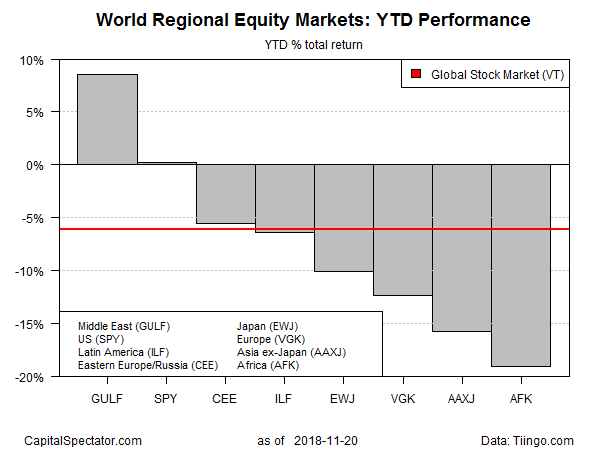

The widespread selling in equity markets around the world has left most regions in the red for year-to-date performance, based on a set of exchange-traded funds as of yesterday’s close (Nov. 20). The conspicuous exception: stocks in the Middle East. The US market, which has fallen sharply in recent weeks, is holding on to a fractional gain for 2018, but the razor-thin increase is no match for the still-solid increase so far this year for markets in the Middle East

WisdomTree Middle East Dividend (NASDAQ:GULF), which tracks a fundamentally weighted index of companies that pay dividends, is up 8.5% this year through yesterday’s close. The fund (the only regional Mideast equity ETF) has declined in recent trading sessions, but the setback has been mild compared with the selling wave in the rest of the world’s regions.

It’s debatable if the relative strength in Mideast stocks will endure. “Weak sentiment is clear across the region,” notes Tariq Qaqish, managing director for asset management at Menacorp Financial Services in Dubai. “It’s accompanied by geopolitical issues, the recent developments in Saudi (with the killing of journalist Jamal Khashoggi) and the possible outcome from that incident,” he tells Reuters.

Technically, the US stock market is still above water for year-to-date results, based on the SPDR S&P 500 (NYSE:SPY). But after yesterday’s sharp selloff, which follows weeks of mostly down days, this widely traded ETF proxy for US equities is up a fractional 0.3% for 2018 through yesterday’s close.

In fact, most of the world’s equity markets are in negative territory for the year so far, based on Vanguard Total World Stock (NYSE:VT), which has shed 6.2% year to date.

The biggest loss so far in 2018 for regional equity funds: VanEck Vectors Africa (NYSE:AFK), which has lost 19.1%.

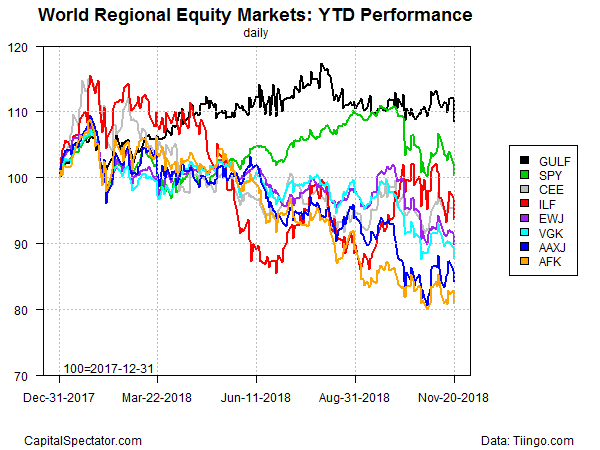

The performance chart below reminds that the US market has endured an especially volatile year. After sliding sharply early on in 2018, SPY rebounded (green line), only to hit a wall in October that delivered another dramatic reversal of fortune.

Although many analysts have turned bearish in the wake of the downturn, Jason Draho, head of asset allocation, Americas, at UBS Global Wealth Management, favors a contrarian view. Writing in a note to client via Bloomberg, he explains: “We view the sell-off as overdone and a bull-market correction, with valuations that have become more compelling. We recently increased our overweight to global equities on the view that the markets are already pricing in growth and trade risks.”

But in the wake of so much selling, minds will differ on what comes next. By some accounts, the latest tumble in stock prices is a warning sign for the US economy. Although the hard data published to date still looks encouraging, the pace of growth appears to be slowing. Yesterday’s revised nowcast for fourth-quarter GDP via the Atlanta Fed’s GDPNow model, for instance, dipped to +2.5%. That’s still a respectable advance, although it marks the second straight downshift in growth following the stellar increase 4.2% increase in Q2.

The fear in some circles is that the softer macro trend will roll on into 2019.

“I think there are very clear signs that investors are beginning to worry about weaker growth in the coming year or so, and how that’s going to feed through to corporate earnings,” Michael Pearce, senior United States economist with Capital Economics, tells The New York Times.

Disclosure: Originally published at Saxo Bank TradingFloor.com.