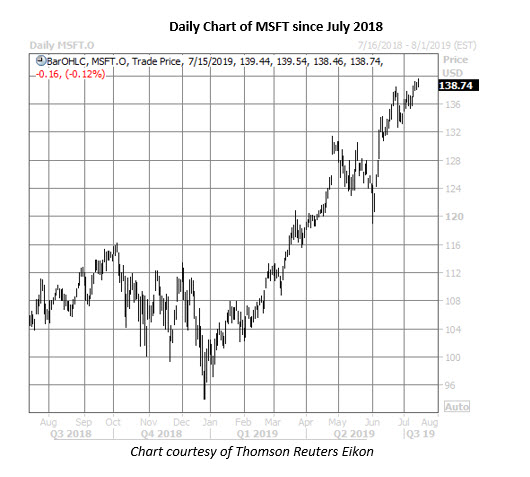

Microsoft Corporation (NASDAQ:MSFT) topped out at a record high of $139.54 earlier, and while it was last seen 0.1% lower at $138.74, the software giant is still holding above the one-trillion-dollar market cap level. MSFT will stay in focus this week, with earnings due after the close this Thursday, July 18, and while call options have been in high demand ahead of the event, not all of the activity appears to be of the bullish kind.

Taking a quick step back, Microsoft landed on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest options volume over the past 10 days, with names highlighted in yellow new to the list. Per the chart below, 510,089 MSFT calls have traded in the last two weeks, compared to 332,617 puts.

While the September 125 call has seen the largest increase in open interest over this two-week time frame, pre-earnings speculators have targeted the July 142 call. According to Trade-Alert, it seems some of these front-month options were used to initiate a three-way bearish spread along with the July 136 calls and July 128 puts; specifically, funding the purchase of the puts with the credit collected by the short call spread.

In today's trading, calls are outpacing puts by a nearly 2-to-1 margin, though volume is lighter than usual. The July 140 call is most active, and it looks like speculators may be buying to open new positions here for a volume-weighted average price of $1.72. If this is the case, breakeven for the call buyers at the close this Friday, July 19 -- when front-month options expire -- is $141.72 (strike plus premium paid).

Microsoft stock has a history of positive earnings reactions, closing higher the day after five of the company's last eight quarterly reports -- including a 3.3% pop in April, and a 1.8% rise this time last year. On average, the shares have swung 2.8% the day after earnings over the past two years, with the options market pricing in a 4.6% move for Friday's trading.