As the summer doldrums roll on, we thought it was a good time to recap where the muni market has come since the Trump sell-off of last fall.

A number of factors have helped the overall muni market.

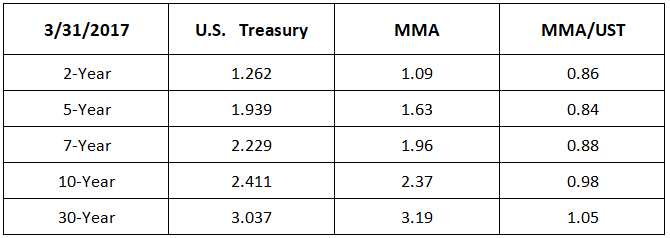

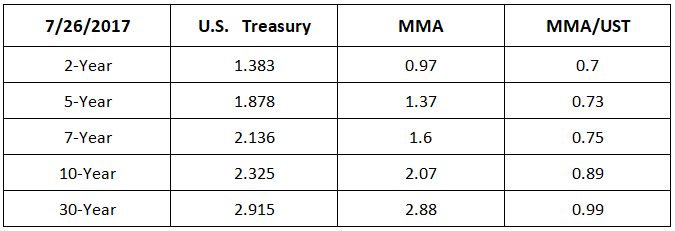

The general level of interest rates has fallen as a result of congressional inertia on tax bills, healthcare, and fiscal spending in general. Markets, both equity and fixed income, generally like congressional gridlock, and we have it now, even with both houses of Congress and the presidency controlled by the Republicans. The charts below show the changes in the US Treasury market and the AAA tax-free bond market since the end of the first quarter. The muni outperformance in the long end is evident. The AAA-to-US Treasury yield ratio is now below 100%, though most AA- and A-rated bonds are still at yield ratios that are historically cheap.

*Source: Municipal Market Analytics

The original tax bill, which included a cut in the marginal tax rate, is now being discussed with a RISE in the top tax rate and cuts further down the tax curve. For the highest earners, that would means that tax-free bonds income would be worth more on a taxable-equivalent basis.

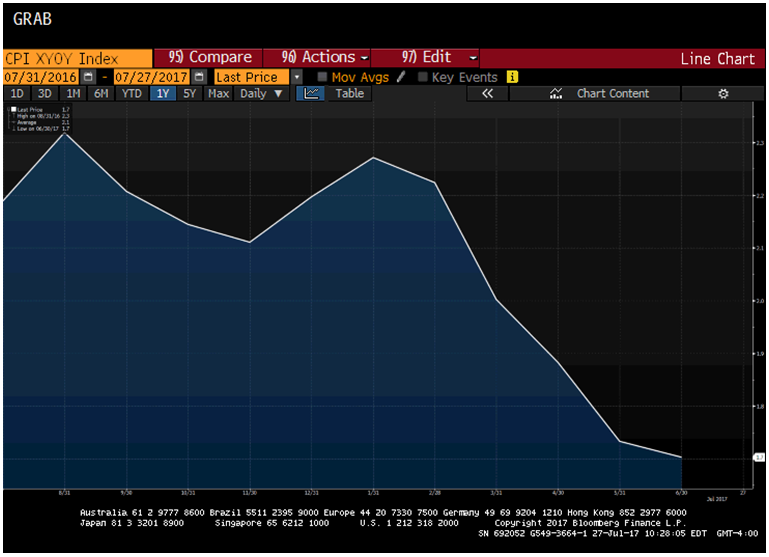

Inflation has been dropping (see graph below). The bond markets, and particularly longer-dated munis, have benefitted from the turnaround in core inflation. This has been a surprise to the Federal Reserve as well as the bond markets. With post-Trump rising yields but falling inflation, extending maturities and durations is a correct strategy, particularly in the muni market beat up by bond fund selling.

