U.S. markets closed mostly in the red yesterday as European economic news came in softer than expected. However, data showed the U.S. services industry grew better than expected in October.

The services sector expanded strongly which indicated the Federal Reserve could taper back its bond buying program sooner than expected. This snapped a two day winning streak for U.S. stocks.

Economic news out of Europe was not very good. The European Commission is expecting the Eurozone economy to contract by 0.4 percent in 2013. It is expected to recover and grow by 1.1 percent next year (2014). This forecast has raised expectation that the European Central bank (ECB) will cut its key rate on Thursday.

STOCKS

The DJIA had a rather bleak day where 2 shares fell for every 1 that went up. At one point we had a triple digit fall before the Blue Chip clawed its way back up to close down 20.9 points to 15,618.22. The S&P 500 was off nearly 5 points to close at 1,762.97. It is just under nine points from last week’s record close. The Nasdaq Composite bucked the losing trend to close up 3.27 points to 3,939.86. We are less than 61 points from 4,000 now.

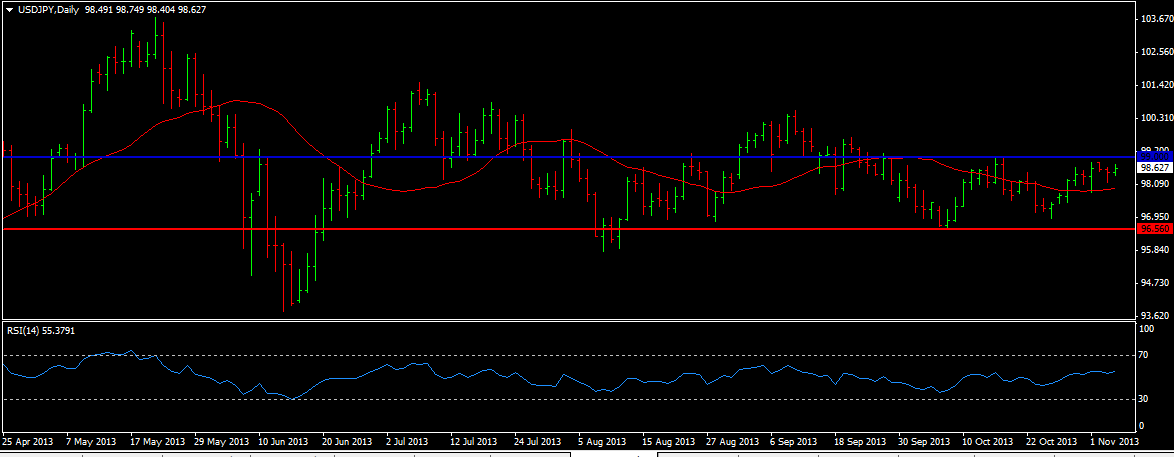

The Nikkei is up one percent at 14,366.85. At one point the index was above 14,370 points. Investors are very happy as the USD/JPY currency pair is approaching $99.00. the Shanghai Composite is extending its losses from its one week low today. The People’s Bank of China (PBOC) says it will continue a prudent stance and is still concerned over inflationary pressures. These comments were made in yesterday’s Q3 policy report.

Australia’s ASX was down 0.2 percent as it continued to move lower after September’s trade deficit came in at AUD 284 million. We had expected it to come in at AUD 450 million.

CURRENCIES

USD/JPY (98.629) has found support at 98.20 and we are recovering from the low at 96.95. We still need that strong push above 99.00 to break this sideways trend and target 100.00.

EUR/USD (1.35009) has found strong support near 1.347 and recovered. We are testing key resistance at 1.350 now. A break here will be bullish. GBP/USD (1.6084) fell to around 1.6000 as expected but support at 1.588 is holding nicely. We could now retarget 1.62.

COMMODITIES

Copper (3.262) is still above 3.25 as we remained range bound between that key support and up towards 3.345. Gold (1313.80) remains near its support at 1310. The yellow metal still looks weak to target 1275. Silver (21.715) is moving sideways. We look bearish for 21 before rising back towards 23.

TODAY’S OUTLOOK

Investors will be focusing on the U.S. Q3 economic growth release (GDP). We also get jobless claims, consumer credit and chain store sales.

This is the prelude before the Non-farm payroll report due this coming Friday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Mixed Global Data Means Mixed Financial Markets

Published 11/06/2013, 03:10 AM

Updated 05/14/2017, 06:45 AM

Mixed Global Data Means Mixed Financial Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.