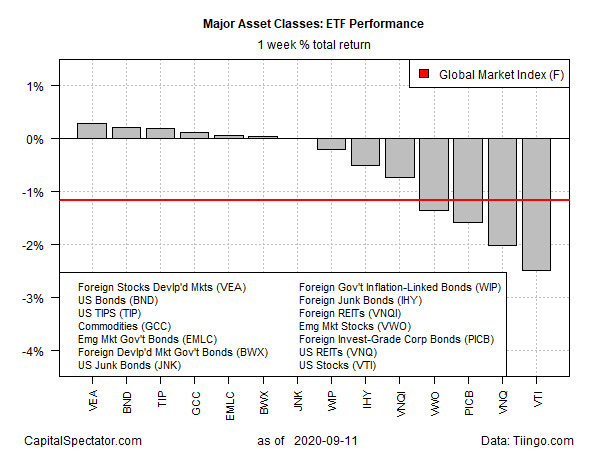

Investors had a tough time identifying a unified narrative for global markets last week, based on a set of ETFs. Performances ranged from a slight gain for equities in developed markets-ex US to a hefty loss for US shares, based on the trading week ended Sep. 11.

Vanguard FTSE Developed Markets Index (NYSE:VEA) took the top spot for returns last week, edging up 0.3%. The gain was slight but it was also conspicuous relative to the losses in US and emerging markets equities (Vanguard US Stock Market (NYSE:VTI) and Vanguard FTSE Emerging Markets Index (NYSE:VWO), respectively).

VEA has been treading water for much of the past month but the fund’s lackluster results of late turned into a leadership position in last week’s turbulent run.

US stocks, by contrast, had a rough week. VTI fell 2.5% — the deepest loss for the major asset classes. The decline marks the second straight week of red ink – the first back-to-back losses for the fund since the coronavirus crash was in full swing in March.

For some analysts, it’s premature to see the selling as a sign the bull market has ended.

“With such a powerful monetary impulse coursing through the US and European economy, the odds are that the market will be surprised again positively” in the fourth quarter, predicts Sebastien Galy, senior strategist at Nordea Investment Funds. “The conclusion is that we should remain in a buy on dip market.”

The Global Markets Index (GMI.F) extended its decline for a second week. The declines mark the first time the benchmark was been down on a weekly basis since late-June. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, retreated 1.2%.

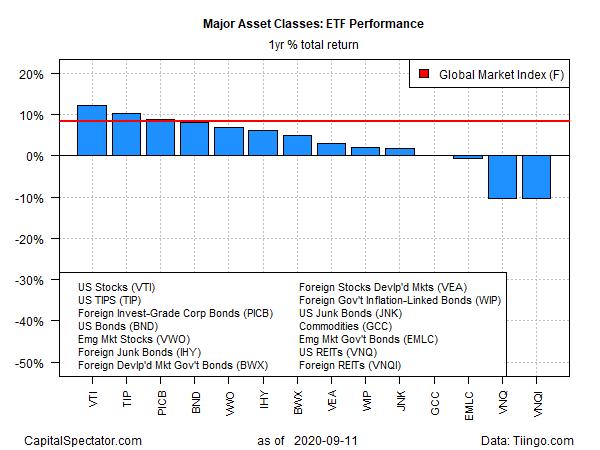

For the one-year window, US equities continue to hold the lead. VTI closed last week with a strong 12.6% total return for the trailing 12-month period.

The weakest one-year performance at the moment: foreign real estate (Vanguard Global ex-U.S. Real Estate (NASDAQ:VNQI)), which is down 10.4% over the past 252 trading days. US property is a close second for the worst one-year performance via Vanguard Real Estate (NYSE:VNQ), which has lost 10.2%.

GMI.F, on the other hand, remains firmly in positive territory with a solid 8.3% one-year gain.

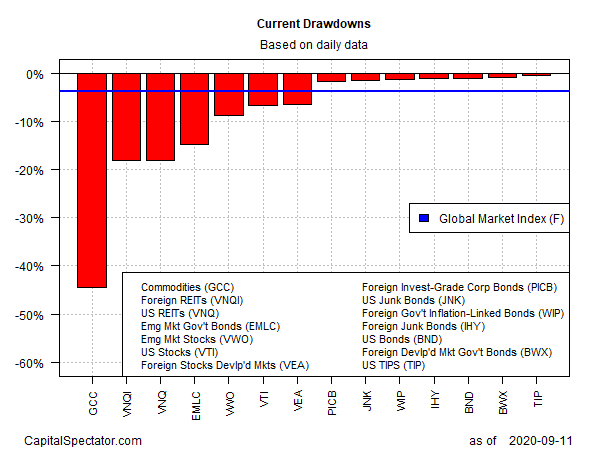

Nearly half of the major asset classes are posting deeper drawdowns relative to GMI.F. The deepest peak-to-trough decline continues to be in broadly defined commodities, which are off more than 40%, based on WisdomTree Continuous Commodity Index Fund (NYSE:GCC).

The smallest drawdown: a slight 0.5% decline for US inflation-indexed Treasuries (TIPS).

GMI.F’s current drawdown: -3.8%.