Michael Kors Holdings Limited (NYSE:KORS) , a global luxury lifestyle company, came out with first-quarter fiscal 2018 results, wherein earnings of 80 cents a share beat the Zacks Consensus Estimate of 62 cents but plunged 11.1% from the prior-year quarter.

Management now projects second quarter earnings in the range of 80–84 cents a share and fiscal 2018 earnings between $3.62 and $3.72 per share. The current Zacks Consensus Estimate for the quarter and fiscal year are pegged at 78 cents and $3.55, respectively.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2018 has remained stable in the last 30 days. In the trailing four quarters, excluding the quarter under review, the company outperformed the Zacks Consensus Estimate by an average of 8.10%.

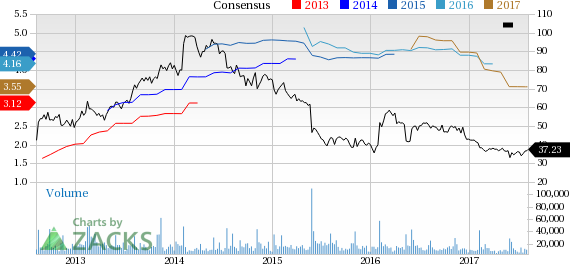

Michael Kors Holdings Limited Price and Consensus

Revenues: Michael Kors generated total revenue of $952.4 million that decreased 3.6% year over year but came ahead of the Zacks Consensus Estimate of $917.9 million. Management now forecasts second quarter total revenue in the range of $1,035–$1,055 million and expects fiscal 2018 revenue to be approximately $4.275 billion.

Key Events: Michael Kors repurchased 4,543,500 shares for approximately $157.8 million.

Zacks Rank: Currently, Michael Kors carries a Zacks Rank #3 (Hold) which is subject to change following the earnings announcement.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Stock Movement: Michael Kors’ shares are up nearly 12% during pre-market trading hours following the earnings release.

Check back later for our full write up on Michael Kors’ earnings report!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post