform. Coupled with the low volatility potential MKR offers its native stablecoin, DAI, these create tremendous benefits from both a utility and an investment perspective.

Investors see great potential in the ability of MKR to help DAI overtake Tether (USDT), the leading stablecoin currently pegged to the U.S. Dollar. This is due to the fact that DAI is decentralized as a result of MKR being a first-level utility token.

As the utility token of the DAI platform, MKR is also used to pay fees and perform other operational tasks, like community management. In this current climate of blockchain-focused projects, the Maker platform offers a strong value proposition for long-term investors.

An increased focus on digital assets also bodes well for MKR. As institutional investors and top technology firms alike begin considering distributed ledger technology, MKR’s stability will likely bring investors to the table.

However, not all specialists’ price predictions are good for the MKR token. For example, perpetually conservative WalletInvestor.com predicts a 77 percent drop in the MKR token in coming months.

DIgitalcoin.com predicts a similar, yet equally low, short-term price for MKR. However, the site does identify MKR as an excellent long term investment — forecasting prices over $1500 USD.

Even TradingBeasts, a site that seems almost impossibly bullish at times, sees continued short term lows for MKR.

Maker Price Prediction 2019

2019 has been unofficially named the year of the blockchain. As such, MKR is optimally positioned not only to survive but to thrive in the future. Its fractional reserve approach to stabilization is both unique and highly functional.

Due to the ongoing need for price stabilization in the crypto market and the potential MKR offers in that regard, Maker could do very well this year. In fact, market stabilization coupled with a strong blockchain foundation could push MKR to substantial growth by the end of the year. Nevertheless, the coin may also remain mired in the current market — remaining relatively stable in price throughout the year.

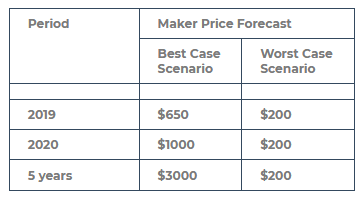

With these competing issues in play, a prediction is difficult. However, it seems best to understand the competing market forces as a cause of stability for the token. For that reason, we at BeInCrypto see 2019 as a year of stability, where MKR will continue growing support for its platform — with prices remaining relatively stable around $650.

That being said, a returning bear market, ongoing price fluctuations, and even a failure of the Maker platform to deliver its targeted functionality could see MKR plummet. A perfect storm of factors could send it as low as $200 or below.

Maker Price Prediction 2020

By 2020, experts hope the price of MKR will have stabilized and begun rising to a higher price point — potentially as high as $1000. This will primarily be a function of the market, led by Bitcoin (BTC) and Ethereum (ETH), both of which are struggling to find long-term bullish support.

However, should stability return to the cryptocurrency market, 2020 could bring increases in price — or, at least, maintain stability. Where MKR lands in 2020 is largely dependent upon events in 2019. If the token remains stable at or around $650, it is likely to find good traction moving in 2020. This would drive increased growth, leading to substantially-bullish movement over $1000.

However, if prices return to previous lows in the $200-$350 range, for example, investors may not see much growth beyond that for 2020. In this way, the overall cryptocurrency market will determine whether MKR is able to grow out of 2019.

Maker Price Prediction 5 years

The MKR five-year price prediction holds a lot of promise, with highs over $3,000 suggested by some investors. This is also due to the state of the overall crypto market. While digital currency is nowhere close to being in widespread usage, blockchain is getting major attention from some key players.

Governmental agencies, social media platforms, and business giants are exploring the many potential use cases for blockchain. It stands to solve many of the scalability issues facing standard web platforms.

Additionally, blockchain technology is being strongly considered as an optimal solution to international banking needs. Some traditional financial institutions — such as JP Morgan, MasterCard, and IBM (NYSE:IBM) — are already integrating blockchain into their existing service structure.

This opens up enormous potential for existing blockchain platforms such as Maker and the MKR token. Its transparency regarding blockchain development — as well as its existing partnerships with systems such as CargoX, Request Network, and Tradeshift — increase both trust and long-term viability for the token.

As the overall cryptocurrency market regains its footing over the next 2-3 years, MKR is well positioned to move into growth. Additional users will bring increased network stability and drive prices upward through the next few years. The coin could see highs at or near the predicted $3,000 mark over the course of five years.

Our Prediction

Based on the current market state and the strong fundamentals of the MakerDAO platform, BeInCrypto forecasts prices remaining stable at or around $650 in 2019. However, we would be reticent to ignore the strange place the entire crypto market is facing. With a continued bear market or even extreme price fluctuations, especially with Ethereum (ETH), MKR could experience dramatic declines in value.

The Maker platform is solid and its focus on true decentralization is encouraging. The platform only launched in 2017 because the team spent over three years in development and is clearly committed to a powerful, flexible platform. Furthermore, the Maker development team is clearly committed to long-term business growth.

While the inherent volatility of any cryptocurrency at any time cannot be ignored, 2019 is likely an excellent year to increase positions in MKR, with anticipation for dramatic growth moving forward.

Nevertheless, investors should always do their own research and tread lightly before investing in cryptocurrency. All cryptocurrencies, including Bitcoin (BTC), are extremely volatile. Never invest more than you can afford to lose and be prepared to lose everything.

What do you think of our price prediction for Maker (MKR) in 2019? Can it catch up to Ethereum again? Let us know your thoughts in the comments below!

Images courtesy of Shutterstock, TradingView.

Disclaimer: The contents of this article are not intended as financial advice, and should not be taken as such. BeInCrypto and the author are not responsible for any financial gains or losses made after reading this article. Readers are always encouraged to do their own research before investing in cryptocurrency, as the market is particularly volatile.