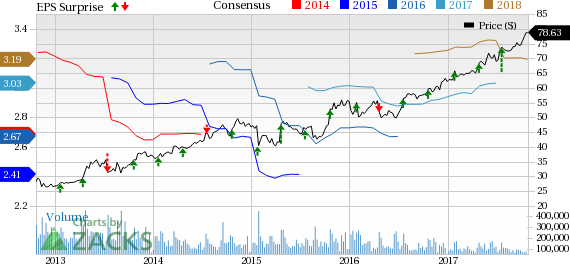

Microsoft Corp. (NASDAQ:MSFT) just released its first quarter fiscal 2018 financial results, posting earnings of 84 cents per share and revenues of $24.5 billion. Currently, MSFT is a Zacks Rank #3 (Hold), and is up about 2% to $80.36 per share in trading shortly after its earnings report was released.

The tech giant:

Beat earnings estimates. Microsoft reported earnings of 84 cents per share, beating the Zacks Consensus Estimates of 72 cents per share. Net income was $6.6 billion for the quarter.

Beat revenue estimates. The company saw revenue figures of $24.5 billion, beating our consensus estimates of $23.52 billion and increasing 12% year-over-year.

Operating income came in at $7.7 billion and increased 15% from the prior-year quarter.

Microsoft said that revenue in Intelligent Cloud was $6.9 billion, a 14% year-over-year gain; its Azure cloud platform saw 90% revenue growth, while server products and cloud services revenue increased 17%.

And, the company said that LinkedIn (NYSE:LNKD) contributed $1.1 billion in revenue during Q3.

“This quarter we exceeded $20 billion in commercial cloud ARR, outpacing the goal we set just over two years ago,” said Satya Nadella, chief executive officer at Microsoft. “Our results reflect accelerating innovation and increased usage and engagement across our businesses as customers continue to choose Microsoft to help them transform.”

Microsoft builds and develops products that include operating systems for computing devices, servers, phones, and other intelligent devices; server applications for distributed computing environments; cross-device productivity applications; business solution applications; desktop and server management tools; software development tools; video games; and online advertising. They also design and sell hardware including PCs, tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories. They offer cloud-based solutions that provide customers with software, services, platforms, and content.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post