Low-volatility, multi-asset portfolio

Midas Income and Growth Trust (MIGT) has a multi-asset portfolio that is circa two-thirds equities with the balance in fixed income, alternative assets and property. This has historically provided lower volatility in its returns than its predominantly equity-focused peers in the Global Growth & Income sector (MIGT has both the lowest one-year NAV volatility and lowest one-year price volatility among its peers – see page 8) and the FTSE All-Share Index. MIGT’s equity investments are tilted towards defensive stocks. There is also a focus on real assets to provide some protection against rising inflation. The yield of circa 4% is above the sector average.

Strategy: Low volatility multi-asset portfolio

MIGT is a global fund with an absolute return benchmark. Its multi-asset portfolio primarily comprises equities (UK 36.4% and overseas 30.5%) and fixed-income securities (14.2%). Property and alternative assets are also included to take advantage of opportunities in these sectors while reducing overall risk. Managed using a predominantly top-down investment style, the manager varies the strategic asset allocation for each class around a long-term position. MIGT makes direct investments in UK equities and investment-grade bonds. Other exposures, such as overseas equities, are gained via fund investments.

Outlook: Sentiment improving, valuations elevated

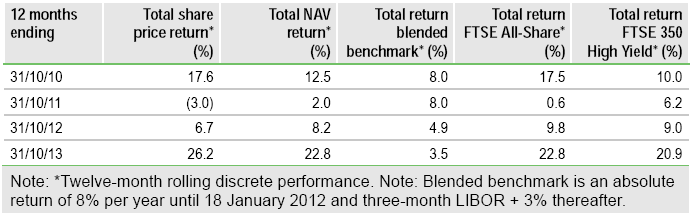

Volatility this year, particularly in reaction to talk of tapering, highlights that considerable uncertainty remains, although there is evidence to suggest the economic outlook is improving and, reflecting this, the FTSE All-Share and FTSE 350 High Yield Indices have returned 22.8% and 20.9% during the last 12 months. Price rises have broadly outpaced earnings increases, so that UK and global equities are not as cheap as they were before, but valuation measures remain comparable to their 10-year averages (see page 3). The manager believes MIGT’s portfolio should remain defensively positioned and has moved the directly held equities towards a more defensive allocation during the last six months. Fixed income has seen a modest reduction with a shift towards shorter-duration investments to reduce sensitivity to interest rate rises.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Midas Income And Growth Trust

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.