- Microsoft will publish its next earnings on Tuesday, January 30, after the bell.

- The tech giant has no room for error, as its stock hit a new record high recently.,

- What do the consensus forecasts suggest, and what key factors investors should be on the lookout for?

- Navigate this earnings season at a glance with ProTips - now on sale for up to 50% off!

After surpassing Apple (NASDAQ:AAPL) for the title of the world's largest company by market capitalization last Wednesday, the Redmond, Washington-based giant Microsoft (NASDAQ:MSFT) hasn't looked backed.

Having risen 8.9% since the beginning of the year, the tech behemoth's stock attained a new all-time closing high of $409.72 yesterday, as its market cap surpassed the $3.05 trillion mark briefly.

Against this backdrop, investors are monitoring results for the final quarter of 2023, scheduled for release today after the market closes, closer than ever.

The focus is on determining whether these results will validate the stock's lofty valuation or potentially trigger a correction.

To understand where the company stands from a fundamental perspective going into the report, we will examine the forecasts for the upcoming results and analyze the outlook for the Redmond, Washington-based company for the year ahead.

We will delve deep into the company's metrics using InvestingPro's powerful ProTips tool for a comprehensive analysis.

ProTips - available only to InvestingPro users - seemingly summarizes the positives and negatives of a company by combing through a sea of data.

Designed for both retail investors and pro traders, ProTips avoids calculations (and reduces workload) by translating a company's data into synthetic observations.

Subscribe now for up to 50% off as part of our New-Year Sale here!

*Don't forget your free gift! Use coupon code PROTIPS2024 at checkout to claim an extra 10% off on the Pro+yearly plan, and PROTIPS20242 for an extra 10% discount on the by-yearly plan.

Microsoft has no room for error after new all-time highs

Microsoft is one of the "Magnificent Seven" stocks, the technology behemoths that drove up the stock market indexes last year and owes much of its rise in recent months to its efforts in the field of artificial intelligence.

Notably, Microsoft is the first investor in AI startup OpenAI, which is behind ChatGPT, giving Microsoft the image of a company ahead in AI compared to younger rivals such as Google (NASDAQ:GOOGL) and Meta (NASDAQ:META).

In addition, the company announced a series of AI-related innovations for its core products, including the addition of an AI digital assistant called Copilot to its Edge web browser and Office software.

The company, which is the second-largest provider of cloud computing, has also been developing its AI-supporting chips, as it steps up its fight against Amazon (NASDAQ:AMZN) and Google in the data center market.

The company's comments on AI integration and its plans in this area will therefore be closely watched in next week's results.

It will also be important to watch the growth of Azure, the company's cloud division, which was particularly strong last quarter, and which contributes to the company's profits more than proportionally to its importance in revenues.

Another point on which investors are awaiting details concerns the integration of Activision.

As this is Microsoft's biggest-ever acquisition, and although it is not very significant from a financial point of view, investors will be reassured that the company is sending out signs that everything is going well.

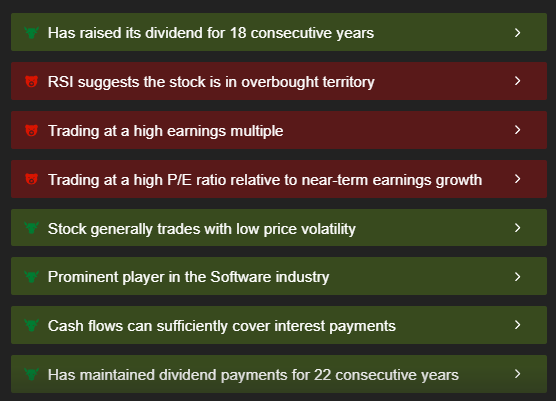

Using InvestingPro's ProTips to take a look at Microsoft's strengths and weaknesses

Before we look at the consensus forecasts for next week's results and the analysts' targets and valuation models for MSFT shares, we'd like to take a look at Microsoft's profile, with the help of the ProTips tool.

Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

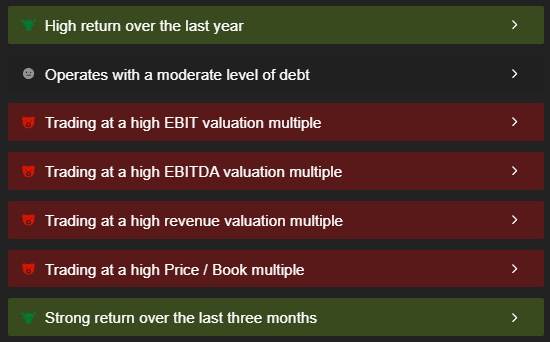

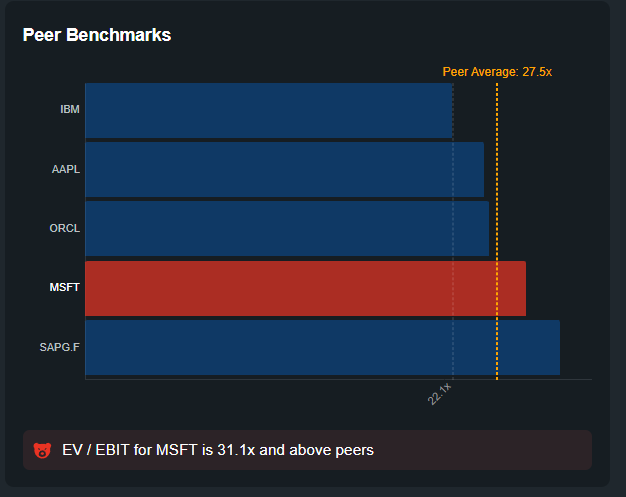

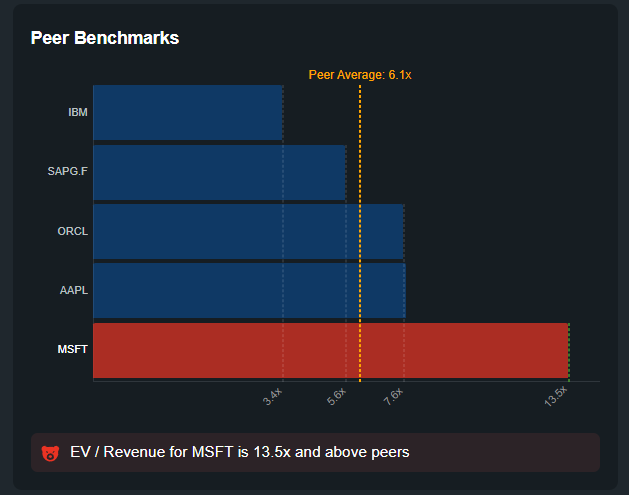

On the weakness side, the ProTips tell us that the stock trades at a high EBIT valuation multiple, outperforming most of its peers on this metric.

Source: InvestingPro

The same is true for the revenue valuation multiple, which is also deemed high, and far exceeds that of its peers.

Source: InvestingPro

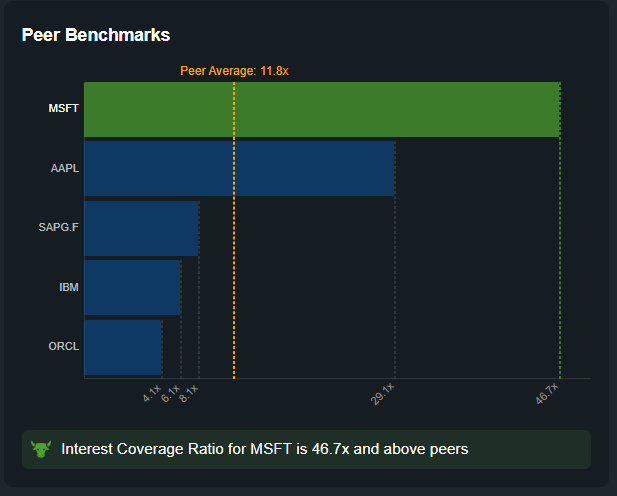

As for the share's strengths, the ProTips tell us in particular that cash flow can sufficiently cover interest payments.

