Microsoft Corporation (NASDAQ:MSFT) beat estimates in its third quarter report despite strong foreign exchange headwinds and a decrease in personal computing. Microsoft has been transitioning from a software company into a cloud-based business, and many see the cloud growth as a sign of a successful restructuring.

On April 23, Microsoft posted 3Q15 revenue of $21.7 billion, beating estimates of $21.12 billion and posting a 6% year-over-year increase. Microsoft posted diluted earnings per share of $0.61, beating estimates of $0.51 though marking a (10%) year-over-year decrease. The company’s gross margin increased 1% year-over-year while its operating income decreased (5%) year-over-year.

The strengthening of the dollar impeded quarterly growth. Microsoft Corporation (NASDAQ:MSFT) noted that revenue would have grown 9% year-over-year and earnings per share would only have decreased (7%) year-over-year had it not been for the significant currency headwinds.

The popularity of personal computing is waning, as illustrated by a (19%) year-over-year decrease in Windows OEM Pro revenue. However, Microsoft’s overall Devices and Consumer revenue grew 8% year-over-year. Additionally, revenue derived from Microsoft’s Cloud segment grew an overwhelming 106% year-over-year, driven by increases in Office 365 subscriptions and Azure.

Analysts had mixed ratings for Microsoft following the report.

Rick Sherlund of Nomura Equity Research raised his Microsoft rating from Neutral to Buy following the Q3 report and maintained his $50 price target. Sherlund is optimistic about Azure and Office 365 growth but he still sees near-term problems for the technology giant. However, he believes the company’s fundamentals are “bottoming” and therefore “patient investors can consider moving to Microsoft over this transition period.” He explained, “We think the recent bad news at Microsoft is not over yet, with difficult comparisons in the June and September quarters and the pressures on the core business as the cloud conversions gain increasing traction. By calendar 2016, we believe organic cc growth returns to low single digits.” He concluded that Microsoft is a favorable competitor compared to its peers of the same valuation.

Rick Sherlund has rated Microsoft 71 times since September 2011 with a 63% success rate recommending the stock and a +9.5% average return per MSFT rating. Overall, Sherlund has a 70% success rate recommending stocks with a +12.1% average return per rating.

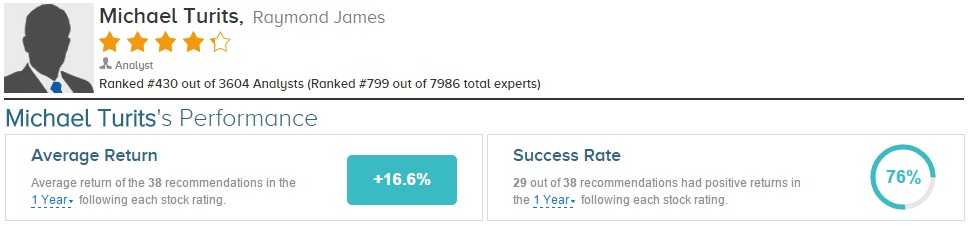

Separately on April 24, analyst Michael Turits of Raymond James reiterated a Market Perform rating on Microsoft, though he did not provide a price target. He summarized that Microsoft’s “basic trends remain the same,” such as the declining PC market and a growing cloud segment. Turits commented, “We remain positive on Microsoft’s enterprise businesses and strategic move to cloud.” He added that Microsoft is fairly valued given “stagnant PCs and secular price pressure on consumer windows; ongoing risk in phone hardware; and transitional and long-term license/margin risk in the move to cloud.”

Michael Turits has rated Microsoft 16 times since January 2012, earning a 67% success rate recommending the stock with a +10.7% average return per MSFT rating. Overall, Turits has a 76% success rate recommending stocks with a +16.6% average return per rating.

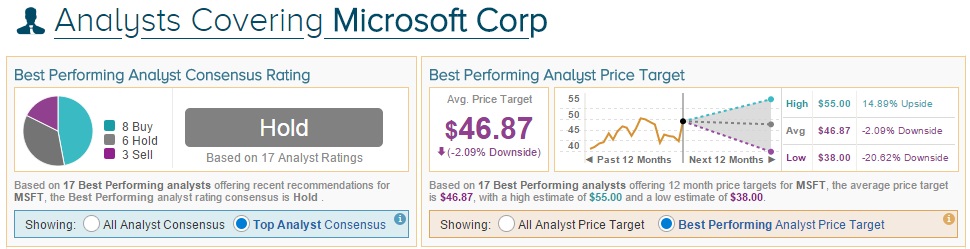

On average, the top analyst consensus for Microsoft on TipRanks is Hold.