The software and Azure giant Microsoft (NASDAQ:MSFT) is scheduled to report it’s fiscal Q1 ’25 on Wednesday night, October 30 ’24, after the closing bell.

Consensus estimates for Microsoft are expecting:

- EPS: $3.10 for 4% y-o-y growth

- Revenue: $64.5 billion for 14% y-o-y growth

- Operating inc: $29.3 billion for 9% y-o-y growth

Looking at these estimates, the first thought I had was, “Why are EPS and operating income y-o-y growth rates so low ?” and at first glance, the EPS and operating income “upside surprise” were sizable in the September ’23 quarter at 13% and 11% respectively.

Looking at the notes after fiscal Q1 ’24 earnings (September ’23) it looks like Microsoft guided to margin pressure through fiscal ’24 and fiscal ’25 thanks to an accounting change, and that’s still rippling through the Microsoft P&L.

In fiscal Q4 ’24, (ended June 30 ’24), Microsoft guided Q1 ’25 to:

- Revenue of $63.8 to $64.8 billion, so the midpoint is $64.3 billion and the consensus is already a little higher than that;

- Azure growth guided to 28% – 30% constant currency (my thought: a couple of sell-side analysts thought Azure growth would re-accelerate in 2h ’24 calendar year, but Azure y-o-y growth has been stuck between 28% and 31% since the fiscal Q2 ’23 (December ’22 calendar), when Azure grew 38% y-o-y, so it looks to me like Azure growth MIGHT may have plateaued.)

While CrowdStrike Holdings Inc (NASDAQ:CRWD) is out of the news except for the Delta litigation, it now appears to be in the background of current Microsoft events.

Finally, another reason the stock trades like a wet blanket has been thrown over it, is that Microsoft said that the three segments reporting results each quarter – i.e. Productivity & Business, Intelligent Cloud, and Personal Computing – will see their components re-shuffled, probably due to the fact that the Intelligent Cloud segment represents 44% of total Microsoft revenue and 46% of Microsoft operating income as of fiscal Q4 ’24, (or roughly half the total Microsoft business), and now with AI, which is part of Intelligent Cloud, Microsoft probably wants to even out the segments. (That’s a guess on my part.)

Not to be too skeptical, but companies can sometimes do this to hide or try and mask slowing growth, within a particular segment. It’s hard to say if that’s the case with Microsoft, but I’m guessing the key metric again will be to watch Azure’s y-o-y growth, as well as any new disclosure around CoPilot.

Surprisingly, analyst consensus around full-year fiscal ’25 expected EPS and revenue growth is looking for just 11% EPS growth (that was an expected 15% 4 quarters ago) on 14% revenue growth, which has been fairly constant the last 4 – 5 quarters.

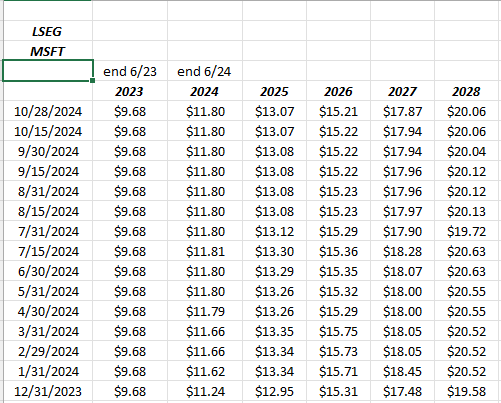

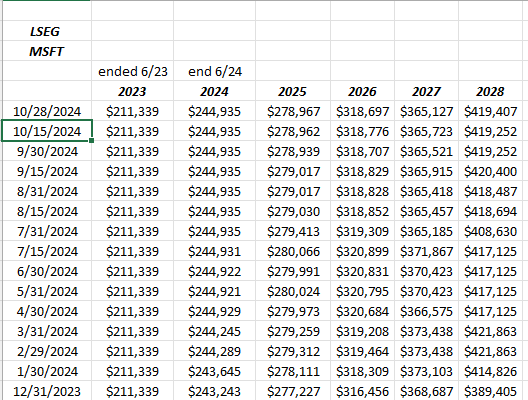

EPS and revenue estimates:

Microsoft’s EPS estimates for fiscal ’25 began to slide almost immediately after the April ’24 earnings report. 2026 has been a bit weak too.

Microsoft’s fiscal ’25 revenue estimate was looking wobbly (i.e. negative revisions) but it has returned to normal in the last few months. Have to say, revenue estimates for Microsoft have held up better than forward EPS estimates.

Watching operating margin:

- Q4 ’24: 43%

- Q3 ’24: 45%

- Q2 ’24: 44%

- Q1 ’24: 48%

- Q4 ’23: 43%

Q1 ’25 to be released Wednesday night, has a tough compare with Q1 ’24’s 48% operating margin.

Valuation:

At $428 per share, Microsoft is trading at 33x expected ’25 EPS growth of 11%, so today as it stands Microsoft is the opposite of Goggle and a stock that’s cheap on a PEG or PE-to-growth basis.

On a cash-flow basis, MSFT is trading at 25x cash-flow and 39x free-cash-flow (ex cash) and 12x price-to-sales.

This blog’s earnings-based model puts a fair value on Microsoft between $475 – $500, while Morningstar’s fair value estimate of MSFT is $490, hence the two models roughly agree (usually the earnings-based model derives a higher fair value than the inherently more conservative Morningstar model).

Summary / conclusion:

Looking over the last 15 years, Azure and the cloud was a huge boon for Microsoft’s operating margin, as back in 2013 to 2015, just as Satya Nadella came in as CEO, and the cloud was getting revved up, Microsoft’s operating margin was in the mid-to-high 20% range, with an occasional 30% print, and today, thanks to Azure, Microsoft’s operating margin is on the low 40% range, and looks to have maybe peaked out ?

Will / can AI drive operating margin expansion further from here ?

Some of the issues that have caused the stock to trade like it’s wearing a piano on it’s back, are the Activision (ATVI) merger (closed in October ’23), the slow uptake of CoPilot (?), which also (I thought) was launched in late ’23 and usually with a new product launch the company is always willing to talk numbers, but it seems (to me) that there has been little said about the CoPilot scale in general. Then we have the issue around Crowdstrike, and it’s disabling of many Windows PC’s, and then the usual drag of AI capex on the mega-cap tech names in general, and the restructuring of the Microsoft business segments.

MSFT Capex: average y-o-y growth rate:

- 4-quarter avg: 35%

- 12-quarter avg: 31%

- 20-quarter avg: 29%

- 40-quarter avg: 27%

Have we seen peak Microsoft ?

The stock is up 14.5% YTD as of Friday’s 10/25/24 close, while the SPY is up 22.98% as of the same date. The stock peaked at $468 in early July ’24 and thus remains down almost 10% since then, giving up a lot of relative ground to the SP 500.

The chart is very similar to Alphabet’s (NASDAQ:GOOGL), as the 50-day and 200-day moving averages have converged, but the stock has remained above those moving averages.

MSFT remains client’s #1 equity position.

***

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of futures results. Investing can and does involve the loss of principal, even for short periods of time. This information may or may not be updated, and if updated, may not be done in a timely fashion. All EPS and revenue estimate data is sourced from LSEG.