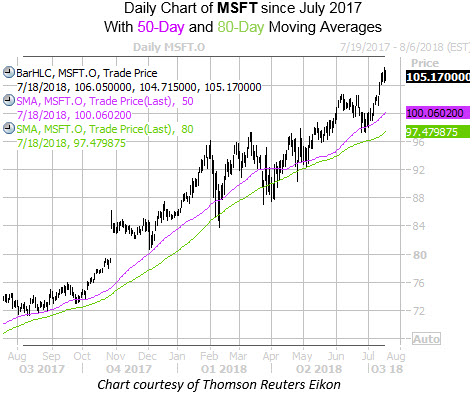

Microsoft Corporation (NASDAQ:MSFT) stock is down 0.9% at $105.17 this morning, after touching a record high of $106.50 yesterday. The Dow stock has gained 43% over the past 12 months, with its 50-day and 80-day moving averages acting as lines of support for the past two years. What's more, it seems recent options buyers are expecting higher highs for MSFT shares after earnings tomorrow.

The tech powerhouse is slated to report fiscal fourth-quarter earnings after the close tomorrow. Digging into its earnings history, MSFT stock has closed higher the day after the company reported in six of the past eight quarters -- including a 6.4% swing higher in October. On average, the shares have moved 2.7% in the subsequent session over this two-year time frame, regardless of direction. This time around, the options market is pricing in a larger-than-usual 5.5% next-day move for Friday's trading.

As far as direction, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows the software concern with a 10-day call/put volume ratio of 2.54, ranking in the 71st percentile of its annual range. In other words, MSFT calls have been purchased over puts at a faster-than-usual clip during the past two weeks, pointing to a bullish pre-earnings skew among speculators.

Digging deeper, the August 105 call saw a notable increase in open interest in the past two weeks, with nearly 13,500 contracts added. Data indicates the majority of this activity was bought to open, meaning the buyers expect Microsoft shares to extend their journey north of $105 in the near term.

In terms of analyst sentiment, those following the stock have also been optimistic, with 22 of the 25 brokerage firms covering MSFT sporting "buy" or "strong buy" ratings. Further, Microsoft stock's average 12-month price target of $113.47 stands in uncharted territory.