Mexico’s state oil company, Pemex, is a perfect example of the ongoing collapse in the global oil industry. Falling oil prices and declining production are putting severe pressure on the company’s financial balance sheet. It has been four long years since Pemex posted a small profit. However, since 2012, Pemex has suffered huge annual losses while its long term debt has exploded.

The result is… Pemex is technically bankrupt. Now, I am not the only one saying this. There have been several articles written about horrible financial situation at Pemex. According to this article:

March 3, 2016:

Mexico’s largest company is broke. The country’s state oil company, Pemex, which is one of the federal government’s main sources of revenue, is losing money and is one of the world’s most indebted oil firms.

The company’s production has dropped for 11 straight years now, while gross income plummeted more than 80 percent last year.

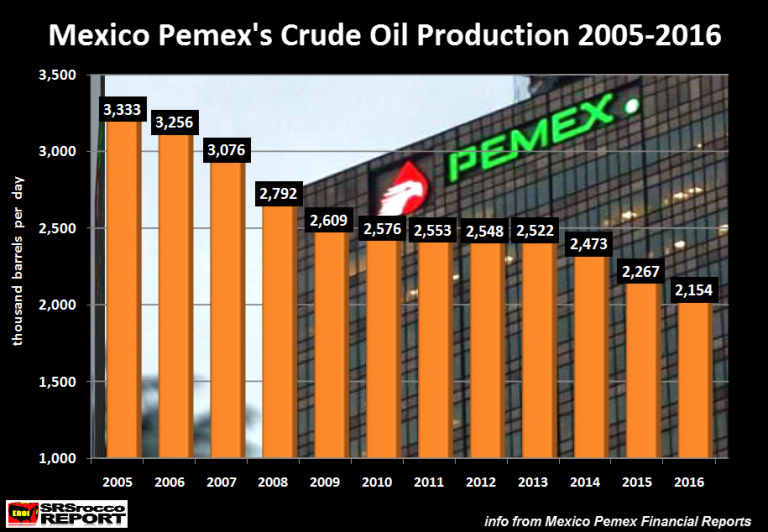

One of the biggest causes of the financial problems at Pemex is due to its falling oil production. Crude oil production at Pemex has fallen 35% since 2005, from 3.3 million barrels per day (mbd) to 2.1 mbd in 2016:

As oil prices and production declined, Pemex lost $30.3 billion in 2015 and $14.3 billion in 2016. The reason Pemex cut its losses in 2016, even as oil prices fell lower, was due to hefty budget cuts and the layoff of thousands of workers. According to this article:

April 15, 2016:

Petroleos Mexicanos (Pemex) will cut up to 50 thousand workers gradually, according to Alexis Milo, chief economist at Deutsche Bank. “Pemex has approximately three times the number of employees should. Therefore, we anticipate that it will unveil a program of mass layoffs, but gradual, approximately 50 thousand workers, “explained the expert analysis.

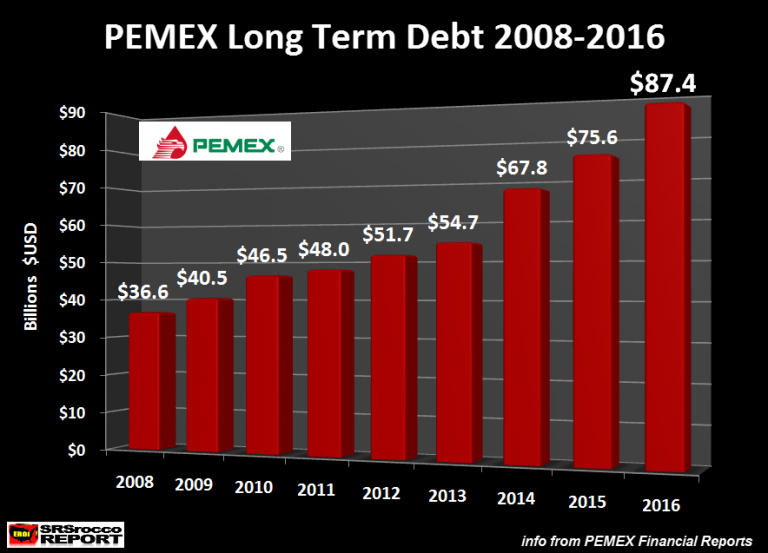

Even with budget cuts and worker layoffs, the financial situation as Pemex continues to disintegrate. Pemex’s long term debt jumped nearly $12 billion last year to $87.4 billion. Since 2005, Pemex’s long term debt has more than doubled from $36.6 billion to the $87.4 billion at the end of 2016:

