- Did you miss out on investing very early in AI stocks?

- No need to worry, as the next big technological revolution is just beginning: quantum computing

- Let's take a look at the best stocks to buy that are involved in quantum computing research

The artificial intelligence (AI) revolution has only just begun, yet researchers and numerous technology companies are already focusing on the next major technological breakthrough that has the potential to reshape the global economy: quantum computing.

Quantum computing's applications could be even more extensive than AI, and it might serve as a foundation for other significant technological advancements.

Quantum Computing: Bigger Disruption Than AI?

Without going into the scientific details, quantum computing is a type of computing that uses quantum mechanics to perform calculations with power and speed incomparable to today's best supercomputers.

As such, one of the obvious applications of quantum computers is artificial intelligence since many scientists see quantum computers as indispensable for achieving General Artificial Intelligence (GAI), the Holy Grail of AI, with one of the systems that would equal or surpass human intelligence.

Quantum computing is also often cited as a major risk for the world of cybersecurity since quantum computers would theoretically be capable of forcing current encryption techniques.

While a decade ago, quantum computing was still the stuff of science fiction, this is no longer the case, with several major technology companies investing heavily in the development of quantum computers.

Which Companies Are Involved in quantum Computing Research?

These include IBM (NYSE:IBM), which boasts "the world's largest fleet of quantum computers."

Honeywell (NASDAQ:HON), meanwhile, has clearly made quantum computing a top priority, teaming up with Cambridge quantum to create Quantinuum, "the world's largest integrated quantum computing company".

Chipmakers are also getting in on the act, with Intel (NASDAQ:INTC) developing Tunnel Falls, a chip specifically designed for quantum computing systems.

Computer giant Microsoft (NASDAQ:MSFT) is also working on quantum computing, the company revealed last summer that it had achieved "the first step towards a quantum computer", namely a stable qubit device.

Finally, Alphabet (NASDAQ:GOOGL), which was one of the first technology companies to tackle quantum computing, reported a major breakthrough earlier this year, managing to complete in seconds a task that would have taken the most powerful supercomputer known today 47 years.

In addition, the company has officially set itself the goal of building a "useful, error-corrected quantum computer" by 2029.

To sum up, quantum computing is set to become a reality over the next few years, and the implications of the advent of this technology are at least as difficult to imagine as those of AI.

While it's still too early to try and pinpoint which company will achieve leadership in this field, it's still worth analyzing the current profile of these quantum computing pioneers to determine which one represents the best investment opportunity.

Best Stock for the Quantum Computing Race

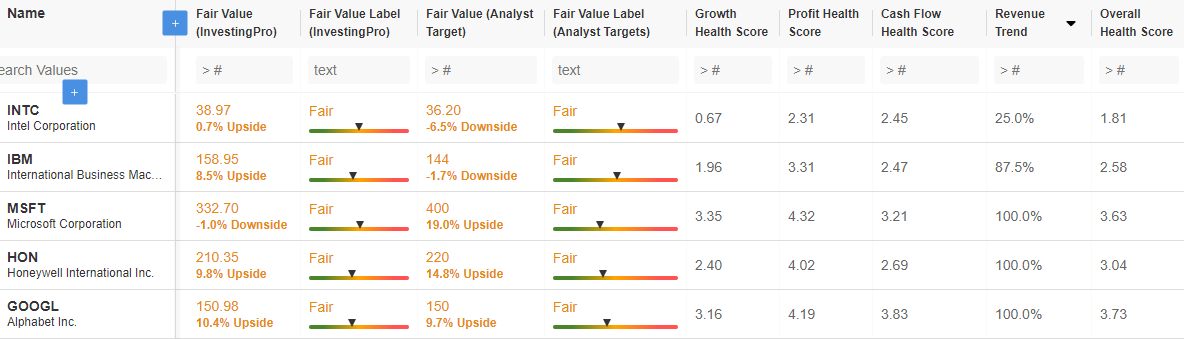

To find out, we turned to InvestingPro's fundamental analysis tool, starting by assembling the stocks mentioned in this article into an Advanced Watchlist:

Source : InvestingPro

The first thing we notice is that the InvestingPro models and analysts consider the current valuation of these stocks to be "fair," with limited downside potential.