*Source: Bloomberg

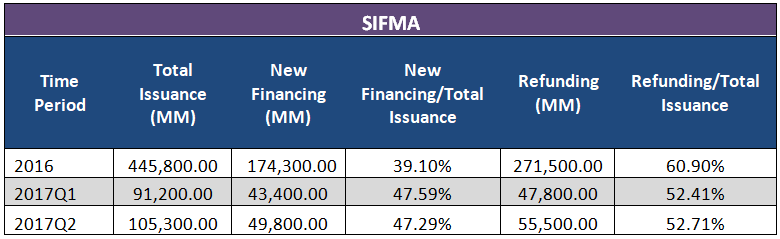

Increased Municipal Refinancing

*Source: SIFMA “US Municipal Securities Holders” Report. (Last Updated 7/06/2017)

Refinancings dominated last year’s issuance, particularly as we got into the low yields post-Brexit. With the Trump sell-off in November, which lasted through January, overall issuance is off this year, as refinancings were not feasible earlier in the year and issuers were put off by the overall rise in rates after the election. However, with the recent drop in yields, refinancings started to come back into the market in March and have continued right through the summer. Though the cost savings are not as dramatic as they were last year and yields are still higher than a year ago, municipalities are not willing to let this second opportunity to refinance and prerefund older, higher-coupon debt go by. Plus, there is one less year to call dates than a year ago, which reduces the amount of negative arbitrage. That is the difference between the municipal financing rate and the Treasury rate to escrow older bonds. In other words, longer muni yields are still cheaper than Treasury yields. So, still-considerable cost savings combined with less negative arbitrage means that there is a strong propensity among issuers to refinance their debt. To that end, in the current lower-interest-rate environment, we find that callable, higher-coupon bonds that are candidates to become prerefunded offer compelling yields on a risk/reward basis, given their shorter duration.

Also, the overall muni market got some good news this month as the House of Representatives Financial Services Committee approved the Municipal Finance Support Act. In a nutshell, this act will allow banks to count more of their municipal bond holdings in the calculation of HQLA (high-quality liquid assets). Though the bill still has to clear the hurdle of the Senate, if it goes through it should ensure continued participation of banks in the municipal market and is a large improvement over previous proposals.

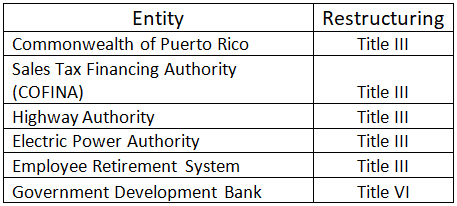

Finally, market events in Puerto Rico continue, with a number of noteworthy developments. We now have five entities restructuring under Title III as well as the only FOMB- (Federal Oversight and Management Board)-approved Title VI restructuring to date. Readers may remember from previous commentaries that Judge Laura Taylor Swain is overseeing Title III restructurings along with a five-judge mediation panel appointed to assist with creditor–debtor negotiations. We have identified each entity and the restructuring path they are currently utilizing.

*Source: Debtwire

Defaults expanded in July to include the Puerto Rico Electric Power Authority (PREPA) and the Convention Center District Authority (CCDA). The default of PREPA follows a stunning decision by the FOMB to reject the authority’s restructuring support agreement (RSA). Until a month ago PREPA was considered by many to be the most likely candidate to achieve a consensual restructuring under Title VI. The FOMB’s actions imploded a deal that has been years in the making and cost those involved millions of dollars.

Of even more significance than PREPA has been the default and entrance of COFINA into Title III. Following the passage of legislation that would have made COFINA revenues available to the Commonwealth, the trustee, Bank of New York Mellon (NYSE:BK), issued a notice of default. COFINA entered into Title III shortly thereafter, leaving questions regarding default unanswered, especially those relating to certain accelerator clauses that senior bondholders want to enforce. Judge Laura Taylor Swain escrowed interest payments for June and July until the questions regarding default are remedied. We expect COFINA’s August payment to be escrowed as well.

We continue to watch court proceedings closely and remain confident that the insurers we utilize are capable of meeting their obligations. We would not continue to hold their paper if we thought otherwise.

Enjoy your vacation!

A special thank you to colleagues Shaun Burgess and Gabriel Hament for assisting in compiling the data.