Energy analysts have stated that many of Pemex’s financial problems also stem from mismanagement and possible corruption issues. While this may be true, the world’s top public oil companies have also seen their long term debt skyrocket over the past several years. For example, Royal Dutch Shell’s long term debt has ballooned from $38 billion in 2014 to $83 billion in 2016.

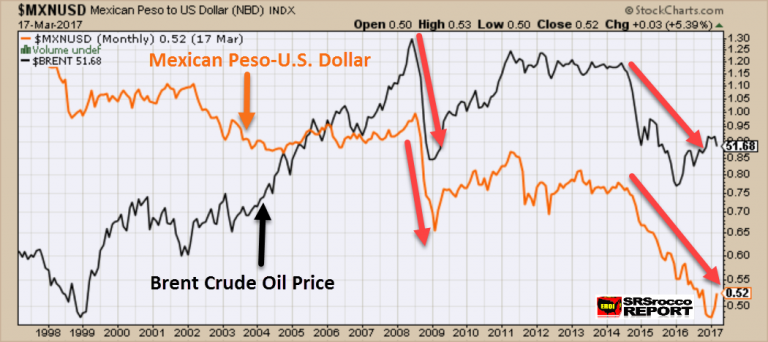

Another interesting negative side effect of lower oil prices on Mexico’s economy, is the falling value of its currency, the Peso. This chart shows value of the Mexican Peso to the U.S. Dollar over the past 20 years:

The Mexican Peso-U.S. Dollar is shown in orange, while the Brent Crude oil price is in black. As we can see the largest drop in the Mexican Peso’s value took place when the Brent Crude oil price declined significantly. Since the Brent Crude price fell below $100 in August 2014, the value of the Mexican Peso’s has fallen 32% versus the U.S. Dollar.

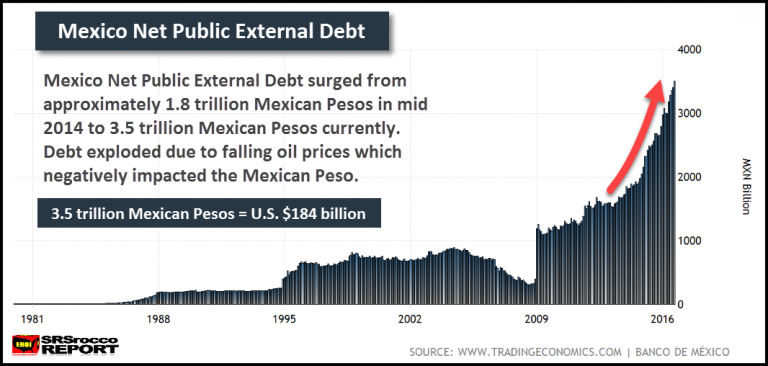

A falling value of the Mexican Peso means that its outstanding debts based in U.S. Dollars increases. This can be plainly seen by the huge rise of Mexico’s net public external debt. Again, since the price of Brent Crude fell below $100 in August 2014, Mexico’s net public external debt has nearly doubled:

Mexico’s net external public debt increased from approximately $1.8 trillion Pesos in mid 2014 to 3.5 trillion Pesos currently ($184 billion in U.S. Dollars). With falling oil revenues on top of rapidly increasing debt at Pemex, the company is finding it extremely difficult to finance or rollover its debt. That being said:

July 18, 2016:

Unable to generate revenue, Pemex has decided to deepen its debt, a decision that has troubled the international markets and rating agencies. Borrowing provides short-term relief, they warn, but it also increases fiscal pressure. Falling output and lower oil prices reduce expectations of generating cash, which in turn reduces the company’s ability to invest in exploration and production: a vicious circle that is hard to break.

