The Japanese yen has started the week with strong losses Monday, as USD/JPY has pushed above the 113 line in Monday’s European session. In economic news, Japanese Flash Manufacturing PMI dipped to 50.2, its weakest reading in nine months. The estimate stood at 52.0 points. In the US, there is only one event on the schedule, Manufacturing PMI. On Tuesday, the US will release CB Consumer Confidence, a key indicator.

The yen has posted sharp gains in February, despite the fact that Japanese fundamentals have not impressed. GDP contracted in the fourth quarter, while Japanese consumer spending has fallen off, hurting growth and raising the specter of deflation, which would be a nightmarish scenario for policymakers. Despite all the gloom and doom, the Japanese yen has not only held its own against the strong US dollar, but flexed its muscles and posted superb gains in recent weeks. The Japanese currency has maximized its traditional safe-haven status, as global financial instability has driven investors away from risk assets towards safer waters like the yen. However, the recent rush to safe assets will not last indefinitely, and with the economy struggling, weak fundamentals are not about to disappear. Given this backdrop, the BOJ may have to take further monetary action at its next policy meeting in March. At the January policy meeting, the BOJ adopted negative interest rates, shocking the markets and sending the yen sharply lower before the currency rebounded. Further easing steps would likely weaken the yen.

The US released CPI last week, the key gauge of consumer inflation. CPI came in at 0.0%, and Core CPI improved to 0.3%, marking the strongest gain since April 2015. These readings are certainly not strong, but managed to beat their estimates, so speculation has increased that the Fed may reconsider a rate hike in March. However, such a move still seems unlikely, unless inflation picks up dramatically. Earlier in the week, the Federal Reserve sent out a cautious message in its minutes, which reiterated the central bank’s concern that turmoil in global markets could have negative repercussions for the US economy. Policymakers sent out a broad hint that a rate hike is unlikely in March, as they discussed “altering their earlier views of the appropriate path for the target range for the federal funds rate”. This could have a negative impact on the US dollar, as investors may look elsewhere to park their funds if US rates are not moving higher anytime soon. Federal Reserve chair Janet Yellen said last week that the Fed still planned to raise rates later in 2016, but FOMC member James Bullard argued that there was room to delay any rate moves, given global financial turmoil and weak US inflation. Many experts are skeptical that the Fed will make any more moves before next year, but central banks have a way of surprising the markets.

USD/JPY Fundamentals

Sunday (Feb. 21)

- 21:00 Japanese Flash Manufacturing PMI. Estimate 52.0 points. Actual 50.2 points

Monday (Feb. 22)

- 9:45 US Flash Manufacturing PMI. Estimate 52.3 points

Upcoming Key Events

Tuesday (Feb. 23)

- 10:00 US CB Consumer Confidence. Estimate 97.4 points

*Key releases are highlighted in bold

*All release times are EST

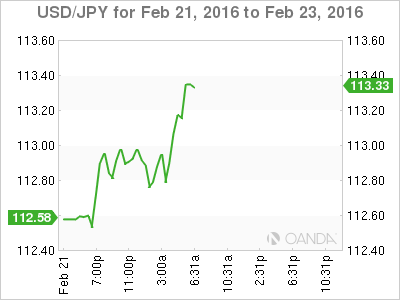

USD/JPY for Monday, February 22, 2016

USD/JPY February 22 at 7:00 EST

Open: 112.52 Low: 112.50 High: 113.33 Close: 113.35

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 109.87 | 111.50 | 112.48 | 113.86 | 114.65 | 115.90 |

- USD/JPY was flat in the Asian session an has posted sharp gains in European trade.

- There is resistance at 113.86

- 112.48 has some breathing room in support as USD/JPY has posted strong gains

- Current range: 112.48 to 113.86

Further levels in both directions:

- Below: 112.48, 111.50 and 109.87

- Above: 113,86, 114.65, 115.90 and 116.88

OANDA’s Open Positions Ratio

USD/JPY ratio has shown movement towards long positions, which retain a strong majority (65%). This is indicative of strong trader bias towards the pair continuing to move upwards.