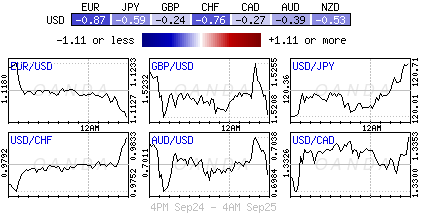

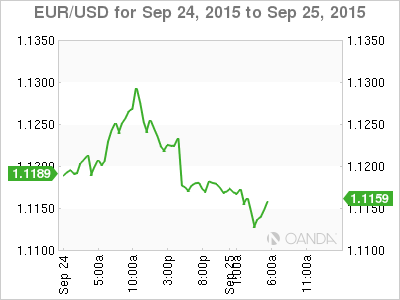

Fed Chair Yellen solidifies expectations for 2015 liftoff: A week ago the Fed stood pat on rates partly on worries about global financial and economic developments. Their decisive inaction hurt what little confidence many investors had left after the August meltdown. Last night, Ms. Yellen played down those risks when highlighting the likelihood of a hike this year. The euro traded at €1.1460 after the FOMC, then €1.1105 earlier this week on dealer speculation that a Fed hold would pressure the ECB to expand its QE program as early as next month.

On Wednesday, Draghi and company indicated that they were ‘waiting and watching.’ The lack of dovishness from Europe pressured a number of speculators to further reduce their EUR/USD shorts. Questionable Euro parity being achieved in the medium term persuaded many investors to dramatically pare their Euro shorts over the past six- months.

The USD is notably higher on Yellen’s hawkish remarks across the board (€1.1152, ¥121.00). With the lack of significant currency positions, next week’s U.S jobs report, which is not expected to deviate from the strong employment story, should support some significant currency moves for the dollar against the majors as many dealers are expected to scramble to reestablish some of their original positions.

Blame China – Central Banks on alert: The yen longs that have been favored to hedge recent global equity declines have come under pressure in the overnight session (¥121.00). Aside from a hawkish Fed, not helping the safe-haven currency of choice was Japan’s nationwide core CPI registering its first decline in two-years (-0.1%). The disappointed print has prompted PM Abe and Bank of Japan’s (BoJ) Kuroda to discuss economy and monetary policy. Investors continue to look for any hints of the BoJ being urged to do more easing at next months meeting (the BoJ will also release its updates on inflation and growth). Finance Minister Aso’s office have cut their overall assessment on the economy for the first time in a year; citing China’s slowdown and U.S rate hike risks contributing to “slowness in some areas” of Japan’s economy.

Downside risks have risen: Sticking to the Fed’s recent script, the Bank of England (BoE) financial policy committee said that the risks to the stability of the financial system have “intensified” this summer. Members highlighted China’s slowdown and volatility in financial markets as potential vulnerabilities. There were two specific areas flagged – depths of liquidity and capital outflows linked to divergent monetary policy.

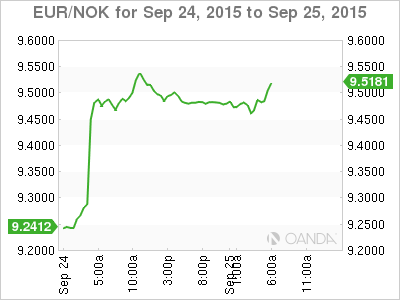

Stand and deliver: Norges Bank (Norway) delivered a significant if not totally surprising -25bps rate cut to +0.75% yesterday. The accompanying dovish comments point clearly to a lowering of their rate path (€9.5057). However, fixed income dealers are only pricing in an outside chance of a further rate reduction in December (currently +25%) as the significant NOK fall this week exceeds the CB’s Q4 estimate for imported weighted NOK. The market seems to be speculating that the NOK’s depreciation could limit the bank’s scope for further easing just yet and perhaps even provide outside support. With a dovish ECB and cautious Fed, dealers will likely shift their focus to Sweden’s Riksbank from an easing perspective (€9.4122, NOK/SEK 0.9900).

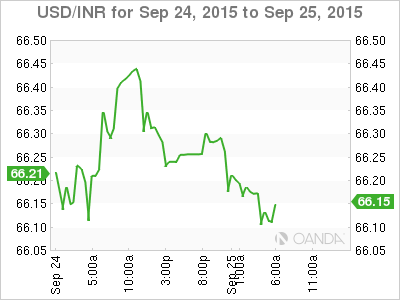

No reprieve for Emerging Markets: Because of two words, China and Fed, events have taken a turn for the worst. The MSCI (EM currency index) has fallen to its lowest level in six-years. MXN fell to a new record low yesterday ($16.7870); TRY ($3.0370) and ZAR ($13.7077) continue to straddle their record lows. Brazil, who has hitched its wagon to a commodity hungry China, is flirting with “junk status” and a currency attack (BRL $3.9330). The MYR has plummeted to new lows this morning ($4.3850) and on track for its largest weekly loss in two decades, while the INR ($66.10) has fallen to a fresh 17-year low. The twin challenges of China and the Fed have certainly intensified the fall of EM currencies. The spotlight is now firmly on the weakest economies CB to be aggressively proactive. Currently Brazil’s BCB is losing the battle – central bankers are expected to use their foreign reserves to stem the currency’s decline and mitigate the capital outflow concerns.