Micron Technology, Inc. (NASDAQ:MU) earnings are due after the close next Tuesday, Dec. 18. The graphics chip stock has a history of positive earnings reactions, closing higher the next day in five of the past eight quarters. Options traders today are betting on more of the same this time around, even as MU stock trades near a trendline with historically bearish implications.

In today's trading, roughly 64,000 calls and 48,000 puts have changed hands, in-line with what's typically seen. The December 35 call is most active, and it looks like new positions are being purchased here for a volume-weighted average price of $1.51. If this is the case, breakeven for the call buyers at next Friday's close -- when front-month options expire -- is $36.51 (strike plus premium paid).

More broadly speaking, speculative players have been buying to open puts relative to calls at a quicker-than-usual clip. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Micron's 10-day put/call volume ratio of 0.64 ranks in the 92nd annual percentile.

Meanwhile, short-term options are pricing in elevated volatility expectations at the moment, which isn't too surprising ahead of a scheduled event like earnings. MU's 30-day at-the-money implied volatility (IV) of 58.2% ranks in the 94th annual percentile. Plus, the 30-day IV skew of 11.6% registers in the 90th percentile of its 12-month range, meaning short-term calls have rarely been cheaper relative to puts.

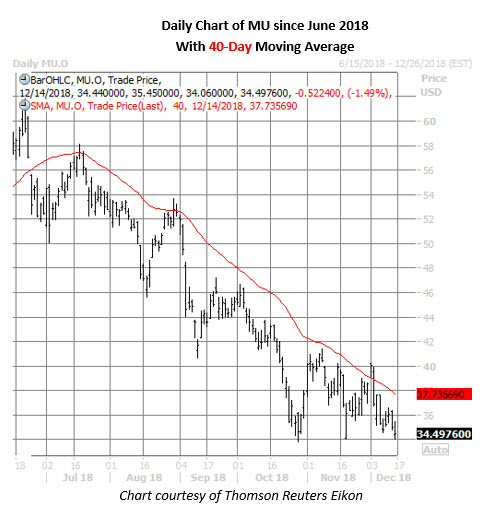

Looking at the charts, Micron stock has had a rough fourth quarter. The shares are set to for their second consecutive quarterly loss, pacing for their worst quarterly performance since March 2016 -- down 23.7% so far, including today's 1.5% drop to trade at $34.50. Longer term, MU shares have been pressured steadily lower by their 40-day moving average since their mid-May peak at $64.66.

The tech stock is once again trading near this trendline, suggesting stiffer headwinds in the near term. In the five other times MU has come within one standard deviation of its 40-day after a lengthy stretch below it, the shares were 9.3% lower, on average, one month out, according to data from Schaeffer's Senior Quantitative Analyst Rocky White.