Source: InvestingPro

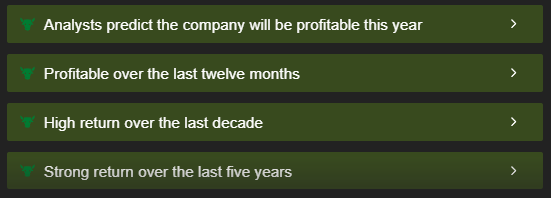

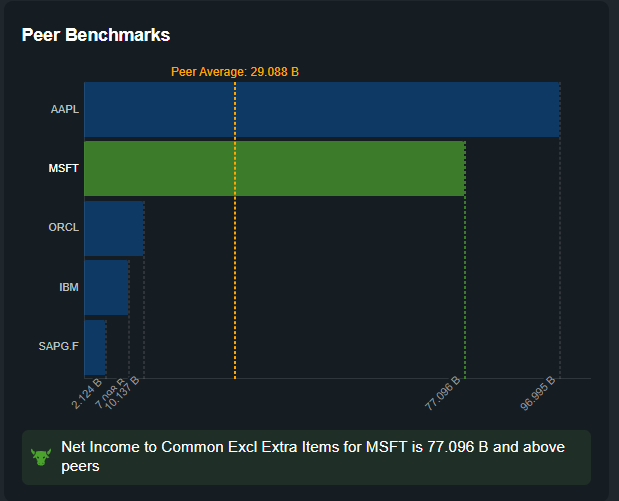

Another key point is the company's positive profitability over the past 12 months.

Source: InvestingPro

To sum up, the ProTips therefore suggest that although Microsoft is a solid, profitable company, its current valuation is probably not ideal for a buy.

What are the consensus EPS and revenue forecasts for upcoming results?

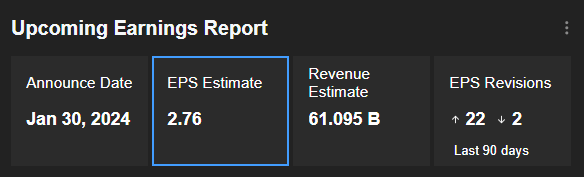

In terms of consensus forecasts, analysts expect EPS of $2.76 on average, down from $2.99 in the previous quarter, but 19% higher than in the same quarter last year.

Source: InvestingPro

In terms of revenue, analysts forecast $61.095 billion, up 8.1% on the previous quarter, and up 15.8% year-on-year.

It is also worth noting that Microsoft has exceeded expectations in terms of EPS and sales for the last three consecutive quarters, and has only posted below-consensus EPS once in the last 8 quarters.

Source: InvestingPro

Therefore, it is not entirely out of the realm of possibility that the company will once again surpass the consensus expectations for the results anticipated next week.

Valuation and analysts' forecasts for MSFT shares

On the subject of valuation models, it should be noted that these indicate that Microsoft shares are currently correctly valued.

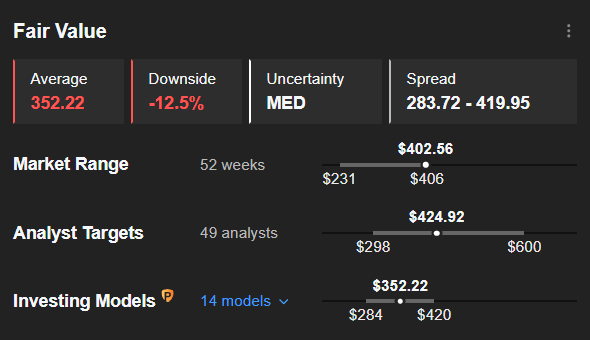

Indeed, the InvestingPro Fair Value, which synthesizes 14 recognized financial models, stands at $352.22, or 12.5% less than Wednesday's closing price.

Analysts, on the other hand, are more optimistic, forecasting an average rise to $424.92 over 12 months, representing a modest upside potential of 5.55%.

Conclusion

Microsoft's high valuation, as highlighted by the ProTips and InvestingPro Fair Value, means that today's earnings release represents a significant risk.

Given the share's recent rise and the symbolic milestones that have been surpassed, the company will have no room for error, and the slightest disappointment could lead to a sharp correction in the share price.

Conversely, for a notable increase in the stock price, Microsoft will likely need to surpass expectations by a substantial margin, given that the share price has already experienced a considerable rise in anticipation of the event.

Nonetheless, the company has had a recent history of surpassing expectations and beating against the giant has proven a costly mistake for the last few years.

***

InvestingPro: Empowering Your Financial Decisions, Every Step of the Way

Take advantage of InvestingPro ProTips and many other services, including IA ProPicks strategies on the InvestingPro platform with a discount of up to -50%, until the end of the month!

Don't forget your free gift! Use coupon code PROTIPS2024 at checkout to claim an extra 10% off on the Pro+yearly plan, and PROTIPS20242 for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.