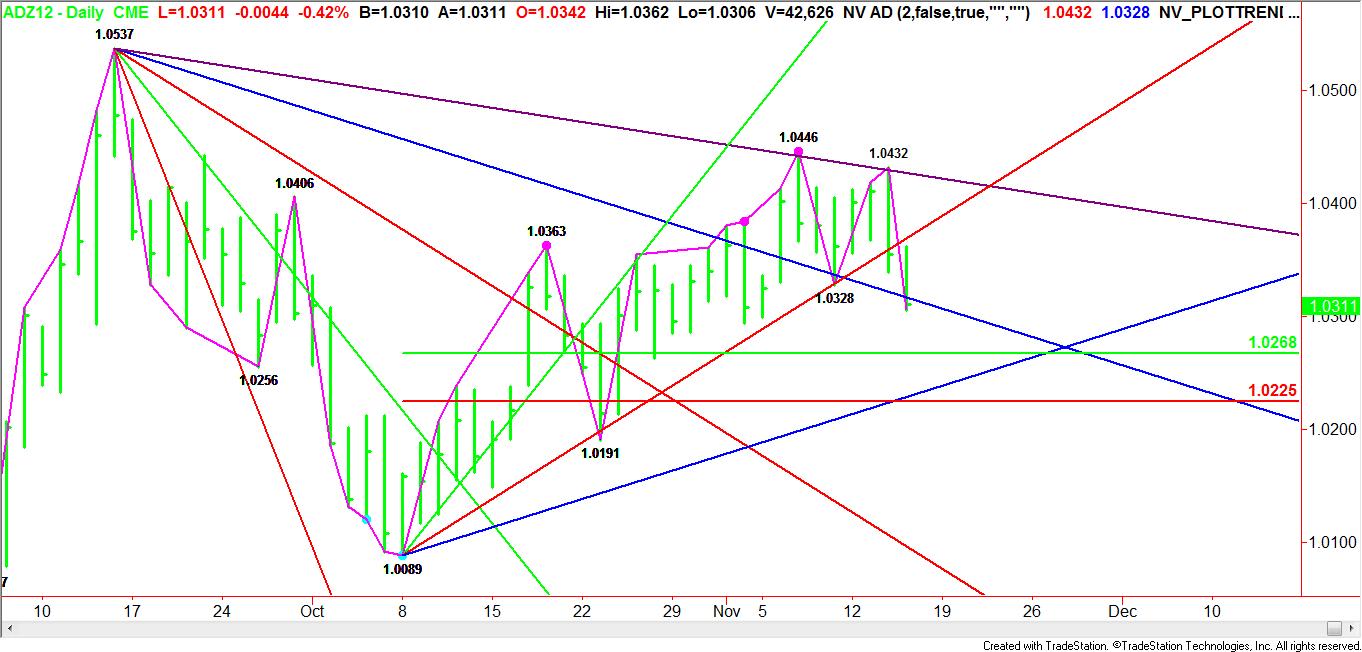

The December Australian Dollar is under pressure this morning, pressured by rising tensions in the Middle East and amid worries over the possibility of the U.S. fiscal cliff. Short-term selling pressure is emerging after longer-term concerns over declining export prices and the weaker global outlook helped form two tops at 1.0432 and 1.0446.

Some traders are also speculating that the Reserve Bank of Australia is applying subtle downward pressure on the Aussie by allowing foreign currency reserves to grow. Reports indicate that the RBA allowed its foreign currency holdings to rise by $457 million during the month.

Technically, the December Australian Dollar turned its main trend to down when the market crossed the last swing bottom at 1.0328. Additional selling pressure emerged when the uptrending Gann angle was broken at 1.3069.

Based on the main range of 1.0089 to 1.0446, expectations are for a further decline into a retracement zone at 1.0268 to 1.0225. Another uptrending Gann angle comes in at 1.0229, making 1.0229 to 1.0225 a possible support cluster.

