For today's bulletin, the first of 2018--HAPPY NEW YEAR TO ALL OF OUR READERS--we take a look at one of our STRONG BUY stocks that is yet another big home builder. Like Pulte Homes--which we covered a few weeks ago, M/I Homes Inc (NYSE:MHO) has recovered nicely from the housing crisis and the Bush economic b low up of 2007-2008.

PM/I Homes is one of nation's leading builders of single family homes. M/I Homes have established an exemplary reputation based on a strong commitment to superior customer service, innovative design, quality construction and premium locations. M/I Homes serve a broad segment of the housing market including first-time, move-up, luxury and empty nester buyers. M/I Homes design, market, construct and sell single-family homes and attached townhomes to first-time, moveup, empty-nester and luxury buyers. The company have homebuilding operations in Columbus and Cincinnati, Ohio; Indianapolis, Indiana; Tampa, Orlando and Palm Beach County, Florida; Charlotte and Raleigh, North Carolina; Virginia and Maryland. .

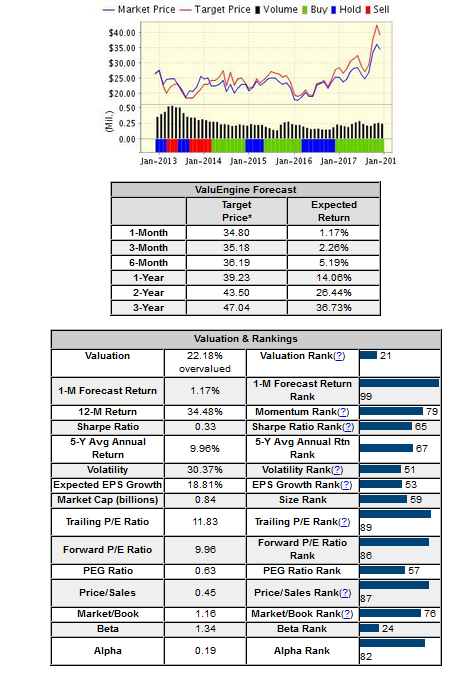

ValuEngine continues its STRONG BUY recommendation on MI Homes for 2017-12-29. Based on the information we have gathered and our resulting research, we feel that MI Homes INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Price Sales Ratio.

You can download a free copy of detailed report on MI Homes (MHO) from the link below.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.