Pemex has few options. It is fast running out of places to borrow money, while reducing its outgoings through mass redundancies would be political suicide for the government: the company employs some 150,000 people, with a further 100,000 former employees on its payroll.

Pemex faces one of the most difficult situations in its history, but there is no question of it being allowed to go bankrupt, despite the increasing burden it represents to the state. That said, if the government cannot turn its fortunes round, Pemex could end up dragging the Mexican economy down with it.

The last sentence in the quote above is the likely outcome for Mexico’s state run oil company. That is, Pemex will likely drag the Mexican economy down with it. I believe it’s just a matter of time.

Now, I am not singling out Pemex as what is wrong with the global oil industry, Even though Pemex may have been guilty of employing more workers than it needed, I am happy to see some of its profits going to its workers or the Mexican economy rather than to a multi-national corporate conglomerate that enriches a few at the top.

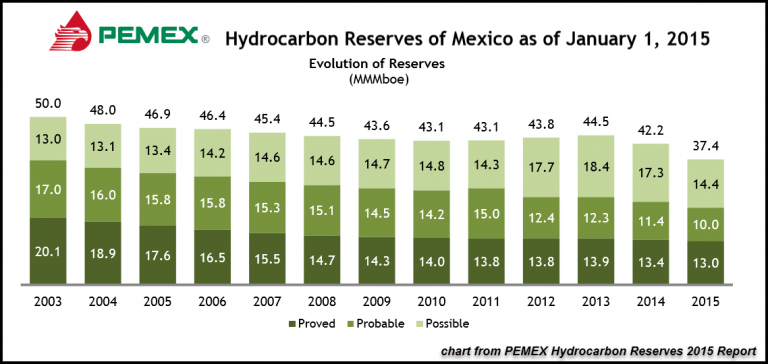

Another negative factor facing Pemex’s future is its falling oil reserves. Pemex’s proven hydrocarbon reserves have fallen from 20 billion barrels of oil equivalent (boe) in 2003 to 13 billion boe in 2015:

While oil companies list their oil and gas reserves as “proved, probable and possible categories”, as the oil price continues to decline, it will most likely be the proven reserves that will remain commercially viable. And even some of the so-called “Proven” reserves may not be profitable to extract if oil prices fall back to $30 or even lower.

If you have been reading my articles on the Thermodynamic oil decline, the model suggests that the global oil price will continue to decline because the rapidly falling net energy won’t be worth that much to the world economy. This has to be one of the most misunderstood factors by my readers and the public.

For some strange reason, people just can’t get the head around a continued falling price of oil. They still cling to the economic principle of “Supply & Demand.” I used to believe market prices were based on supply and demand forces, but now I realize it has always been the principle of thermodynamics that is the leading factor. While supply and demand forces add volatility to the market price of a commodity, metal, energy or a good, the cost of production has always been the overriding factor in determining price.

As the global oil industry and its massive support system continues to devour more and more energy each year to supply oil to the market, the value of the oil supplied to the market will also decline. Again, you have to think about a barrel of oil like the value of a brand new car versus one that is 15 years old. A brand new car is worth say, $25,000 versus a 15 year old car valued at $5-$6,000. The reason is the embedded energy in all the parts have been worn out and are now depreciated. Thus, in even more time, the value of the car will be based on its scrap value.

For example, the paper titled, EROI of different fuels and the implications for society provided the following figures for U.S. and global oil and gas EROI’s:

The EROI for the production of oil and gas globally by publicly traded companies has declined from 30:1 in 1995 to about 18:1 in 2006 (Gagnon et al., 2009). The EROI for discovering oil and gas in the US has decreased from more than 1000:1 in 1919 to 5:1 in the 2010s, and for production from about 25:1 in the 1970s to approximately 10:1 in 2007 (Guilford et al., 2011). Alternatives to traditional fossil fuels such as tar sands and oil shale (Lambert et al., 2012) deliver a lower EROI, having a mean EROI of 4:1.