High-Risk Demand

Besides the unfolding of a bearish technical picture, an overall drop in demand for higher-risk assets could push the Aussie down even further if warlike conditions continue to escalate in theMiddle East. This could cause a flight to safety rally into the U.S. Dollar, leading to additional pressure on all major currencies.

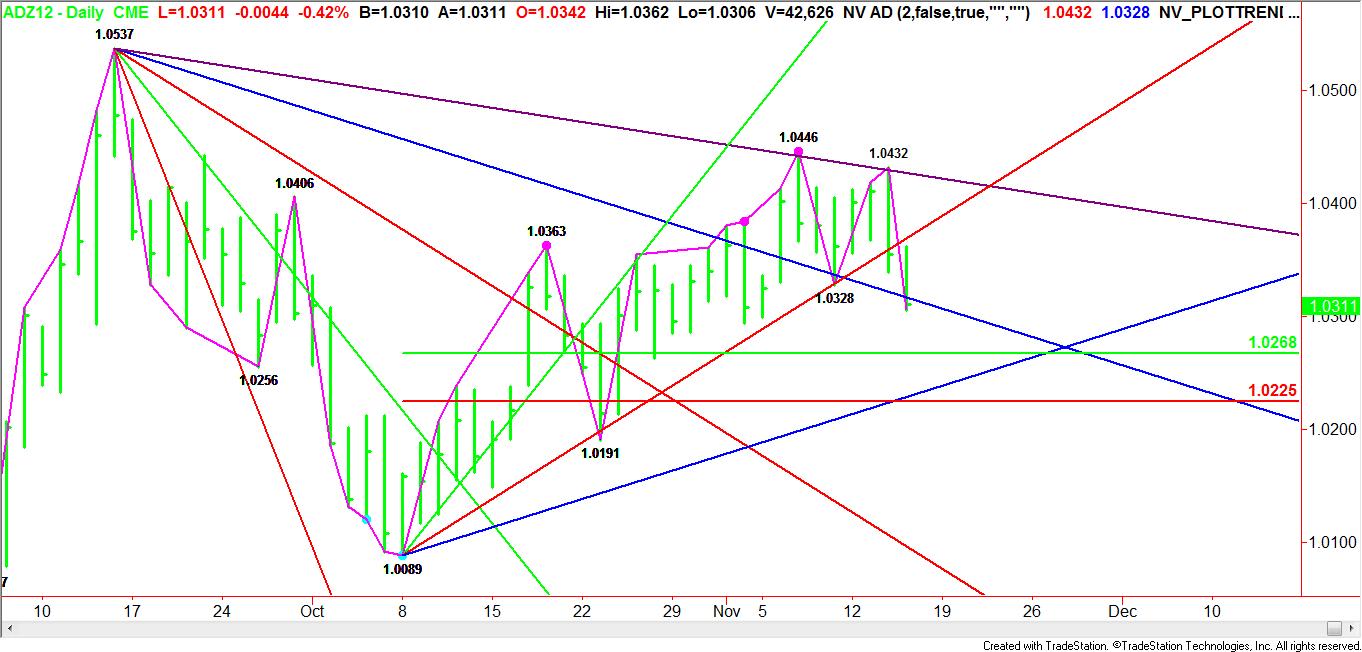

Some traders are also speculating that the Reserve Bank of Australia is applying subtle downward pressure on the Aussie by allowing foreign currency reserves to grow. Reports indicate that the RBA allowed its foreign currency holdings to rise by $457 million during the month.

Technically, the December Australian Dollar turned its main trend to down when the market crossed the last swing bottom at 1.0328. Additional selling pressure emerged when the uptrending Gann angle was broken at 1.3069.

Based on the main range of 1.0089 to 1.0446, expectations are for a further decline into a retracement zone at 1.0268 to 1.0225. Another uptrending Gann angle comes in at 1.0229, making 1.0229 to 1.0225 a possible support cluster.

High-Risk Demand

Besides the unfolding of a bearish technical picture, an overall drop in demand for higher-risk assets could push the Aussie down even further if warlike conditions continue to escalate in theMiddle East. This could cause a flight to safety rally into the U.S. Dollar, leading to additional pressure on all major currencies.