I never heard a formal name for this pattern but I see it a lot. The price falls in a long downtrend, finds support and bounces. The bounce is short lived, like a Dead Cat Bounce, and the price falls back to the low. From there the price starts to rise again and moves higher in a long uptrend. Like it is riding down the left side of the brim, up over the top and down, then back up the right side of the brim of a Mexican Hat.

It has that “W” shape that harmonic patterns have but the middle is to low to qualify. Maybe it is just a double bottom when you look at it after the full pattern has played out, but the two bottoms are not always equal. And doesn’t Mexican Hat pattern sound more interesting anyway?

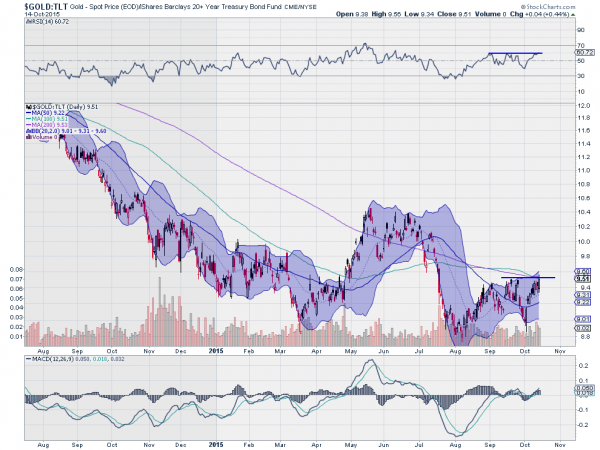

The chart of the ratio of the SPDR Gold Shares (N:GLD) to the iShares 20+ Year Treasury Bond (N:TLT) has that same look. It has already completed the ride down the left brim and up over the top. Now it looks to be starting up the right brim. A push over 9.60 in the ratio should confirm the trip higher.

The momentum indicators are supporting the move up. The RSI is pushing up through resistance, in the bullish zone and heading to a new 4 month high. The MACD is crossed up and rising. Even the Bollinger Bands® have turned higher.

After confirmation the trade would be to buy gold and sell bonds to profit on the ride higher in the ratio.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.