If you followed my contrarian investing lead several weeks ago, then you’ve already made a number of profitable shifts to take advantage of falling bond yields. (See Against the Herd: Lower Rates Rather Than Higher Rates In 2014.) Perhaps you ventured back into the long end of the curve by acquiring shares of Vanguard Long-Term Bond (BLV). Or maybe you picked up shares of SPDR Sector Select Utilities (XLU), as the prospect of a dividend income stream from the previously maligned sector seemed more attractive.

Most analysts and many commentators had failed to connect the dots on interest rates. Theoretically, the tapering of Federal Reserve bond buying should have led to a steady rise in rates. In practice, the uncertainty associated with how the global economy will function without its quantitative easing (QE) crutch has sent the investing community back to the safety of investment grade debt. Economic data from retail sales to mortgage applications to manufacturing — data that had often been overlooked while the Fed served as a backstop — is now contributing to higher bond prices (lower yields) as well as erratic price swings for stocks.

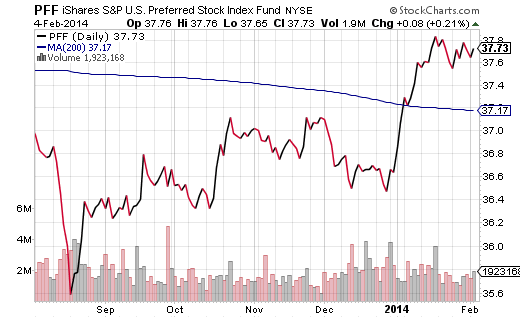

To be frank, I did not predict a sharp January pullback for riskier assets. I did express a probability of increased volatility for equities, and I spoke at length about the likelihood that rate sensitive investments (e.g., long bonds, munis, preferreds, etc.) could come back into vogue. Assets like iShares Preferred (PFF) and PowerShares Preferred (PGX) had already been making bold statements since 2014 began.

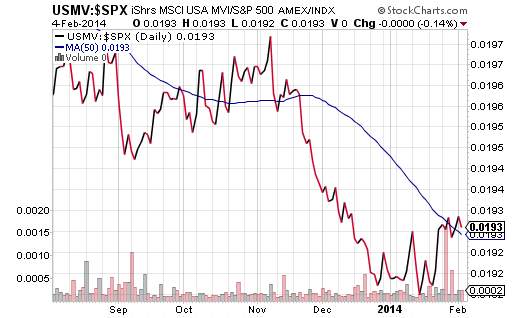

Other “risk-off” trends have been capturing the imagination of investors as well. For example, back in October, lower volatility stocks showed some sign of relative strength compared with the S&P 500 due to the government shutdown. Shortly thereafter, however, iShares MSCI USA Minimum Volatility (USMV) struggled as investors ratcheted up their risk tolerance. Today, USMV is regaining fans as many look for less risky ways to participate in stock ownership. This trend can be seen in the rising USMV:S&P 500 price ratio below.

The depth and the duration of the current pullback is likely to take its cues from the upcoming January jobs report. A stronger-than-expected report might cause short-sellers to cover their backsides and encourage dip-buyers to give the Fed the benefit of the doubt; that is, maybe tapering is not the same as monetary tightening. On the flip side, a dismal jobs number could add fuel to the forgettable fire; that is, with so much time before the next Federal Reserve policy meeting in mid-March, one should prepare for six weeks of volatile trading.

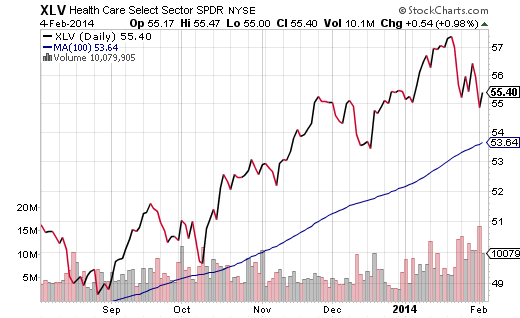

Rather than experience whiplash by economic data points, I have already taken a more cautious stance for my clients. For instance, SPDR Select Health Care (XLV) figures prominently in many portfolios because it has demonstrated smaller drawdowns during recent corrective activity and because it is still performing phenomenally well on the upside. It is one of the few sectors that has yet to pierce an intermediate 100-day moving average.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.