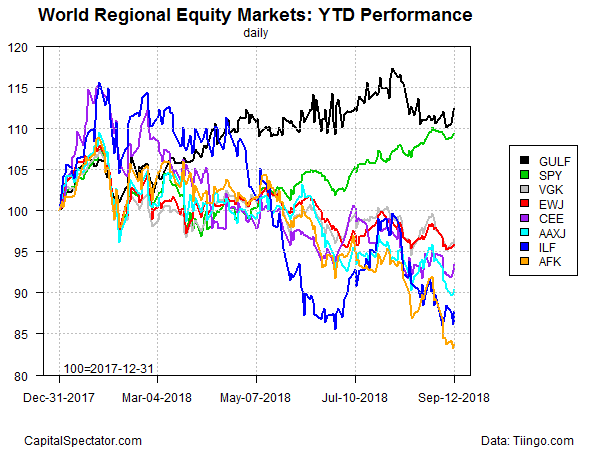

Stock markets in the Middle East continue to hold a modest edge over US equities in the year-to-date horse race for regional stock-market performances. The gap is closing, however, in favor of American shares after a bout of weakness in Middle Eastern prices, based on a set of exchange-traded funds.

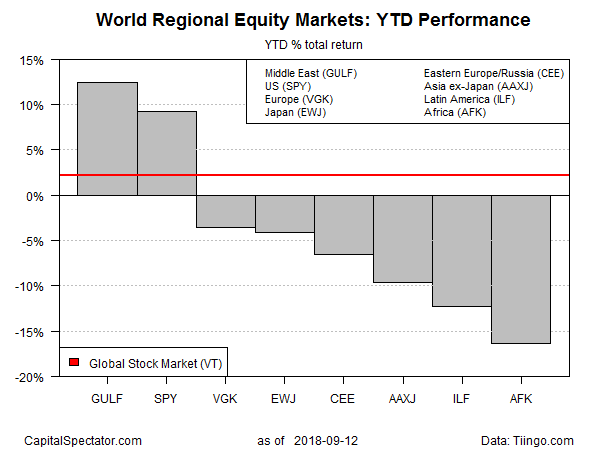

WisdomTree Middle East Dividend (NASDAQ:GULF) is still comfortably in the lead with a 12.4% total return year to date, as of yesterday’s close (September 12). But the ETF’s stumble in recent weeks, fueled in part by worries of an escalating trade war between the US and China, has pared its edge.

By contrast, SPDR S&P 500 (NYSE:SPY) has continued to trend higher with relative consistency. Year to date the fund posted a solid 9.3% total return through Wednesday’s close.

Both funds are currently reporting returns this year that are well above the global equity benchmark via Vanguard Total World Stock (NYSE:VT), which is ahead by a comparatively soft 2.2% so far in 2018.

Meanwhile, year-to-date losses hang over the rest of the field for the major regions of the world’s equity markets. The biggest setback is in African shares. VanEck Vectors Africa (NYSE:AFK) has shed a hefty 16.3% so far in 2018, leaving the fund near its lowest close in more than a year as of Wednesday.

The performance chart below provides a visual reminder that the global equity market’s key regional return drivers this year are cleanly split between a pair of winners (Middle East and US ) and everything else.

UBS advises that trade risk is a potentially critical factor for the outlook on stocks in the near term, for good or ill. “Our results show that US equities are pricing in little trade impact at the moment, and could be vulnerable should tensions escalate,” analysts at bank report via MarketWatch. “Conversely, if trade tensions ease, [emerging-market] Asia equities have the most room to rally.”