This suggests, firstly, that for the purposes of a long-term investment aimed at reaping the rewards of quantum computing, the current valuation of these shares is probably not ideal.

Keeping an eye on these stocks while waiting for a better entry point is certainly the strategy to adopt for the time being.

However, this does not prevent one of these stocks from standing out.

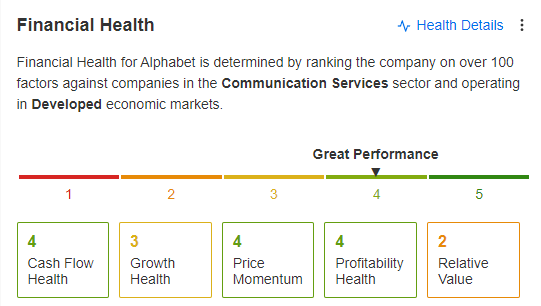

Source : InvestingPro

Indeed, Alphabet has the highest InvestingPro health score, testifying to financial health, which should enable it to continue investing massively in the development of quantum computing.

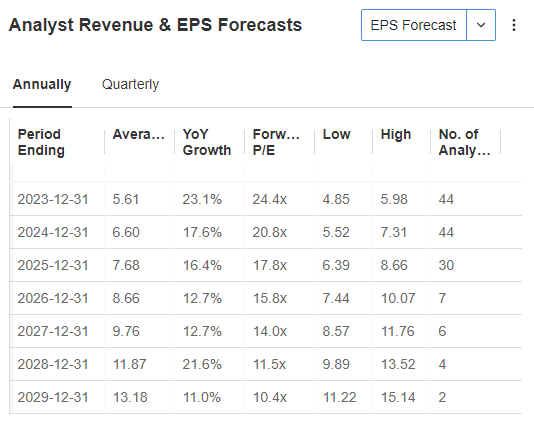

This financial health should also be maintained in the future if we are to believe analysts' forecasts, who are predicting solid, steady growth in earnings per share over the next few years.

Source : InvestingPro

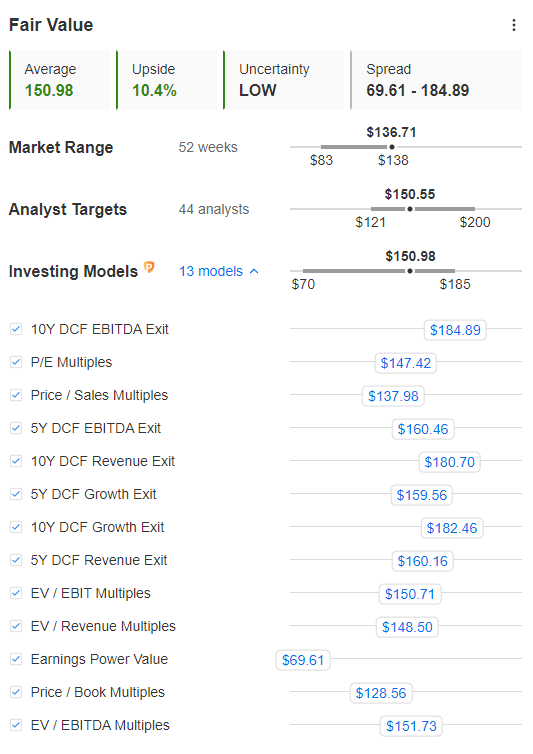

Finally, note that the InvestingPro fair value of Alphabet shares, currently at $150.98, reflects a potential upside of 10.4%.

Source : InvestingPro

However, as shown above, the estimates of the various models on which the Fair Value is based range from $69.61, for the "Earning Power Value" model, to $184.89 for the 10Y DCF EBITDA Exit model.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.