Not only has the EROI for the production of oil and gas by the globally traded companies fallen from 30:1 in 1995 to 18:1 in 2006, the EROI of U.S. oil discoveries fell from a staggering 1000:1 in 1919 to 5:1 in the 2010’s. I have not seen current EROI oil and gas production data for the United States or global oil industry, but I can assure you they have continued to decline considerably since the last data reported in 2006.

The falling EROI is gutting the entire global oil industry. While some state run or publicly traded oil companies may be performing better than others, or enjoy a higher EROI, they will all continue to head lower over the following years.

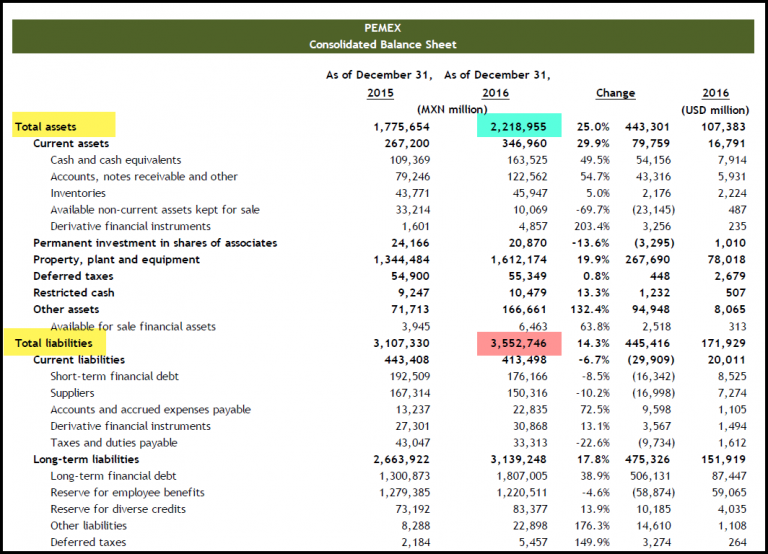

As I mentioned in the beginning of the article, Mexico’s Pemex state oil company is technically bankrupt. Their total liabilities are greater than their total assets:

Pemex’s total assets are valued at 2.2 trillion Mexican Pesos versus 3.5 trillion in total liabilities. Converting this to U.S. Dollars (shown on the right hand side of the table), Pemex’s total assets are $107.4 billion compared to $171.9 billion in total liabilities.

You will notice a large portion of Pemex’s total liabilities are due to obligations for its “Reserve for employee benefits” of $59 billion. Even if Pemex decided to discontinue paying all its employee benefits, it would still have total liabilities of $113 billion, higher than its current assets of $107 billion.

The Mexican government will do all in its power to keep Pemex from going bankrupt. However, propping up a company that will continue to lose money is not a sustainable for long. Furthermore, Pemex is finding it increasing difficult to finance his mounting long term debt which surpassed $87 billion in 2016.

The global oil industry is in serious trouble. Surging debt levels while profits turn into losses will only make a bad situation worse in the future. While many energy analysts are pointing to the recent increase in U.S. oil production as positive sign for energy independence in the next few years, I see it much differently.

The majority of the increase in U.S. oil production since the lows last year has come from one field… the Permian. According to the U.S. Energy Information Agency Drilling Productivity Reports, combined production from Bakken and Eagle Ford has only increased 40,000 barrels per day since they bottomed several months ago. However, nearly half of the increase in total U.S. oil production came from the Permian Field.

As the U.S. and global economies continue to weaken this year, demand for oil will decline. This will put more pressure on the short-term oil price by pushing it lower, thus negatively impacting the global oil industry even more. At some point, the U.S. and global oil industry will likely suffer a heart-attack.

Lastly, I would like to remind everyone that oil is the lifeblood of our advanced economies. Without oil, the production and transportation of other energy sources such as coal, natural gas and bio-fuels would be seriously hampered. Where I live, there is a constant movement of coal trucks up and down the interstate transporting coal to electric generation plants or to railroad coal terminals.

With the advent of modern truck transportation, a lot of the nations railroad lines were removed or neglected. We are in serious trouble, and it is mostly due to oil… not fiat money or politics.